Many people find making financial plans tough. A one-page financial plan can make it easier. This plan helps you see your money, goals, and steps in a simple way. Let's see how it works!

What Is a One-Page Financial Plan?

A one-page financial plan is a simple yet powerful tool. It helps people manage their personal and business finances on just one sheet of paper. This plan shows your current financial position, goals for the future, and steps to get there.

It turns complex data like net worth, cash flow, savings, and investments into an easy-to-understand format.

This type of plan focuses on what's most important to you. Whether it's saving for retirement, managing monthly income or setting up an emergency fund, it cuts through the clutter.

With this clear view, making informed decisions about how to best use your money becomes easier. It keeps track of where you are now financially and maps out where you want to be in five years or more.

Key Components of a One-Page Financial Plan Template

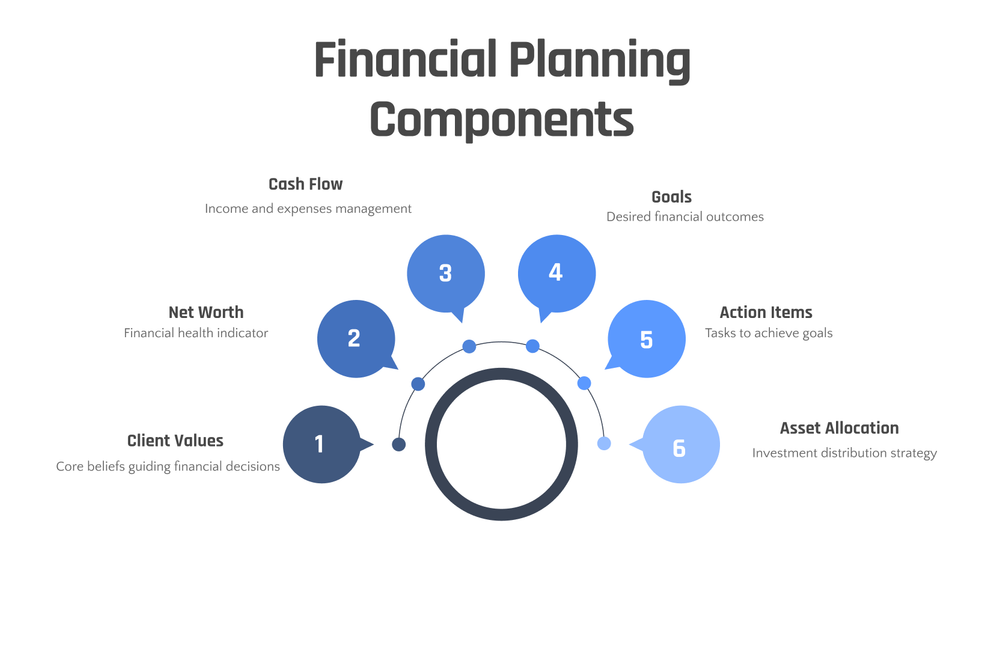

Creating a one-page financial plan starts with understanding client values, net worth, cash flow, goals, and action items. Asset allocation is crucial for long-term success.

Client Values

Client values shape goals and guide decisions in a financial plan. They reflect what is most important to you, like saving for retirement or building emergency funds. Understanding these values helps prioritize spending and investing.

It makes sure your financial roadmap aligns with your life's aims.

Your values are the compass that guides your financial journey.

Next, we look at net worth: assets minus debts.

Net Worth

Upon discerning client values, examining net worth becomes the subsequent phase. Net worth manifests as a financial health illustration. It demonstrates what one possesses subtracted by their debts.

To calculate it, consolidate assets such as banking funds, retirement savings, and any real estate. Then deduct liabilities like car loans and credit card dues. This figure is a crucial measure of current financial standing for clients.

Understanding this aids in establishing objectives to better financial health. Should net worth be low or negative, tasks may prioritize debt reduction or enhancing bank savings and investments to increase the number over time.

Monitoring fluctuations in net worth annually can demonstrate improvement aligned with enduring financial objectives like bolstering retirement funds or home ownership.

Current Cash Flow

The current cash flow plays a pivotal role in a one-page financial plan. It encompasses monitoring the money coming in and going out, including income, expenses, and savings. Grasping the cash flow pattern helps identify surplus funds for investments or debt repayment.

This element also offers a clear view of an individual's or company’s financial well-being and informs decision-making to ensure sustainable growth and stability.

By scrutinizing the existing cash flow using tools like cash flow statements and budget templates, one can gain insight into short-term financial progress while pinpointing areas that require enhancement.

Furthermore, this analysis assists in making well-informed decisions concerning marketing efforts, financial advice from professionals, or managing personal budgets for future financial outcomes.

Goals

Your financial plan should clearly outline your goals. These goals can include purchasing a home, saving for retirement, or funding a child's education. It's crucial to set specific, measurable targets for each goal and assign realistic time frames to achieve them.

This will help guide your financial decisions and keep you on track towards achieving what matters most to you.

Setting clear financial goals provides direction and motivation in managing your money effectively. By aligning your one-page financial plan with these goals, you'll stay focused on what truly matters, making it easier to monitor progress and adjust strategies as needed.

Action Items

Action items are the specific tasks and steps needed to achieve the goals outlined in a one-page financial plan. These can include establishing automatic savings transfers, exploring investment opportunities, consulting with a financial professional for advice, or adjusting spending habits to align with long-term objectives.

By regularly reviewing these action items and tracking progress, individuals can stay focused on their financial goals and make necessary adjustments to their plan as circumstances change.

It's crucial to prioritize action items based on their impact on overall financial health and long-term goals. For instance, if increasing annual income is a key goal, an action item could involve evaluating potential opportunities for career advancement or additional streams of revenue.

Each item should be actionable and measurable within a specific timeframe, ensuring that progress towards the overarching financial plan remains consistent.

Asset Allocation

Asset allocation is an essential part of a one-page financial plan template. It involves determining how to distribute an individual's investment portfolio across various asset classes such as stocks, bonds, and cash equivalents.

By diversifying the assets in this manner, it aids in managing risk and maximizing potential returns. Allocating investments in line with the client's objectives and risk tolerance is crucial for long-term financial success, ensuring that their portfolio remains well-rounded and in line with their goals.

Effective asset allocation also takes into account factors such as the client's age, time horizon, and overall financial health. A well-structured one-page financial plan template should feature a clear breakdown of how the client's assets are allocated across different investment categories based on these considerations, helping them remain organized while making informed decisions about their financial future.

This approach can lead to improved performance compared to focusing assets solely in one or two categories.

Tools for Creating One-Page Financial Plan Templates

To create a one-page financial plan template, consider using these resources:

-

Online Templates: Utilize online resources that provide pre-designed templates for one-page financial plans. Customize these templates to fit your client's specific needs.

-

Financial Planning Software: Harness specialized software tools crafted for creating and managing financial plans. These platforms often provide interactive interfaces and can streamline the process.

-

Spreadsheet Programs: Utilize spreadsheet programs such as Microsoft Excel or Google Sheets to create a customized, detailed one-page financial plan. These programs offer flexibility and customization options.

-

Financial Planning Apps: Explore mobile applications tailored for financial planning. These apps often come with useful features like goal tracking, budgeting tools, and investment portfolio management to simplify the planning process.

Best Practices for Using One-Page Financial Plans

When using one-page financial plans:

-

Simplify the information

-

Include visual aids for clarity

Keep It Simple

When creating a one-page financial plan template, keeping it simple is crucial. Simplifying the language and layout makes the plan easier to understand and follow. A straightforward approach helps clients grasp the key components like net worth, cash flow, goals, and action items effortlessly, leading to better engagement and understanding of their financial situation.

By keeping the plan simple, it becomes more accessible to a wider audience, increasing its effectiveness in providing clear guidance for clients' financial well-being. Simplicity also encourages regular updates and reviews as it doesn't feel overwhelming or time-consuming.

This ensures that the plan stays relevant and aligned with any changes in the client's circumstances or financial goals.

Incorporate Visuals

Incorporating visuals into a one-page financial plan can improve understanding and engagement. Charts, graphs, and tables can help clients comprehend complex concepts like asset allocation and cash flow at a glance.

Visuals also facilitate tracking progress toward financial goals over time. For instance, a bar graph showing increasing net worth or a pie chart illustrating diversified asset allocation can provide clear visual cues for clients to evaluate their financial health and stay motivated.

These visuals can be easily created using basic software tools like Excel or Google Sheets, ensuring accessibility for both the client and the advisor.

Integrating images alongside textual content in a financial plan template creates an interactive experience that captures attention and reinforces key messages about profits, balance sheets, investment advice, and more, while helping small businesses remain organized as they navigate complex financial decisions.

Furthermore, incorporating visuals gives a personalized edge to the plan's presentation style, making it visually appealing while conveying essential information about short-term projections and long-term estate planning with ease.

By strategically including these images throughout the document, it supports concise communication of vital topics such as determining net worth or assessing current cash flow for utmost clarity.

Regularly Update and Review

Regularly updating and reviewing your one-page financial plan is essential for staying on track with your goals. By routinely revisiting your plan, you can ensure it reflects any changes in your financial situation or personal values.

This helps to guarantee that you're always working towards the most current targets and making decisions based on accurate information. Regular updates also allow for adjustments in case there are shifts in your net worth, cash flow, or asset allocation.

By doing so, you're actively engaging with your financial health and ensuring that your plan remains relevant to guide better decision-making, ultimately benefiting both short-term and long-term financial projections.

Consistently reviewing the one-page financial plan template not only keeps you organized but also enables you to stay responsive to changing circumstances - a vital element in maintaining the best financial plans.

It's wise to align these reviews with regular checkpoints throughout the year such as quarterly or bi-annual assessments to effectively measure progress and make necessary tweaks where required.

Conclusion

In just one page, a financial plan can help clients stay organized and focused on their short-term and long-term goals. By determining client values, net worth, cash flow, and goals, a one-page financial plan template ensures that all aspects of the company's financial health are considered.

With the right tools and expertise, creating these plans becomes accessible to everyone. The goal is to keep it simple but effective through regular updates and reviews. Incorporating visuals enhances understanding for both the clients and advisors.

FAQs

1. What is a one-page financial plan template?

A one-page financial plan template is a tool used to stay organized and monitor a company's financial health. It provides an overview of the short term accounts and helps determine the right steps for success.

2. How can I use this sample financial plan template?

You can use this sample financial plan template to gain insights into your company's finances, decide on future steps, and keep track of all important accounts.

3. Can using such templates ensure client success?

Yes, with expertise in interpreting these templates, they offer valuable tips to manage finances effectively which leads to client success.

4. Do I need any specific tools or skills to use these templates?

While you don't need special tools beyond the template itself, having some background knowledge or expertise in finance will help you understand it better and make more informed decisions.