Starting a financial advisor business can feel overwhelming. Every successful advisory firm begins with a solid financial advisor business plan. This guide will show you how to create one, using clear examples.

Keep reading to learn more.

Why Financial Advisors Need a Business Plan

A business strategy aids financial consultants in setting concise objectives and a course for accomplishment. It illustrates the actions required for expansion, incorporating promotional strategies, budget formulation, and financial forecasts.

This strategy serves as a manual for driving informed choices and monitoring headway in achieving business objectives.

A thoughtfully prepared business strategy is indispensable for any consultancy firm aspiring for sustained success.

Armed with this, consultants can pinpoint their prospective audience, comprehend sector trends, and place their service provisions effectively amid rivals. This groundwork fosters expansion by centering on client demands and the optimal methods to address those demands with inclusive financial planning services.

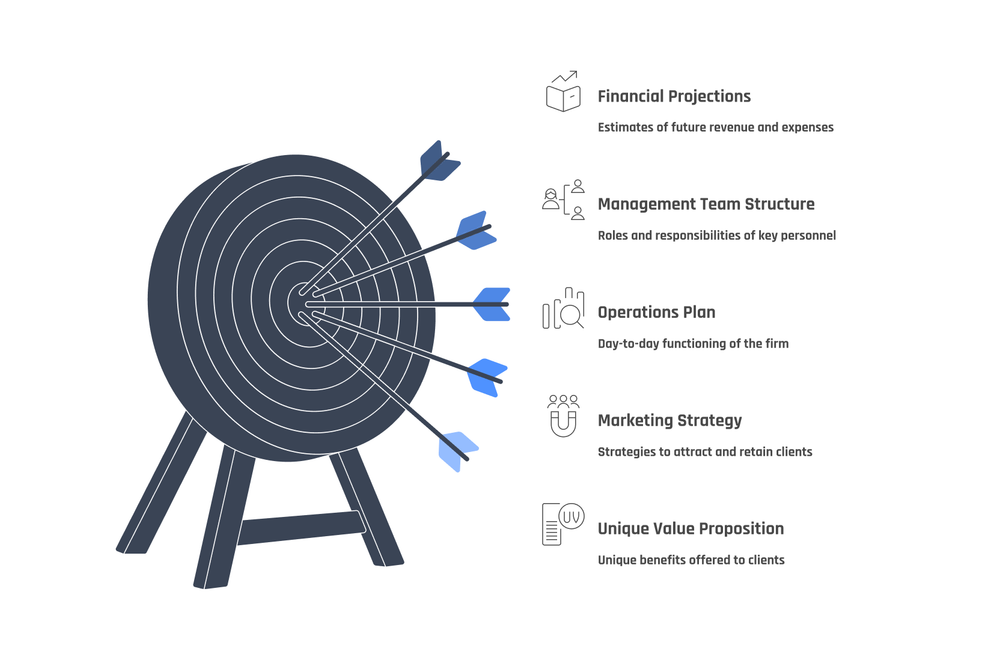

Key Elements of a Financial Advisor Business Plan

Crafting a financial advisor business plan involves essential components like the executive summary, company overview, target market analysis, competitive analysis, unique value proposition (UVP), marketing strategy, operations plan, management team structure, and financial projections.

These elements help in outlining the goals and directions for the advisory firm's success.

Executive Summary

The Executive Summary starts your financial advisor business plan. It gives a quick preview of what the plan covers, from service offerings to financial goals. This part catches attention and shows your vision for growth and success.

It should outline key points like the target market, unique value proposition, and how you'll meet clients' needs. Plus, it touches on budget and financial projections to show how the firm plans to make money.

Keep it clear and exciting to get readers hooked from the start.

Company Overview

A company overview introduces who you are and what you do. For a financial advisory firm, this section outlines the business's mission and the services it offers, such as tax planning, risk management, and comprehensive financial planning.

It might also highlight how long the advisory business has been helping clients manage their assets for better financial security.

Our mission is to empower small business owners by making informed decisions about their finances.

This part of the plan should detail where your firm stands in the market. Mention any specialty that sets you apart from competitors or any niche markets like long-term care insurance you serve particularly well.

It gives potential clients a clear view of why they should choose your services over others.

Target Market and Customer Analysis

Moving from understanding the company's overview to analyzing the target market and customers is vital in creating a financial advisor business plan. Identifying the target market involves recognizing specific groups of people who will benefit from the services offered.

It requires thorough research into demographics, such as age, income level, occupation, and location. Moreover, customer analysis involves understanding their needs and preferences when seeking financial advice.

This includes identifying what types of financial planning services are most sought after by potential clients within the industry.

The focus lies in tailoring marketing efforts towards these identified segments to attract and retain clientele effectively. By determining these key aspects carefully through market trends and analysis tools, advisors can create a strategic plan designed to enhance their long-term success in achieving business goals.

Industry and Competitive Analysis

The industry and competitive analysis play a vital role for financial advisors to comprehend their position in the market. By immersing in this process, advisors can pinpoint opportunities and risks within the landscape.

Grasping the industry's growth rate, market size, and key trends provides crucial insight for strategic decision-making. Assessing direct competitors' strengths and weaknesses helps in formulating effective differentiation strategies to stand out amidst a crowded field.

Scrutinizing the industry aids in identifying potential niches or underserved markets that can be targeted for business growth. Furthermore, assessing competitors' marketing approaches and service offerings offers valuable lessons on positioning and pricing strategies.

Successful financial advisors use this analysis as a guiding tool to craft unique value propositions that cater precisely to their target audience's needs, driving long-term success in the ever-evolving advisory realm.

Unique Value Proposition (UVP)

The Unique Value Proposition (UVP) distinguishes a financial advisor from others in the industry. It's the unique benefit or advantage that a client can exclusively receive from that specific advisor.

A robust UVP could involve delivering personalized financial planning customized for long term care insurance needs, offering a comprehensive business plan with measurable KPIs and clear objectives, all crafted to improve an advisory firm's long-term success.

This distinct approach not just sets advisors apart from competitors but also reveals the keys to attracting and retaining clients while achieving success in business finances.

Marketing and Outreach Strategy

Financial advisor business plans should include a solid marketing and outreach strategy to attract and retain clients. Here's how to craft an effective plan:

-

Identify Your Target Market: Determine the specific demographics, needs, and preferences of your ideal clients.

-

Utilize Online Platforms: Leverage social media, online advertising, and content marketing to reach a wider audience.

-

Networking and Referrals: Establish partnerships with complementary businesses and seek referrals from satisfied clients.

-

Educational Workshops: Host workshops or webinars to educate potential clients about financial planning topics.

-

Community Involvement: Sponsor local events, volunteer in community initiatives, and establish a strong local presence.

-

Client Testimonials: Showcase success stories from satisfied clients to build trust and credibility.

-

Continuous Communication: Maintain regular contact with existing clients through newsletters, emails, or personalized updates.

Crafting a comprehensive marketing and outreach strategy is crucial for the success of any financial advisory firm. It's essential to attract new clients while retaining existing ones in a constantly changing market landscape leading to the next heading after "- Marketing and Outreach Strategy".

Operations Plan

Financial advisor's operations plan is a vital part of the business plan. It outlines how the advisory firm will function on a day-to-day basis and how various operational tasks will be managed. Here are the key components of an operations plan:

-

Staffing Plan: Detail the roles and responsibilities of each team member, including hiring plans and organizational structure.

-

Workflow Management: Outline how client inquiries, financial analysis, and other tasks will be managed efficiently.

-

Client Servicing Procedures: Describe how client meetings will be scheduled, conducted, and documented for follow-up actions.

-

Technology Infrastructure: Specify the systems and software that will support operations, such as CRM, financial planning tools, and cybersecurity measures.

-

Compliance Processes: Document how the firm will adhere to regulatory requirements in its operations to ensure legal adherence.

These elements form the backbone of a sound operations plan for a financial advisory business.

Management Team Structure

The management team structure is essential for the success of a financial advisor business. It delineates the roles and responsibilities of key personnel, such as the CEO, CFO, and other executives.

This ensures efficient decision-making and smooth operation within the company. A well-structured management team enables effective leadership, strategic direction, and implementation of business plans to achieve long-term success.

Furthermore, having a robust management team enhances investor confidence and supports sustainable growth.

Financial Plan and Projections

A financial plan is a roadmap for money management. It includes budgeting, saving, investing, and insurance strategies. Financial projections are estimates of future revenue and expenses.

They help advisors set goals and make informed business decisions based on expected cash flow.

For instance, in the coming year, a financial advisor plans to attract 50 new clients with an average annual fee of $3,000 each. This will result in projected revenue of $150,000. After deducting operating costs such as rent, marketing expenses, and employee salaries, the net profit is forecasted at $80,000.

These figures assist advisors in planning for growth and ensuring sustainable profitability.

Tips for Writing an Effective Financial Advisor Business Plan

Define clear objectives and goals, include measurable key performance indicators (KPIs), incorporate a budget and financial forecast, seek feedback and revise the plan. Read more for detailed insights.

Define Clear Objectives and Goals

To achieve success as a financial advisor, it's crucial to establish clear objectives and goals for your business plan. These will function as the roadmap guiding your efforts towards growth and profitability.

By outlining specific targets, such as acquiring a certain number of clients or increasing revenue by a set percentage, you create measurable criteria for evaluating your progress.

Including key performance indicators (KPIs), like client retention rate or average account size, into your goals provides a quantitative way to track performance and make informed decisions based on real data.

The clarity of these objectives also aids in prioritizing tasks and allocating resources efficiently to propel the business forward.

When developing your financial advisor business plan, incorporating tangible goals ensures that every initiative is purposeful and aligned with the overarching vision for long-term success.

Furthermore, setting these objectives not only aids in establishing benchmarks but also acts as motivation for both you and your team. Having well-defined goals promotes accountability within the organization while keeping everyone focused on working towards shared accomplishments.

Include Measurable Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) play a vital role in a financial advisor business plan. They are pivotal in tracking progress and measuring success. For instance, KPIs could encompass the quantity of new clients acquired, percentage growth in assets under management, or client retention rate.

These quantifiable metrics offer clarity on the business's performance and steer decision-making for future strategies. Integrating KPIs assures that the financial advisor can assess their progress against set goals and make necessary adjustments to ensure long-term success.

Additionally, KPIs provide valuable insights into the efficiency of marketing endeavors, operational productivity, and overall financial well-being. By integrating specific KPIs related to client acquisition, revenue generation, and operational productivity as delineated in the plan's Key Elements section such as Marketing and Outreach Strategy and Financial Plan & Projections; these indicators directly contribute to honing business strategies for optimal growth.

Incorporate a Budget and Financial Forecast

To ensure the financial advisor business plan is comprehensive and effective, it's essential to incorporate a budget and financial forecast. This helps in planning and allocating resources strategically, ensuring financial stability and growth.

-

Budgeting allows careful allocation of resources for marketing, operations, and other key areas.

-

Financial forecasts help in projecting future income, expenses, and cash flow based on realistic assumptions.

-

It enables setting financial targets and tracking progress against them.

-

Helps in identifying potential financial challenges or opportunities that may arise.

-

Provides a clear picture of the financial health of the business to potential investors or stakeholders.

-

Aids in making informed decisions regarding investment in technology, hiring staff, or expanding services.

-

Enables periodic review and adjustments to stay aligned with the changing market dynamics.

Seek Feedback and Revise the Plan

After drafting the financial advisor business plan, it's essential to seek feedback from industry experts or mentors. Receiving constructive feedback can help refine the plan and ensure it aligns with industry standards.

Moreover, revising the plan based on valuable suggestions can enhance its effectiveness in attracting potential clients and investors. Seeking feedback and iteratively refining the plan is crucial for its long-term success and adaptability in a dynamic market.

As you begin seeking feedback, keep in mind that this process not only enhances your understanding but also improves the overall quality of your financial advisor business plan. It's wise to outsource some tasks if necessary, particularly when considering measurable KPIs and integrating a budget into your financial forecast for long-term success.

Examples of Financial Advisor Business Plans

Check out a Comprehensive Financial Planning Business Model and a One-Page Financial Advisor Business Plan Example to see practical applications of the concepts discussed in this guide.

These examples can provide valuable insights into crafting your own business plan.

Comprehensive Financial Planning Business Model

A comprehensive financial planning business model includes critical elements such as an executive summary, company overview, target market analysis, unique value proposition, marketing strategy, operations plan, management team structure, and financial projections.

By incorporating these elements, a clear roadmap for long-term success is ensured as the business grows. Many advisors find it helpful to begin their plan by including measurable KPIs and a budget.

Seeking feedback from peers or mentors can help refine the plan to fit the dynamic industry landscape.

Financial planners often delegate tasks as the challenges of managing various aspects become time-consuming. Instances within this model demonstrate how advisory firms have developed plans to strengthen growth strategies customized for achieving specific objectives in the financial services realm.

Using tools like business plan templates and financial planning software can further streamline this process while ensuring that steps are taken in line with predefined goals. Financial planners, aiming for more than one-page plans or formal documents, are advised to delve into creating a well-structured comprehensive business model that supports their mission for long-term success.

One-Page Financial Advisor Business Plan Example

A one-page financial advisor business plan is a concise document outlining key aspects of your business. It condenses the essential elements into a single page format, making it easy to comprehend and refer back to.

This type of plan typically includes a brief overview of your company, target market analysis, unique value proposition, marketing strategy, and financial projections. An example of this could be presenting your firm's mission statement at the top and then detailing goals, strategies for achieving them, and expected outcomes in bullet points or simple tables below.

This streamlined approach helps you stay focused on crucial details and can serve as a quick reference tool when making strategic decisions or seeking outside funding.

Tools and Resources for Crafting a Business Plan

You may want to explore business plan templates, financial planning software, and market analysis tools as you craft your business plan. These resources can streamline the process and ensure that your plan is comprehensive and well-structured.

Business Plan Templates

Crafting a financial advisor business plan can be simplified by utilizing predefined templates to lead you through the process. These templates encompass crucial sections like the executive summary, company overview, and financial projections, thereby saving time and effort in organizing your plan.

Using templates guarantees that important elements such as target market analysis and unique value proposition are thoroughly covered, while offering a structure for developing a comprehensive business roadmap.

Integrating a budget and forecasting within these templates assists in outlining the financial aspect of your plan clearly and precisely, thereby improving its overall effectiveness in demonstrating long-term success potential.

Financial planner business plan | marketing plan | One page Business Plan

Financial Planning Software

When creating a comprehensive financial advisor business plan, leveraging financial planning software can be a valuable resource. This software is intended to improve and streamline the process of organizing and analyzing financial data, projecting cash flows, and creating detailed financial forecasts.

By integrating financial planning software into the business planning process, advisors can effectively handle the intricacies of budgeting and forecasting.

Financial planning software also offers features that enable scenario analysis, assisting advisors in customizing their plans for different market conditions or client needs. Moreover, this software provides tools for managing investment portfolios, which is essential for advisory firms aiming for long-term success.

Market Analysis Tools

After establishing your financial planning software, the next crucial step is selecting the right market analysis tools to understand your industry. Utilize these tools to gather data on customer preferences, trends, and competitors.

Market analysis tools such as demographic reports, competitor analysis platforms, and market research surveys can provide valuable insights into consumer behavior and market demand.

These resources help you make informed decisions about marketing strategies and identifying potential growth opportunities for your financial advisory business.

Remember that using dedicated market analysis tools can save you time and effort in understanding the intricacies of your target market. By integrating these tools into your business plan, you pave the way for a more strategic approach that supports long-term success in the continuously changing landscape of financial advisory services.

Conclusion

Crafting a solid business plan is crucial for the success of financial advisors. It outlines clear goals, strategies, and financial projections necessary for long-term growth. With examples and tips provided in this guide, writing an effective plan becomes more achievable.

Utilizing tools and resources further streamlines the process, leading to a well-structured roadmap for future business endeavors.

In conclusion, a well-thought-out business plan forms the foundation for sustained success in the ever-evolving realm of financial advisory firms. By including these key elements and learning from real-world examples, financial advisors can confidently set out on their journey towards achieving their business objectives.

FAQs

1. What is a formal business plan for financial advisors?

A formal business plan is a written document that outlines the goals of advisory firms, including strategies and timelines to achieve long-term success.

2. Why should I start writing a financial advisor business plan?

Writing a business plan helps you set clear objectives for your firm's growth. It also helps identify tasks you might outsource to save time.

3. Can creating a financial advisor business plan be time-consuming?

Yes, it can be time-consuming because it requires thoughtful planning and research. But the benefits outweigh the effort as it sets your firm on track for success.

4. Can you give me some examples of what to include in my financial advisor’s business plan?

Sure! A few examples would include an executive summary, company description, market analysis, organization structure, product line or services description, marketing strategy and financial projections.