Done-For-You Prospecting and Outbound for Wealth Advisors

For RIAs managing $250M to $3B in assets, growth shouldn't come at the cost of existing clients.

The RIA Growth Dilemma

RIAs managing $250M to $3B face a unique dilemma—how to grow without losing sight of their current clients. You're not a sales or marketing professional, and you shouldn't have to be.

You're busy enough managing your existing clients.

Poseidon is built to bridge that gap.

By helping you with LinkedIn and Email outreach, refining your prospecting, and tracking every engagement, Poseidon ensures you are meeting new prospects every week while you take care of your day job.

Trusted by top RIAs and financial professionals across industries

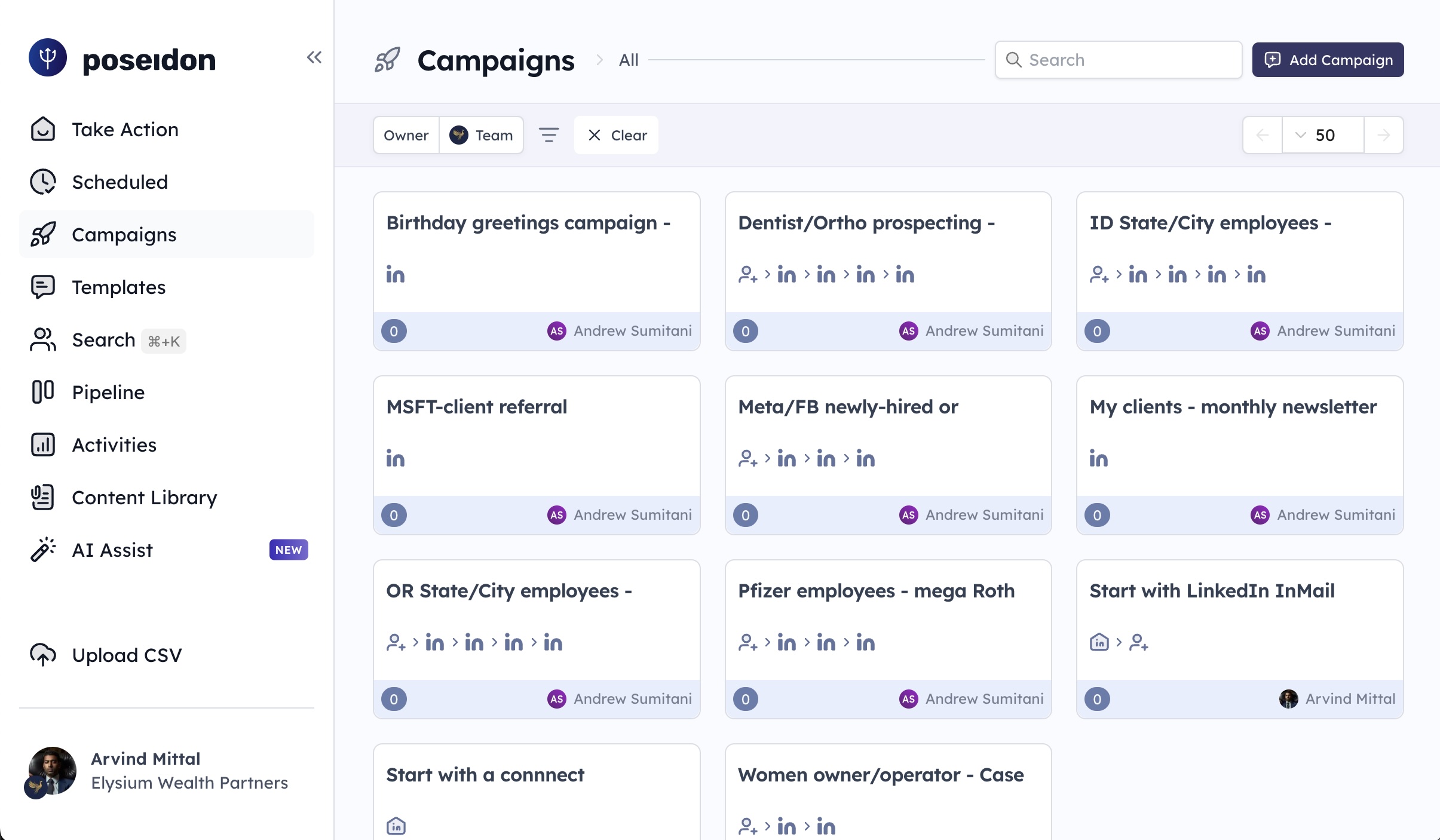

1,000+ tailored campaigns launched to nurture warm leads and deepen client relationships every month.

3x faster pipeline growth compared to traditional lead generation strategies.

+40% higher reply rates from high-value prospects with personalized outreach. More sustainable than spending money on stale leads over and over every month.

2.4 average days to first engagement.

Engagement cycles reduced from months to days, driving quicker conversions and more meaningful client interactions.

Poseidon empowers RIAs with AI-driven insights, precise targeting, and seamless multi-channel outreach, helping them connect with the right prospects at the right time.

Efficient Client Management

Balancing between managing clients and growing your business is tough. Poseidon takes care of the marketing so you can focus on what you do best, managing clients and growing your business.

Breakthrough Growth at Scale

Grow your business while providing personalized outreach. It can be taxing at times to constantly be on the lookout for new clients and think of how to market to them.

Proven, Measurable Results

Focus on the metrics that matter most. When you have a system that works, you can focus on what you do best, managing clients and growing your business.

Build trust with your prospects.

Prospects have become much more adept at avoiding marketing messages. Advisors who believe they can successfully flood prospects' inboxes with generic messages and letters are in for a rude awakening. In today's media-saturated world, it's significantly more challenging to reach your target audience than it ever was.

You somehow balance managing your existing customers with acquiring new ones each month. How can you automate your growth without compromising relationships with your current clients? That's where our team and process can help.

Multi-Channel Outreach

Shared inboxes connect all outreach channels so that you don't have to keep everything in your head.

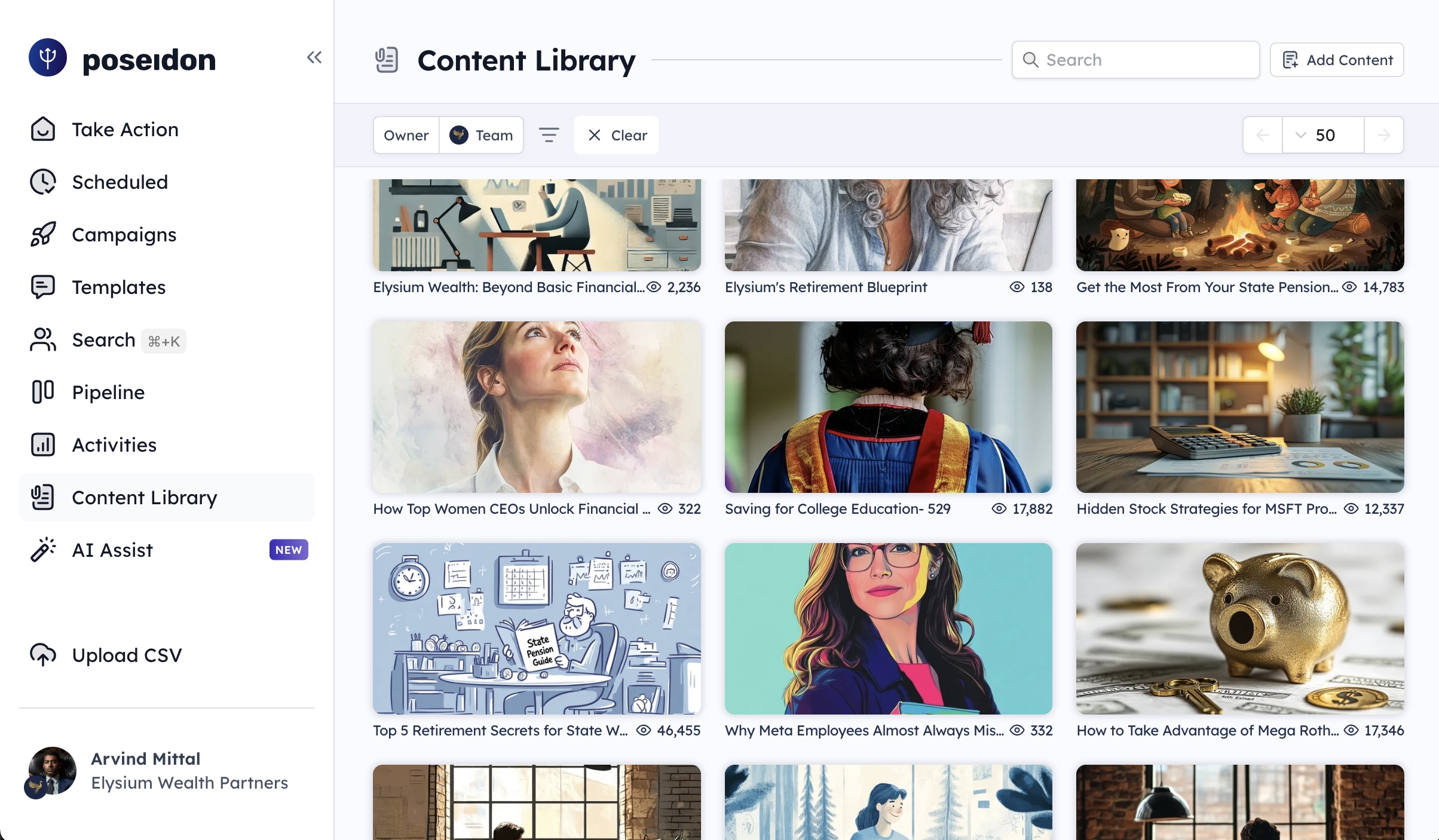

Content Library at Your Fingertips

Send visually stunning email content with a drag-and-drop.

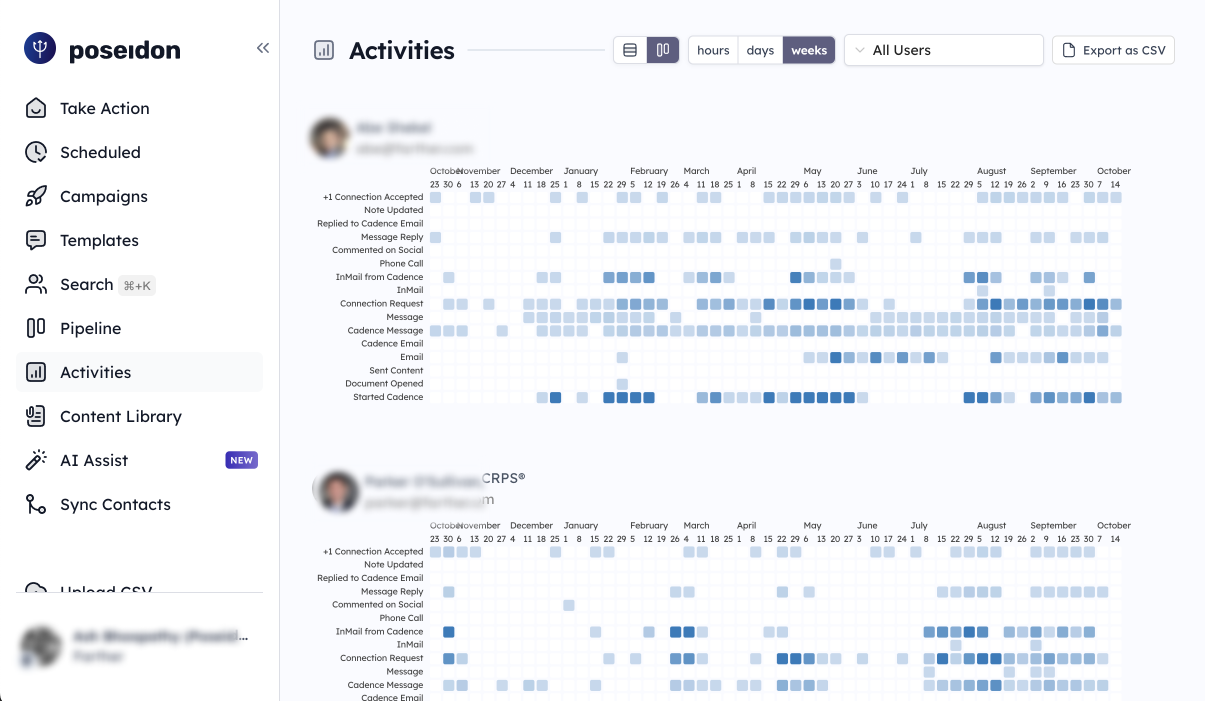

Track Activities across Channels

Make sure that you're not missing out on any opportunities to connect with your prospects

Old Way (interruption)

New Way (attraction)

Cold calls interrupting prospects at inconvenient times.

Thought leadership through insightful articles, blogs, and webinars.

Mass email blasts with generic messaging.

Targeted outreach using personalized messages aligned with client goals.

Purchased lead lists with low-quality prospects.

Organic growth through relationship-building on social platforms and communities.

Outbound sales reliant on high-pressure tactics.

Creating inbound opportunities by positioning yourself as a financial expert.

Transaction-focused conversations.

Long-term relationship building based on value and trust.

Limited visibility into where prospects are in their financial journey.

Using data-driven insights to engage at the right moment with the right advice.

Limited differentiation from competitors.

Standing out by building a unique personal brand that reflects expertise.

Scattered content that doesn’t align with a personal brand.

Integrated brand strategy across all platforms, showcasing values and expertise.

Chasing prospects who feel pressured.

Attracting ideal clients by becoming a trusted financial advisor in your niche.