Starting a career as an RIA can seem hard. An RIA is a professional who gives financial advice to clients. We'll show you how to become one, step by step. Get ready to learn more!

What Is a Registered Investment Advisor (RIA)?

After covering the basics, let’s focus on what a Registered Investment Adviser (RIA) is. A registered investment adviser (RIA) is a person or firm that offers advice about securities and investing to their clients.

They must register with either the Securities and Exchange Commission (SEC) or state authorities. This depends on their assets under management (AUM). Advisors with more than $110 million in AUM register with the SEC.

Those below this threshold typically register at the state level. It is important to note the distinction between registered representatives and investment advisor representatives (IARs). While registered representatives are affiliated with brokerage firms, IARs provide advice and services related to investments.

RIAs have a duty to act in their clients’ best interests. This means they are fiduciaries. They offer personalized financial advice and manage investments based on what will benefit each client most. A brokerage firm can also serve as an RIA, providing a broad spectrum of financial services.

From financial planning to portfolio management, RIAs cover a wide range of services for individuals looking to grow their wealth wisely.

Understanding the Role of Investment Adviser Representatives

Investment Adviser Representatives (IARs) are pivotal in the financial industry, offering personalized investment advice and managing investment portfolios for clients. These professionals work under the umbrella of a Registered Investment Advisor (RIA) firm, ensuring that clients receive tailored financial strategies that align with their goals and risk tolerance.

To become an IAR, individuals must meet specific educational and professional requirements. Typically, this includes passing the Series 65 exam or an equivalent qualification, which demonstrates a deep understanding of investment strategies, financial planning, and regulatory compliance. Additionally, IARs must register with the Securities and Exchange Commission (SEC) or state securities regulators, depending on the firm’s assets under management and the states in which they operate.

The role of an IAR involves more than just providing investment advice. These professionals are responsible for continuously monitoring client portfolios, making adjustments based on market conditions, and ensuring that all investment decisions are in the best interest of their clients. This fiduciary duty is a cornerstone of the profession, emphasizing the importance of trust and transparency in client relationships.

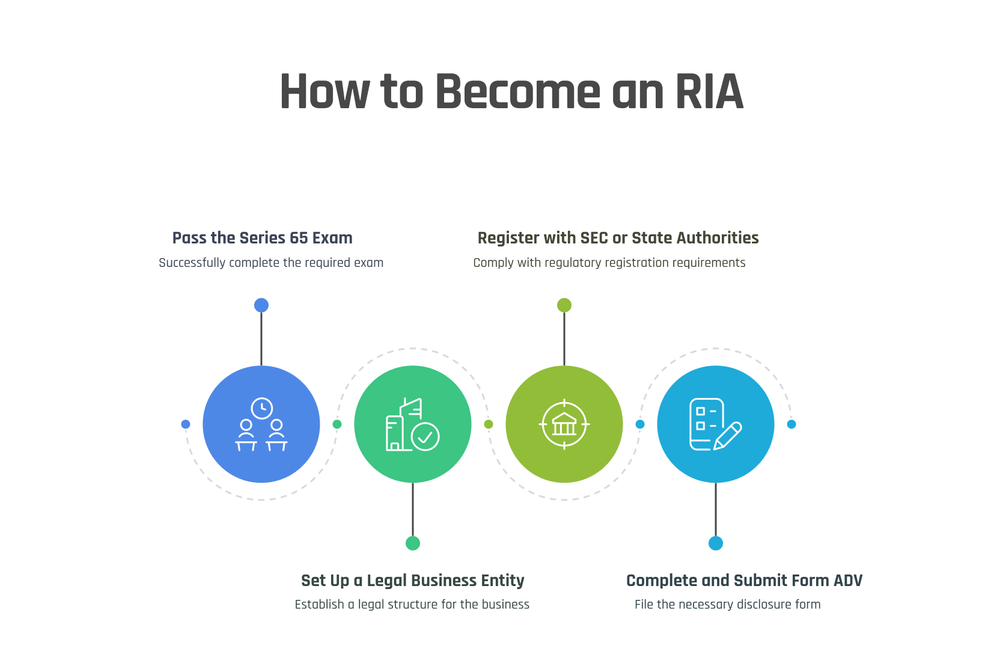

Key Steps to Become an RIA

To become an RIA, you need to pass the Series 65 exam and set up a legal business entity. After that, creating an online account with the Investment Adviser Registration Depository (IARD) is necessary for filing Form ADV.

Filing Form ADV is a critical step in the registration process. This form has two parts and provides essential disclosures about your business practices, backgrounds, and potential conflicts of interest to clients and prospects. You must file Form ADV through your IARD online account.

Advisors must register with the SEC or state authorities based on specific criteria, such as assets under management (AUM). Understanding the eligibility criteria and requirements for SEC registration is essential to determine whether you need to register with the SEC or state agencies.

1. Pass the Series 65 Exam

To become a Registered Investment Advisor (RIA), you must pass the Series 65 exam. This test covers laws, regulations, and ethics around investment advising, including federal securities laws. It is required by most states.

The exam has 130 questions and lasts 180 minutes. You need at least a score of 94 out of 130 to pass. The exam assesses the candidate's financial knowledge, ensuring they are well-versed in investment advice and regulatory requirements.

Studying for the Series 65 helps you understand the basics of financial planning, portfolio management strategies, and fiduciary responsibilities. Many people use study guides or take classes to prepare.

Once you pass, you can advise clients on investments and manage their portfolios according to state laws and SEC rules.

2. Set Up a Legal Business Entity

After passing the Series 65 exam, the next step is to form a legal business entity. This means choosing what kind of company you want to be. Many choose an LLC or a corporation because these options can protect personal assets from business risks.

To get started, pick a unique name for your firm and register it with the state where you will operate. You need to create company bylaws or an operating agreement too.

3. Register with the SEC or State Authorities

To become a Registered Investment Advisor (RIA), you need to register with the Securities and Exchange Commission (SEC) or the State Authorities. This involves completing Form ADV, which includes details about your investment strategies, services offered, fees charged, disciplinary history, and conflicts of interest. The Investment Advisor Registration Depository (IARD) facilitates this process by allowing advisors to create an online account to file Form ADV.

The SEC or State Authorities use this information to evaluate your eligibility to operate as an RIA and provide protection for investors. Depending on the amount of Assets Under Management (AUM), an RIA may need to register with the SEC or their state securities agency, highlighting the differences in requirements between these regulatory bodies. Once registered, you are required to adhere to ongoing reporting and compliance obligations outlined by the SEC or State Authorities.

Registering with the SEC brings authority over firms managing more than $100 million in assets under management (AUM), while smaller RIAs must register with their state securities regulators.

4. Complete and Submit Form ADV

To become a Registered Investment Advisor (RIA), completing and submitting Form ADV is crucial. This form is filed with either the Securities and Exchange Commission (SEC) or state securities authorities, providing details about the advisor’s business, ownership, clients, employees, business practices, affiliations, affiliated parties, and any disciplinary events of the advisor.

It’s an essential part of becoming an RIA as it allows regulators and potential clients to understand your firm better. Form ADV serves as a registration document that outlines key information about the advisor's business, services, and any potential conflicts of interest for current and prospective clients. In addition to general information about the advisor’s business model and potential conflicts of interest that may arise in working with clients are also disclosed through this form.

Form ADV is divided into two parts:

Part 1 which includes basic information about the investment advisory firm such as ownership structure, management personnel background, fee schedules charged by the adviser for their services;

Part 2 requires advisers to prepare written disclosure brochures outlining services offered including types of clients they work with, fee arrangements involved. Part II of Form ADV acts as a disclosure document that outlines the services provided to clients, compensation details, potential conflicts of interest, the adviser’s credentials, and other pertinent information that must be communicated to clients.

Also, disclosing any legal or regulatory problems may be required in this section.disclosed.

Licensing and Qualifications

To become an RIA, obtaining a bachelor's degree is highly recommended as it provides a strong foundation in relevant fields like finance or accounting, significantly enhancing your knowledge and marketability in a competitive industry. You also need to meet education and certification requirements. Ongoing continuing education is necessary to maintain qualifications as an investment advisor.

Additionally, detailing one's professional background in Form ADV is crucial. This written disclosure includes the types of services offered and any potential conflicts of interest, providing transparency to clients and prospects considering the advisor's services.

Education and Certifications

To become a registered investment advisor (RIA), you must meet certain educational and certification requirements. RIAs usually need at least a bachelor’s degree in finance, economics, or a related field. Obtaining a college degree is a foundational step for individuals aspiring to become registered investment advisors, as it provides the necessary educational background to meet professional requirements in the advisory field.

In addition, passing the Series 65 exam is necessary to register with state authorities or the SEC. Some professionals pursue advanced certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) to enhance their credentials and expertise in wealth management and financial planning. Strong mathematical skills are essential for evaluating complex numerical systems and managing investments, making a solid foundation in mathematics crucial for success in this career.

Ongoing continuing education is also required to maintain licensure as an RIA.

Ongoing Continuing Education Requirements

To maintain their license, RIAs must complete continuing education. The SEC mandates 12 hours annually of education focused on the investment advisory business. This enables RIAs to stay updated on industry changes and improves their knowledge in serving clients effectively.

Moreover, individual states may have specific continuing education requirements for RIAs as well.

The ongoing continuing education requirement is crucial as it ensures that RIAs remain well-informed about the latest developments in the industry. This ultimately benefits clients by ensuring that their financial advisor is equipped with the most current information and skills needed to provide sound advice.

Compliance and Regulatory Requirements

Complying with regulations is crucial to an RIA. It entails meeting fiduciary duty, maintaining accurate records, and acting in the best interests of clients. Additionally, outlining operating procedures as part of compliance documentation is essential when finalizing the registration process with the SEC or state regulatory agencies.

Federal securities laws are a significant component of the Series 65 exam, which aspiring Registered Investment Advisers (RIAs) must pass to practice legally. These laws are discussed alongside other essential topics like investment advice, reinforcing their relevance in the regulatory framework for financial professionals.

Fiduciary Duty and Client Best Interests

Registered Investment Advisors (RIAs) have a fiduciary duty, which requires them to always act in their clients' best interests. This means that they must prioritize the client and make investment decisions based on what benefits them the most.

They are also obligated to fully disclose any potential conflicts of interest and guarantee that all recommendations are appropriate for the client's financial situation, needs, and objectives.

Not meeting this duty could lead to severe consequences, as it violates securities laws and regulations aimed at safeguarding investors.

Furthermore, maintaining accurate records is vital for demonstrating compliance with fiduciary duty. Precise records are crucial for regulators to assess whether an RIA has effectively acted in its clients' best interests.

Maintaining Accurate Records

Maintaining accurate records is key for an RIA. It's a regulatory requirement and helps track client information, transactions, and communications. Proper record-keeping ensures compliance with SEC rules and regulations.

Records should cover client agreements, investment advice given, trade confirmations, performance reports, and any disclosures or conflicts of interest.

RIA businesses are also required to maintain records for at least five years after the last date of service to a client. Accurate record-keeping strengthens transparency and trust between the RIA and its clients while ensuring legal compliance.

Costs Associated with Starting an RIA

Starting an RIA involves various expenses. Initial costs include legal and registration fees, which can vary depending on the state of operation. Typically, forming a legal entity such as an LLC or corporation incurs costs ranging from $500 to $1,000. If the minimum net worth guidelines are not met, a surety bond may be required to fulfill state securities agencies' requirements.

There are also fees associated with registering with the SEC or state authorities. Meeting the minimum net worth guidelines is crucial for obtaining approval from these agencies, as it ensures financial stability and compliance. Failure to meet these guidelines may necessitate posting a surety bond as a financial guarantee.

Moreover, ongoing expenses, such as technology for client management systems and compliance software, should be considered. The series 65 exam fee is approximately $175, and there are continuing education requirements to maintain RIA status annually.

It’s crucial to have a clear understanding of these financial commitments before embarking on your journey as an RIA.

Operating an RIA in Multiple States

After establishing your RIA, you may consider expanding across multiple states. If you plan to do so, it’s vital to be aware of the varying registration requirements in each state. Registration with either the Securities and Exchange Commission (SEC) or a state securities regulator is crucial for offering advisory services and adhering to fiduciary duties.

This process can be quite complex as each state has its own set of rules and regulations governing RIAs. As of 2021, an RIA must typically register with the Securities and Exchange Commission (SEC) if they have over $100 million in assets under management or are based in a state without investment adviser regulation.

Conversely, those managing lesser amounts usually need to register with the securities agency in their home state. Advisors who have six or more clients in New York, or who market their services in the state, are required to register with the New York authorities, emphasizing the implications of asset under management thresholds for registration with both the state and SEC.

Expanding into multiple states entails additional fees for registering and ongoing compliance responsibilities such as filing annual reports and updating Form ADV at least annually or more frequently depending on changes.

It is essential to stay up-to-date with each state’s specific requirements where you operate to avoid penalties or disciplinary actions from regulators. Due diligence is crucial when considering this expansion as non-compliance can lead to significant consequences including fines or suspension of operations.

RIA Compensation Models

Exploring the compensation models for RIAs reveals several methods. These models outline how advisors can earn for the services they provide.

| Compensation Model | Description |

|---|---|

| AUM Fees | Advisors charge a percentage of the assets they manage. This rate typically ranges from 0. 5% to 2%. |

| Hourly Fees | Some RIAs charge an hourly rate for consulting services. Rates vary widely based on expertise and location. |

| Flat Fees | This model involves charging a set fee for a specific service package or financial plan. |

| Commission-Based | Advisors earn commissions on products they sell, such as mutual funds or insurance policies. |

| Retainer Fees | Clients pay a regular, fixed amount for ongoing advice. This can be monthly, quarterly, or annually. |

| Performance-Based Fees | This less common model allows advisors to charge fees based on the performance of the investments they manage. |

Each model suits different client needs and investment strategies. Advisors often combine several methods to serve their clients best.

Conclusion

Becoming an RIA involves a series of essential steps. From successfully passing the Series 65 exam to establishing a legal business entity and registering with the SEC or state authorities, there are clear guidelines to follow.

Licensing and qualifications play a crucial role, requiring ongoing education requirements for compliance and regulatory needs. Navigating costs associated with starting an RIA can be demanding but having clarity on compensation models is crucial.

Operating in multiple states presents its own set of challenges, as does understanding fiduciary duty and client best interests. In conclusion, becoming an RIA demands careful consideration of these steps with meticulous attention to compliance and regulatory requirements.

FAQs

1. What is an RIA?

An RIA, or Registered Investment Advisor, is a firm that provides investment advice and manages client assets. They are regulated to ensure they act in their clients' best interests.

2. How do I become an RIA?

To become an RIA, you must register with the SEC or your state regulator. You need to complete required forms, pay fees, and meet qualifications like passing exams.

3. What qualifications do I need?

You typically need a background in finance or business. Many RIAs hold certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst). Passing the Series 65 exam is also essential.

4. Are there ongoing requirements for RIAs?

Yes, RIAs must comply with ongoing regulations. This includes filing annual updates and maintaining proper records of client interactions and investment strategies.