Choosing the right career path can be tough. The financial planner career path is growing fast. This guide will show you how to move up and succeed. Keep reading to learn more!

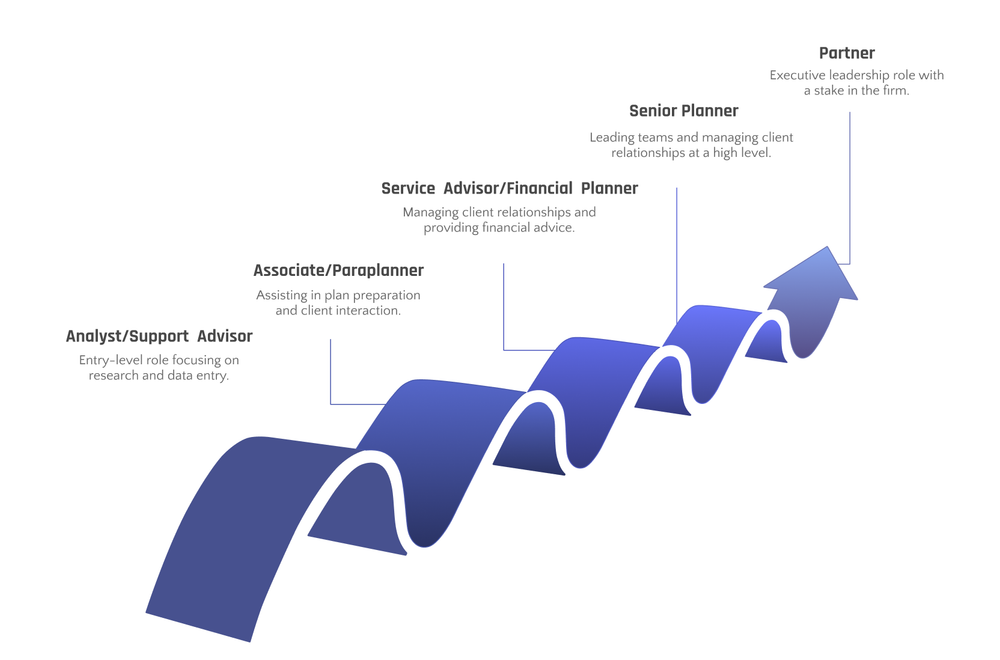

Key Roles in the Financial Planner Career Path

Financial planners start as analysts or support advisors, then advance to become associates or paraplanners. After that, they progress to service advisors or financial planners and eventually senior planners and partners.

Analyst / Support Advisor

Starting as an Analyst or Support Advisor is a common first step on the financial advisor career path. In this role, you mainly help with research and data entry. This helps senior team members make decisions about client investments.

You learn about different financial products like mutual funds and insurance.

An Analyst or Support Advisor also assists in creating reports for existing clients. They show how well their investments are doing. Over time, you gain experience talking to clients directly.

This prepares you for more advanced roles in finance and investment advice.

Associate / Paraplanner

Associate or paraplanner roles are a step up in the financial planning career. People in these jobs help financial planners prepare plans and advice. They work on gathering client information, analyzing investment portfolios, and researching financial products.

This role is key for those looking to deepen their financial knowledge.

They also work closely with clients, helping them understand their long-term financial goals. Skills in tax laws and risk management are often used here. Moving from this role to a service advisor or financial planner is common.

It requires strong interpersonal skills and an understanding of personal finance.

Service Advisor / Financial Planner

After gaining experience as an Associate or Paraplanner, the next step is to become a Service Advisor or Financial Planner. In this role, you will start managing your client relationships directly.

You help clients plan their finances for goals like retirement and education. You also offer advice on investments, taxes, and insurance.

Service Advisors or Financial Planners need good skills in business administration and understanding personal financial advisors' duties. Most have at least a bachelor's degree. Many also get certified as a Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

This certification shows that they have advanced knowledge and can be trusted by clients.

To succeed as a Service Advisor / Financial Planner, dedication to helping clients meet their long-term financial goals is key.

Senior Planner

As a Senior Planner, you must have extensive experience and expertise in financial planning. With several years of apprenticeship experience, you'll lead a team of advisors and manage client relationships while acquiring new clients for the firm.

This role often comes with a median annual wage in six figures, especially if you're self-employed or at large firms. Moreover, attending conferences and staying updated on tax laws and investment strategies are critical to remaining competitive in the ever-changing realm of financial services.

To advance further as a Senior Planner, obtaining certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) is essential. Additionally, developing strong leadership abilities and strategic thinking will support your journey towards becoming a Partner or even owning your own practice down the line.

Partner

As a financial planner, achieving the position of a Partner represents a substantial professional milestone. At this stage, individuals typically form part of the executive leadership team and may possess a stake in the firm.

Partners often supervise client relationships at a high level and play a critical role in shaping their organization's trajectory. They can serve as mentors for junior staff and spearhead strategic initiatives to propel business growth.

It's customary for Partners to have numerous years of experience and possess advanced certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), showcasing their proficiency in handling intricate financial matters.

Progressing to the next section on "Required Certifications and Qualifications," let's explore what it entails to advance further in this career path.

Required Certifications and Qualifications

To become a financial planner, obtaining certifications such as Certified Financial Planner (CFP) is essential. These certifications demonstrate expertise in areas like tax advisory and long-term financial goal planning.

Certified Financial Planner (CFP)

To qualify as a certified financial planner (CFP), a bachelor's degree in finance, accounting, economics or business is required, followed by the completion of a CFP Board-approved education program.

Subsequently, passing the CFP exam and acquiring three years of experience are necessary to attain the certification. The job growth for CFPs is projected to be 15% from 2016 to 2026, signaling a faster pace compared to other occupations.

Moreover, most financial planners possessing a CFP certification can trade stocks and offer guidance on insurance and retirement planning. They dedicate themselves to revealing the strategies for achieving long-term financial objectives for their clients and customarily tailor their advice based on clients' specific requirements and objectives.

CFPs participate in annual conferences as part of their continuing education requirements, ensuring that they remain updated on new developments in the field.

Chartered Financial Analyst (CFA)

After achieving the Certified Financial Planner (CFP) certification, many financial planners opt to pursue the Chartered Financial Analyst (CFA) designation to advance their careers.

The CFA credential provides professionals with in-depth knowledge and skills related to investment management and analysis. It is a well-respected qualification that equips senior advisors and lead advisors with the expertise needed to navigate complexities in the field of wealth management.

With a focus on topics such as quantitative methods, economics, financial reporting, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management, this certification is formulated to enhance a professional's technical expertise towards long-term financial goals.

Furthermore, a master's degree is not only encouraged but also can lead to credibility when seeking positions beyond just entry-level within firms focused on investment management or private banking.

As of 2021, there are over 170 thousand CFA charterholders worldwide who have undergone detailed training tailored to ever-evolving market trends and strategies for optimizing client portfolios.

The CFA designation can open doors for financial planners looking to specialize in analyzing securities or managing investment funds.

Skills for Advancement

To advance in the financial planner career path, having strong technical expertise is crucial. Concurrently, developing strategic thinking and leadership abilities can pave the way for professional growth.

Technical Expertise

Acquiring technical expertise is crucial for advancing as a financial planner. Proficiency in analyzing market trends, understanding investment strategies, and utilizing financial software are essential skills.

Keeping up with industry advancements through attending conferences and staying updated on new business practices can enhance one's knowledge base. Furthermore, having a comprehensive grasp of the intricacies involved in managing long-term financial goals is vital for success in this career path.

Building expertise not only supports clients better but also significantly contributes to personal growth as a financial planner.

Strategic Thinking

Strategic thinking is essential for advancing in the financial planner career path. It involves analyzing market trends, identifying potential opportunities, and devising long-term plans to help clients achieve their financial goals.

This includes envisioning the big picture and making calculated decisions to navigate through changing economic landscapes and client needs. Financial planners who can demonstrate strong strategic thinking skills are better equipped to provide tailored advice that aligns with clients' long-term objectives, ultimately enhancing their own firm's reputation as reliable wealth managers.

Moreover, developing strategic thinking abilities allows financial planners to offer more than just basic investment advice; it enables them to design comprehensive strategies that address intricate financial challenges while staying ahead of ever-changing market trends.

As a result, they can attract next-generation clients seeking holistic guidance for their long-term financial goals while also positioning themselves as leaders in an increasingly competitive industry.

By attending conferences and gaining first-hand experience in navigating the world of strategic planning, financial planners can unveil the necessary insights to ultimately progress towards senior analyst roles or even establish their own successful firms within a few years.

Leadership Abilities

In the financial planner career path, fostering strong leadership skills is crucial for progress. As you move towards positions such as Senior Planner or Partner, leadership abilities grow in significance.

These roles frequently entail leading a team, overseeing client relationships, and making strategic decisions to attain clients' long-term financial objectives. Proficient leaders in this field must motivate their teams, communicate clearly with clients, and skillfully navigate intricate financial environments.

Cultivating these leadership skills will not only boost your career opportunities but also enable you to become a reliable advisor guiding clients toward their financial goals.

Conclusion

In conclusion, the financial planner career path offers diverse opportunities for growth and advancement. As you progress from an entry-level analyst to a senior partner, acquiring necessary certifications such as CFP and CFA is crucial.

This journey demands honing technical expertise, strategic thinking, and leadership skills. Keep in mind that self-employment could be an option down the road but attending conferences and staying updated with industry trends are equally important.

The long-term financial goals of clients should always remain at the heart of your professional endeavors.

FAQs

1. What is a certified financial planner (CFP)?

A CFP is a professional who helps people with their long-term financial goals. They may sell stocks or other investments to help clients reach these goals.

2. How can I advance in my career as a financial planner?

To advance, you could attend conferences and network with the next generation of planners. You might also consider becoming self-employed for more control over your career path.

3. Are there entry-level positions available in this field?

Yes, there are many entry-level jobs for those interested in becoming a financial planner. These roles provide valuable experience and can lead to further advancement opportunities.

4. What skills do I need to succeed as a CFP?

Successful CFPs have strong analytical skills and are good at building relationships with clients. They must also stay up-to-date on market trends and regulatory changes.