Finding the right tools to check on investment portfolios can be tough.

Many advisors use portfolio visualizer tools to help with this. This blog will talk about the best tools for managing and analyzing investments.

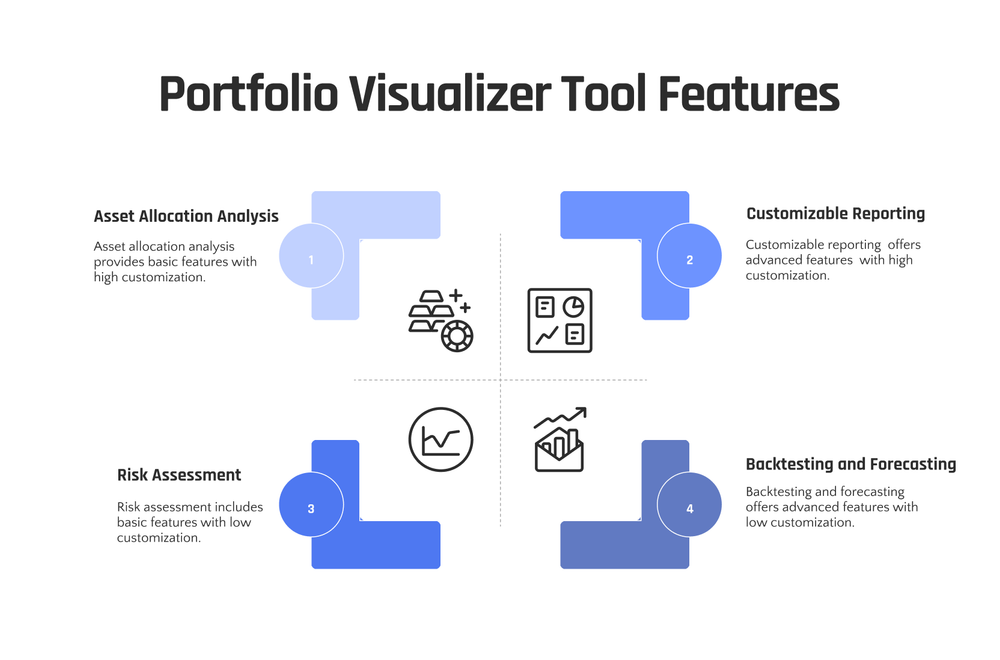

Key Features to Look for in Portfolio Visualizer Tools

Portfolio visualizer tools should offer asset allocation analysis, risk assessment and performance metrics, customizable reporting, integration with financial accounts, and backtesting and forecasting capabilities.

These features allow advisors to make informed investment decisions and optimize portfolio performance.

Asset Allocation Analysis

In the process of analyzing how to distribute investments across various asset types, such tools aid advisors. This allows for the diversification of the investment portfolio. Advisors can align their clients' risk tolerance and financial objectives with the suitable combination of stocks, bonds, cash, and precious metals using these tools.

To propose the ideal target asset allocation, these tools utilize past data and current market patterns. They take into account aspects such as risk evaluation, portfolio performance, and currency volatility.

This provides a transparent perspective on how each type of asset could impact the total investment strategy and returns.

Risk Assessment and Performance Metrics

After discussing asset allocation analysis, it's clear portfolio visualizer tools must also focus on risk assessment and performance metrics. These features help advisors see how risky an investment is and how well it performs over time.

They use numbers like the Sharpe ratio to measure risk against return. This helps in comparing different investments quickly. Also, tools track past performance and estimate future returns using historical data.

These metrics let advisors make better decisions by looking at potential capital gains or losses. They consider factors like market volatility, currency fluctuations, and interest payments.

By studying these details, financial advisors can predict which investments might do well and which ones could be too risky for their clients' portfolios.

Customizable Reporting

After comprehending risk and performance, consultants can utilize customizable reporting to create transparent investment reports. This facility allows them to illustrate to the clients the status of their investments in a straightforward manner.

They have the liberty to choose what specifics to encompass, such as asset distribution or portfolio yields. This ensures that each report addresses the distinct requirements of diverse clients.

Customizable reporting assists in monitoring progress in alignment with financial objectives as well. Consultants can modify reports as required. They accentuate essential aspects like cash influx or predicted capital profits.

This simplifies the process for clients to grasp their investments and decisions.

Integration with Financial Accounts

Moving from customizable reporting to integration with financial accounts, seamless connectivity between portfolio visualizer tools and financial accounts is essential. The capacity to sync with investment accounts, brokerage accounts, retirement accounts, and bank accounts allows for more accurate portfolio tracking and analysis.

By integrating multiple portfolios and aligning them with investment goals, these tools offer a comprehensive view of asset correlations, sector weightings, cash flow, and historical performance.

Backtesting and Forecasting Capabilities

Portfolio visualizer tools with historical testing and projecting capabilities can help advisors make informed investment decisions. These tools allow users to assess the performance of a portfolio under different historical scenarios, providing valuable insights into potential risks and returns.

By leveraging advanced algorithms and historical data, historical testing features enable advisors to simulate how their portfolios would have performed in the past, helping them gauge the strength of their investment strategies.

Additionally, projecting capabilities utilize various analytical models to project future portfolio performance based on different market conditions, empowering advisors to make proactive adjustments to optimize their clients' investments for long-term success.

When evaluating these tools, it's essential for advisors to prioritize those that offer reliable historical testing and projecting features integrated with customizable reporting options.

Also, seamless integration with financial accounts ensures accurate data inputs for more precise analysis and decision-making processes within these platforms. With these capabilities, advisors can be better equipped to guide their clients toward achieving their investment goals while mitigating potential risks.

Empower

Empower provides comprehensive asset allocation analysis, risk assessment, and customizable reporting to help advisors make informed investment decisions. It seamlessly integrates with financial accounts and offers robust backtesting and forecasting capabilities for a holistic portfolio management experience.

Features & Description (Empower)

Empower offers asset allocation analysis, risk assessment tools, and customizable reporting to help advisors make informed investment decisions. It seamlessly integrates with financial accounts, enabling easy access to vital information for portfolio management.

Backtesting and forecasting capabilities provide valuable insights into potential future performance based on historical data. With these features, Empower equips advisors with comprehensive tools for effective portfolio visualization and analysis.

The platform’s user-friendly interface simplifies investment tracking and performance evaluation. By including a range of analytical tools such as factor analysis and Monte Carlo simulations, Empower ensures that advisors can thoroughly evaluate portfolio risk and align investments with their clients' financial goals.

Furthermore, it provides detailed reports on asset classes, mutual funds, stocks, and hedge funds to facilitate well-informed decision-making. Overall, Empower is designed to enhance the advisor-client relationship by offering strong portfolio management solutions tailored to achieve optimal outcomes in a constantly evolving market landscape.

Pros & Cons (Empower)

Examining the advantages and disadvantages of using Empower as a portfolio visualizer tool offers insight for advisors. Here's a detailed breakdown:

| Pros | Cons |

|---|---|

| Empower provides comprehensive asset allocation analysis. | Limited customization options for reports. |

| Features detailed risk assessment and performance metrics. | Some users find the interface challenging to navigate. |

| Offers integration with various financial accounts for streamlined management. | Backtesting capabilities might not meet the needs of all advisors. |

| Supports forecasting to help predict future portfolio performance. | Higher cost compared to some other tools available on the market. |

Empower stands out for its asset analysis and risk assessment features but could improve in areas like report customization and user interface.

Morningstar Portfolio Manager Instant X-Ray

Morningstar Portfolio Manager Instant X-Ray offers detailed insights into the makeup of your investment portfolio, from asset allocation to individual security analysis. It allows advisors to swiftly evaluate the risk and performance metrics of their clients' portfolios without dealing with complications.

Features & Description (Morningstar Portfolio Manager Instant X-Ray)

Morningstar Portfolio Manager Instant X-Ray is a comprehensive tool that offers a detailed view of your investment portfolio. It provides insights into the asset allocation, sector diversification, and stock style breakdown of your holdings.

Besides, it lets you evaluate the geographic exposure of your investments and understand how different regions contribute to your overall portfolio.

This tool also assesses the risk within your portfolio by analyzing metrics such as volatility, beta, and standard deviation. By providing these essential performance measurements, Morningstar Portfolio Manager Instant X-Ray enables users to make informed decisions about their investment strategy based on concrete data.

Additionally, it offers investors an instant analysis of potential risks associated with their portfolios — an important feature for making prudent financial decisions in the constantly changing field of investment management.

Pros & Cons (Morningstar Portfolio Manager Instant X-Ray)

Exploring the Morningstar Portfolio Manager Instant X-Ray reveals its strengths and weaknesses. Here's a quick rundown in table format:

| Pros | Cons |

|---|---|

| Offers detailed asset allocation analysis. | Lacks real-time data updates. |

| Includes risk assessment and performance metrics. | Some features require a premium subscription. |

| Provides customizable reporting options. | Can be complex for beginners. |

| Allows easy visualization of investments. | Integration with financial accounts is limited. |

Next, we'll review the Portfolio Visualizer tool.

Portfolio Visualizer

Portfolio Visualizer offers a comprehensive set of tools for portfolio analysis and tracking. Its user-friendly interface and diverse range of features make it a top choice for advisors seeking effective portfolio management solutions.

Features & Description (Portfolio Visualizer)

Portfolio Visualizer represents a potent resource for evaluating investment portfolios. It facilitates thorough analysis of asset allocation, enabling users to appraise the spread of their investments across diverse assets such as stocks, bonds, and other securities.

The platform further provides robust risk appraisal and performance metrics, allowing users to gauge overall risk exposure and assess historical performance based on various financial measures.

In addition, Portfolio Visualizer offers customizable reporting, providing tailored insights into portfolio diversification and investment performance.

Moreover, this tool seamlessly integrates with financial accounts to streamline data collection and analysis processes. It also encompasses backtesting and forecasting capabilities that empower users to model investment strategies under varying market conditions.

In sum, Portfolio Visualizer acts as an invaluable platform for investors seeking comprehensive portfolio analysis tools with an emphasis on efficient asset allocation and risk management.

Pros & Cons (Portfolio Visualizer)

After exploring the features and functionalities of Portfolio Visualizer, it's essential to weigh its advantages and drawbacks. This will help users make an informed decision about whether this tool aligns with their investment strategy needs.

| Pros | Cons |

|---|---|

| Offers comprehensive backtesting capabilities. | Limited customer service options. |

| Free to use for basic features. | Advanced features require a subscription. |

| Supports asset allocation analysis. | Interface can be complex for beginners. |

| Includes risk assessment and performance metrics. | Does not integrate directly with financial accounts. |

| Provides a wide range of financial modeling tools. | Forecasting capabilities might seem overwhelming initially. |

| Allows for easy customization of reporting. | May require a learning curve to utilize all features effectively. |

This table outlines the key pros and cons of Portfolio Visualizer, offering a snapshot of what users can expect.

Stock Rover

Stock Rover offers a user-friendly interface and comprehensive analysis tools, making it a top choice for advisors seeking in-depth portfolio visualizations. Its robust features include advanced stock screening, charting, and research reports to empower advisors with valuable insights for effective decision-making.

Features & Description (Stock Rover)

Stock Rover is a powerful portfolio management and analysis tool that provides a wide range of features to assist advisors in making well-informed investment decisions. With Stock Rover, users can monitor stocks, analyze portfolio returns, assess risk with maximum drawdown metrics, and evaluate estimated capital gains.

The platform offers personalized reporting and integrates with financial accounts for a seamless user experience.

Stock Rover's backtesting and forecasting capabilities empower users to navigate the intricacies of the constantly changing market by utilizing historical data to guide future investment strategies.

The software also includes asset allocation analysis tools to customize portfolios for specific investment objectives. Moreover, Stock Rover provides a budgeting tool and retirement planner to aid users in effectively planning for their financial future.

Pros & Cons (Stock Rover)

Transitioning from the features and description of Stock Rover, let's break down its strengths and weaknesses. Stock Rover provides comprehensive screening tools to identify potential investments with strong financials, performance metrics, and dividend history. It also offers detailed research reports for thorough analysis.

Stock Rover excels in providing a user-friendly interface, dynamic charting capabilities, and integration with brokerage accounts for seamless portfolio tracking. Users can also access pre-built screeners or create custom ones according to their specific investment criteria.

Stock Rover's extensive array of features may pose a challenge for beginners. Additionally, some users might perceive the pricing as slightly higher compared to other portfolio visualizer tools available in the market.

In conclusion, Stock Rover stands out for its robust research resources but may not be as suitable for those seeking simpler or more cost-effective options.

Vyzer

Vyzer provides customizable reporting and integrates with financial accounts for a seamless experience in portfolio visualization. Its backtesting and forecasting capabilities empower advisors to make data-driven investment decisions.

Features & Description (Vyzer)

Vyzer is a powerful portfolio visualizer tool designed to streamline the investment management process. It offers in-depth asset allocation analysis, providing real-time insights into portfolio diversification and risk exposure.

Vyzer's strong risk assessment tools and performance metrics enable users to make informed decisions based on historical and projected data, ensuring optimal portfolio performance.

The customizable reporting feature allows advisors to tailor reports according to their clients' needs, enhancing transparency and communication. Integration with financial accounts simplifies data aggregation and provides a comprehensive view of all investments in one place.

In addition, Vyzer's backtesting and forecasting capabilities empower advisors to test different investment strategies and make data-driven forecasts for future performance. With Vyzer, advisors can efficiently track stocks, optimize asset allocation, and maximize tax benefits for their clients' portfolios.

Pros & Cons (Vyzer)

Vyzer provides extensive asset allocation analysis and risk assessment, which aids in making well-informed investment decisions. The customizable reporting feature allows tailored insights for each client's portfolio. Although the platform lacks backtesting capabilities compared to its competitors, it does offer a user-friendly interface and robust forecasting tools. However, it requires improvement in integrating with external financial platforms.

When it comes to risk assessment and performance metrics, Vyzer falls short in comparison to other tools like Portfolio Visualizer and Empower due to its limited backtesting features. Nonetheless, its user-friendly interface and forecasting capabilities make it an attractive option for advisors seeking efficient portfolio management solutions.

Kubera

Kubera offers comprehensive features for investment portfolio tracking and analysis. With customizable reporting and advanced forecasting capabilities, Kubera empowers advisors to make informed decisions for their clients' portfolios.

Features & Description (Kubera)

Kubera presents easy-to-use portfolio management tools to track and manage investments effectively. With features such as asset allocation analysis, risk assessment, customizable reporting, and integration with financial accounts, Kubera ensures comprehensive investment monitoring.

It also offers backtesting and forecasting capabilities that enable users to evaluate potential investment scenarios. Through its intuitive interface, users can gain valuable insights into their investment performance.

Moreover, Kubera is distinguished by its strong security measures, including bank-level encryption and two-factor authentication that protect sensitive financial information. The platform's user-friendly design makes it suitable for both novice investors and seasoned professionals seeking a comprehensive tool to manage their portfolios efficiently.

With Kubera's user base spanning various countries since its inception in 2019, it has become a reliable choice for individuals seeking dependable investment tracking solutions.

Pros & Cons (Kubera)

Transitioning from the features and description of Kubera, let's weigh its pros and cons. Kubera offers a comprehensive platform to manage your entire financial life. On the positive side, it provides a consolidated view of all your accounts, including bank, investments, property, and liabilities. This helps in gaining a complete understanding of your net worth and financial health at any given time. Moreover, Kubera ensures secure data storage with encryption technology which is crucial for safeguarding sensitive financial information against cyber threats.

However, one drawback is that while Kubera integrates with major financial institutions' accounts such as banks and investment firms, it may not cover all smaller or regional institutions. This limitation might hinder obtaining a complete overview for some users who have accounts with such establishments.

How to Maximize the Benefits of Portfolio Visualizer Tools

Optimize the benefits by consistently rebalancing your portfolio and aligning the tools with your investment goals. This guarantees that your investments remain aligned with your overall financial strategy and assists you in making informed decisions based on your goals.

Regular Portfolio Rebalancing

Regular portfolio rebalancing involves periodically adjusting investment holdings to maintain the desired asset allocation. This process helps manage risk and maintain the investment strategy over time, ensuring that the portfolio aligns with long-term financial goals.

By rebalancing regularly, one can capitalize on market fluctuations and keep the portfolio in line with risk tolerance and objectives.

According to investment experts, regular portfolio rebalancing is crucial to optimize returns while managing risk. It's recommended to review and rebalance the portfolio at least annually or when there are significant deviations from the target asset allocation.

Through this disciplined approach, investors can make informed decisions based on their financial planning tools and maintain a balanced investment approach tailored towards their specific needs.

Aligning Tools with Investment Goals

To maximize the benefits of portfolio visualizer tools, it's essential to align them with investment goals. This means setting clear objectives for your investments, whether it's long-term growth, income generation, or capital preservation.

By knowing your goals, you can choose tools that offer the features and analysis necessary to support those specific aims. For instance, if your goal is long-term growth, look for portfolio visualizer tools that provide robust backtesting and forecasting capabilities to assess how different investment scenarios may impact future results.

On the other hand, if income generation is a priority, seek out tools that offer customizable reporting for tracking dividend yields and income distributions within your portfolios.

Understanding how these portfolio visualizer tools integrate with financial accounts also plays a crucial role in aligning them with investment goals. Tools that seamlessly integrate with various financial accounts provide a comprehensive view of all assets and liabilities which is vital for informed decision-making when managing an investment portfolio effectively.

In essence it’s about selecting tools that aid in achieving what you've set out as your investment goal–whether it's growing wealth over time or generating regular income while preserving capital.

The right alignment enables investors to make more informed decisions based on their unique financial objectives.

Next up: Conclusion

Conclusion

In the realm of advising, possessing the appropriate portfolio visualization tool is crucial. These tools provide advisors with valuable insights into asset allocation, risk assessment, and performance metrics.

From Empower to Stock Rover, these are valuable allies for advisors in maximizing investment benefits. By integrating these tools and aligning them with specific investment goals, advisors can guarantee their portfolios remain strategically optimized for success.

FAQs

1. What are the best portfolio management software for advisors?

The best portfolio management software for advisors includes tools like Personal Capital, Quicken Premier, and Investment Account Manager. These offer top portfolio analysis tools and investment management reports.

2. Are there any free options available in portfolio analyzer software?

Yes! Many Portfolio Analysis Tools provide a free investment checkup tool or a free portfolio tracker which can be used to manage your stock portfolio effectively.

3. What is the benefit of using the best portfolio analyzer software?

Using the best portfolio analyzer software helps with easy tracking of investments, analyzing current prices, and calculating internal rates to help make informed decisions about minimum initial investments.

4. Is it necessary to have a professional plan for these tools?

While some services may require a professional plan, many others offer basic features like instant X-ray views of your investments without needing an upgrade.

5. How does Portfolio Management Software help advisors?

Portfolio Management Software aids in creating detailed investment management reports by analyzing various factors such as stock performance and market trends which assists advisors in providing effective advice.