Choosing the right online CFP program can be tough. Many programs are out there, but not all fit your needs, so selecting the right program is crucial for your success. Many of these programs offer a self-paced format, allowing you to progress through the material at your own speed.

This post will guide you through the top five options to make your decision easier.

Keep reading to find your match.

What is a CFP Board Registered Program?

A CFP Board Registered Program is a comprehensive education program that meets the rigorous standards set by the Certified Financial Planner (CFP) Board. These programs are meticulously designed to provide students with an in-depth understanding of the financial planning process. Key topics covered include investment planning, tax planning, retirement planning, estate planning, and insurance planning.

Enrolling in a CFP Board Registered Program is a crucial step towards obtaining CFP certification. It ensures that students acquire the necessary knowledge and skills to deliver competent and ethical financial planning services. By adhering to the CFP Board’s stringent guidelines, these programs prepare aspiring financial planners to navigate the complexities of the financial planning profession effectively.

Benefits of a Comprehensive Program

Opting for a comprehensive program, such as a CFP Board Registered Program, offers numerous benefits to students. These programs provide a thorough education in financial planning, enabling students to develop a deep understanding of the financial planning process and the various components that constitute a comprehensive financial plan.

Moreover, comprehensive programs are designed to help students hone critical skills essential for success in the financial planning profession. These include critical thinking, problem-solving, and effective communication skills. The curriculum is often delivered by experienced instructors who are experts in their field, offering valuable insights and real-world examples that enrich the learning experience.

By enrolling in a comprehensive program, students are better equipped to meet the demands of the financial planning industry and provide high-quality financial planning services to their clients.

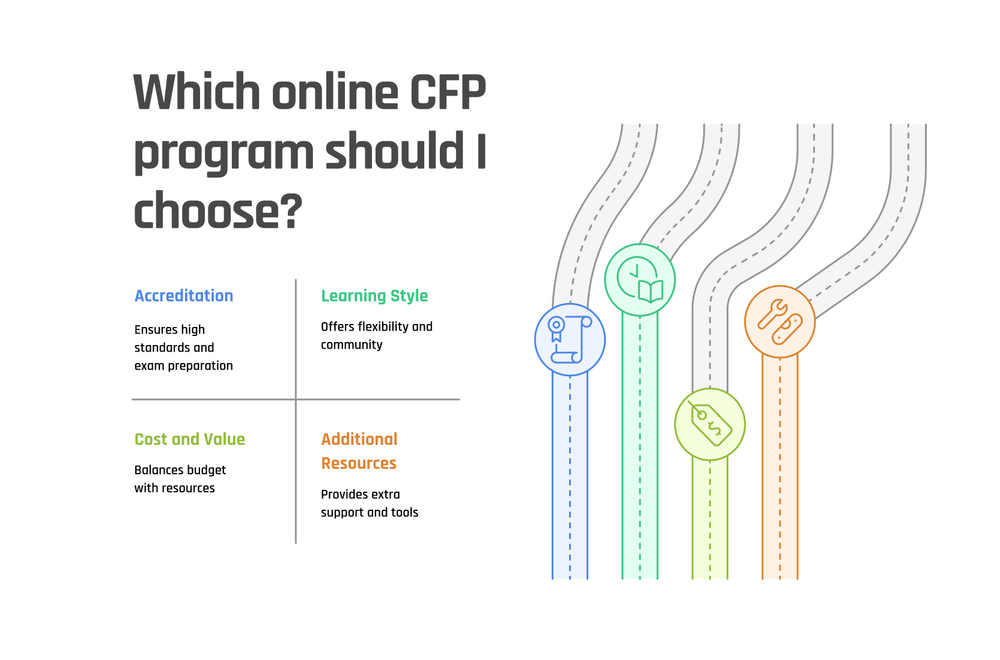

What to Look for in an Online CFP Program

When choosing an online CFP program, consider the various program options available, including certificates, bachelor's, and even doctorate programs.

These factors are crucial to finding the right fit in your financial planning certification journey. Additionally, be aware of the educational requirement for CFP certification, which includes completing specific coursework that prepares you for the CFP exam and contributes to your success in the financial planning field.

Accreditation by the CFP Board

Certification by the CFP Board means that an online CFP program meets high standards. The board checks if a program has everything needed for students to learn about financial planning well, including adherence to the CFP Board's Code of Ethics and Standards of Conduct.

This includes looking at the courses offered to see if they cover all important topics in financial planning. Programs that get this accreditation are listed on the CFP Board’s website, making them easier to find for those interested in becoming certified financial planners. These programs also prepare students for the CFP® Certification Examination, equipping them with essential knowledge and skills needed to excel in their financial planning careers.

Accreditation is a stamp of approval from the CFP Board. Students should choose accredited programs because this ensures they are getting good education that prepares them for the CFP exam and their future careers. These programs also follow updates and changes in laws and practices related to financial planning, keeping students informed and ready for real-world challenges.

Flexibility: Synchronous vs. Asynchronous Learning

Online CFP courses offer two types of learning: synchronous and asynchronous. Synchronous learning means you attend live classes online at set times. You get to interact with instructors and classmates in real-time.

This setup feels like a traditional classroom but from your home or office. Asynchronous learning lets you study on your own schedule. You watch recorded lectures and complete assignments when it fits into your day, offering on demand access to resources and instructor support.

This option is great for people who have other commitments like work or family.

Both styles have their benefits. Synchronous classes help create a sense of community and immediate feedback from teachers. Asynchronous courses give more control over your time management, making it easier to fit studying into a busy lifestyle.

Choosing between the two depends on what works best for you in balancing studies with personal and professional life.

Cost and Value for Money

Picking the right online CFP program means looking at program costs. You want a program that gives you a lot for your money. Some programs might be cheaper, but they don’t offer as much help or resources.

Others might cost more but give you everything you need to pass the CFP exam, like study guides and practice tests.

Think about what each program offers besides just the lessons. Do they have advisors or extra materials to help you understand complex topics? These extras can make a big difference in getting ready for your career in financial planning and passing the certification exam.

Some programs also offer the option to pay on a per course basis, providing flexibility in how you finance your education.

So, choose a program that fits your budget but also gives you all the tools to succeed.

Additional Resources and Support Provided

The American College of Financial Services offers access to the Wealth Management Center, which provides a wide array of financial planning resources and tools. These resources include publications, videos, webinars, and case studies that help students understand real-world scenarios. The CFP Board also offers a 'Find An Education Program' search tool to help candidates locate suitable education options based on various filters like location and program type.

The college also provides personalized career services such as resume review and interview preparation to support students in their job search after completing the program.

Boston University’s Financial Planning Certificate Program provides access to industry-specific software like MoneyGuidePro® for a hands-on learning experience. Students can utilize this tool to create comprehensive financial plans in line with real-world applications and practice client interactions. The program also emphasizes the importance of exam prep resources, which are essential for candidates to succeed on the CFP exam and retain necessary information.

Additionally, students receive ongoing support from faculty members who are experienced industry professionals providing valuable insights and mentorship throughout the program.

The American College of Financial Services

Learn about The American College of Financial Services and their online CFP program to make an informed choice.

Features & Description (The American College of Financial Services)

The American College of Financial Services offers an online CFP program that is accredited by the CFP Board. Candidates must hold a bachelor's degree to qualify for the coursework necessary for CFP marks. It provides flexible synchronous and asynchronous learning options, allowing students to study at their own pace.

The program ensures value for money with additional resources like live instruction for exam preparation and support in wealth management and client relationships.

The American College of Financial Services features a comprehensive virtual coursework designed to enhance financial planning skills. Students receive live instruction from experts in the field through a CFP Board registered certification education program option.

The interactive online certification program explores investment planning, retirement education, and personal financial management to provide tailored expertise towards constantly changing client needs in the financial planning world.

Pros & Cons (The American College of Financial Services)

Here are the pros and cons of the American College of Financial Services for financial planners considering their CFP programs:

| Pros | Cons |

|---|---|

| CFP Board accreditation ensures high standards. | Cost may be higher compared to some other programs. |

| Offers both synchronous and asynchronous learning options. | Some courses may lack the interactive aspect of in-person learning. |

| Includes additional resources like study guides and practice exams. | Financial aid options are limited. |

| Renowned faculty with extensive experience. | Enrollment process can be cumbersome for some. |

| Upholds strict ethical standards, ensuring a commitment to prioritizing clients' interests. |

Boston University Financial Planning Certificate Program

Boston University Financial Planning Certificate Program offers comprehensive virtual CFP coursework and live instruction for CFP program with a focus on wealth management and client relationships.

Read more about this top-notch program.

Features & Description (Boston University Financial Planning Certificate Program)

Boston University presents a comprehensive Financial Planning Certificate Program crafted to equip students with the skills and knowledge necessary to excel in the financial planning realm.

This program, registered with the CFP Board, offers a detailed curriculum focusing on wealth management, investment planning, retirement planning, and client relationships. With live virtual instruction and a personalized approach to preparing for the CFP exam, this program ensures that students receive excellent education while having the flexibility of online coursework. The curriculum also covers various retirement plans, specifically highlighting qualified plans as essential components of financial planning and employee benefits.

Importantly, Boston University’s program is meticulously tailored to keep pace with the ever-changing world of financial planning, including key topics such as equity securities to provide a thorough understanding of asset classes and investment strategies.

Pros & Cons (Boston University Financial Planning Certificate Program)

Having explored the features and description of the Boston University Financial Planning Certificate Program, let’s shift focus to its advantages and disadvantages. This comparison aims to aid potential students in making an informed decision.

| Pros | Cons |

|---|---|

| Accredited by the CFP Board, ensuring quality education. | Cost may be high for some students. |

| Offers both synchronous and asynchronous learning options for flexibility. | Limited one-on-one instructor support compared to smaller programs. |

| Program completion may lead to increased job opportunities. | Some students may find the program challenging due to rigorous coursework. |

| Successful completion of the program correlates with better job opportunities and a higher pass rate for the CFP exam compared to the national average. | Technology issues may affect some students’ learning experience. |

| Accessible to students nationwide, regardless of geographical location. | Financial aid options are limited. |

Kaplan Financial Education CFP Program

The Kaplan Financial Education CFP Program offers comprehensive virtual coursework and live instruction for CFP exam preparation. Read more about the program to enhance your financial planning skills.

Features & Description (Kaplan Financial Education CFP Program)

Kaplan Financial Education offers an Online CFP Program that is accredited by the CFP Board. This program includes live online instruction for CFP exam preparation and covers a wide range of topics in wealth management, such as client relationships, investment planning, and retirement planning.

The curriculum also includes essential topics on business assets, which are crucial for understanding various aspects of taxation affecting both individuals and businesses.

The program provides virtual coursework with instructor-led classes to ensure a comprehensive learning experience.

The Kaplan Financial Education CFP Program stands out with its affordability and flexibility in terms of synchronous and asynchronous learning options. It’s crafted to provide more than just a certification; it aims to enrich your expertise in financial planning through a review course customized to meet industry demands.

Furthermore, this program offers extra resources and support for thorough exam preparation alongside the coursework.

Pros & Cons (Kaplan Financial Education CFP Program)

Kaplan’s CFP program is well-known for its comprehensive coursework and variety of study options. Here are the pros and cons in a simple table format:

| Pros | Cons |

|---|---|

| Wide range of study options including live, online, and self-study. | Can be expensive compared to other programs. |

| Updated materials that reflect current CFP Board requirements. | Some users find the platform interface to be less user-friendly. |

| Offers a money-back guarantee if you don’t pass the CFP exam. | Intensive study schedule may not suit everyone. |

| Access to instructors for questions and clarification. | Some have noted varying quality in instructor support. |

| Graduates tend to pass the CFP exam at rates significantly above the national average. | |

| Let’s move on to the College for Financial Planning, another great option for future financial planners. |

College for Financial Planning – A Kaplan Company

The College for Financial Planning – A Kaplan Company offers a comprehensive online CFP program. Explore more about this top-notch program in our blog.

Features & Description (College for Financial Planning)

The College for Financial Planning provides an online CFP program intended to offer extensive virtual coursework and live instruction for CFP exam preparation. The program is crafted to assist financial planners in acquiring the essential skills in wealth management, client relationships, and investment planning.

With an emphasis on affordability and quality, it provides students with the necessary resources to succeed in the constantly changing world of financial planning. The curriculum also covers qualified pension plans, ensuring a comprehensive understanding of various retirement plans and employee benefits. This CFP education program is a CFP Board registered alternative that aims to provide valuable insights and practical knowledge necessary for aspiring Certified Financial Planners.

The program includes self study programs, offering flexible, independent learning options that emphasize academic rigor and interactivity, setting it apart from other e-learning platforms. Now, let’s explore the advantages and disadvantages of this dynamic educational offering.

Pros & Cons (College for Financial Planning)

Moving on from the features of the College for Financial Planning, let’s now examine the advantages and disadvantages. The program offers a flexible online format that caters to working professionals looking for more than just textbook learning. Additionally, it appeals to financial professionals seeking to enhance their careers with a recognized and valuable CFP® certification. However, some students have reported limited interactive opportunities compared to other programs, which may impact their overall learning experience.

Regarding affordability, the program is designed to be cost-effective, providing value for money in terms of CFP exam preparation and wealth management education. On the contrary, while it offers extensive resources and support, some users have mentioned a lack of live instruction opportunities compared to other platforms. These aspects require careful consideration when determining if this program aligns with your financial planning certification goals.

Dalton Education CFP Program

Dalton Education CFP Program provides extensive virtual coursework for individuals aspiring to become financial planners. To discover more about this program, explore the details on our blog!

Features & Description (Dalton Education CFP Program)

Dalton Education’s CFP Program offers a comprehensive online learning experience for aspiring financial planners. The program emphasizes 98% student satisfaction and a pass rate of 89% for the CFP exam, signifying its efficacy and quality.

With an average completion time of just 10 months, this flexible program allows students to study at their own pace, catering to working professionals or those with busy schedules.

Moreover, it includes live virtual instruction from experienced industry professionals to provide real-world insights and practical knowledge in wealth management, investment planning, retirement planning, and more. The curriculum also covers various retirement plans, including profit sharing plans, to ensure a well-rounded understanding of employee benefits.

Additionally, the program highlights the importance of behavioral finance, focusing on understanding client attitudes, biases, and decision-making processes to support effective client service and foster business growth.

Dalton Education’s CFP Program is accredited by the CFP Board - the entity responsible for certifying financial planners in the United States. This accreditation ensures that students receive education aligned with current industry standards and best practices while also preparing them for success in obtaining the prestigious Certified Financial Planner designation.

The program provides access to a wide range of resources such as case studies, practice questions, and personalized support from instructors—making it one of the top choices for individuals seeking a high-quality yet affordable online CFP certification program tailored to their career goals.

Pros & Cons (Dalton Education CFP Program)

The Dalton Education CFP Program provides live online instruction and flexibility for busy schedules, offering a comprehensive curriculum that prepares students for the CFP exam. The program emphasizes wealth management, client relationships, and retirement planning education. However, some participants find the cost relatively high compared to other programs.

Students appreciate the interactive nature of the instructor-led online certificate program at Dalton Education; however, it may not be as affordable as some alternatives in our list.

Pros:

-

Comprehensive curriculum

-

Live online instruction

-

Flexible schedule

-

Emphasis on wealth management and client relationships

-

Successful completion of the program leads to better job opportunities

Cons:

- Higher cost compared to other programs

Continuing Education Opportunities

Continuing education is a cornerstone of the financial planning profession, enabling professionals to stay abreast of the latest developments and trends in the field. The CFP Board mandates that certified financial planners complete ongoing certification requirements, which include continuing education courses and professional development activities.

These opportunities are vital for enhancing knowledge and skills, ensuring that certified financial planners remain current with industry advancements. Continuing education also provides a platform for networking with other professionals, sharing best practices, and staying connected with the latest research and innovations in financial planning.

By engaging in continuing education, financial planners can maintain their certification, uphold the highest standards of professional competence, and continue to provide exceptional financial planning services to their clients.

Conclusion

Looking for the best program for online CFP education? We’ve explored five top-notch options to help financial planners. Each program offers unique features and benefits, ensuring you find one that suits your needs.

It's also crucial to understand the importance of certification marks. These marks, owned by the Certified Financial Planner Board, identify and protect the intellectual property of financial planning credentials like CFP®. Meeting the rigorous requirements to use these marks establishes credibility in the financial planning profession.

With these options, you can take the next step in your career as a certified financial planner.

FAQs

1. What are the best online CFP programs for financial planners?

The best online CFP programs for financial planners include courses that cover essential topics in personal financial planning, such as investment planning, tax strategies, and retirement funding.

2. How can I choose the right CFP program?

To choose the right CFP program, consider factors like accreditation, course content, flexibility, learning style, and support services offered by each school.

3. Are these online CFP programs recognized in the industry?

Yes, most of these online CFP programs are accredited and recognized in the financial planning industry by the Certified Financial Planner Board of Standards (CFP Board). They meet standards set by professional organizations.

4. Can I study at my own pace with an online CFP program?

Many online CFP programs allow you to study at your own pace. This flexibility helps you balance your studies with work or personal commitments.