Choosing a career in wealth management can feel overwhelming. Many people need help understanding what this path involves.

This guide will break down the pros and cons of a wealth management career, from earning potential to the stress it can bring.

What Does a Wealth Manager Do?

A wealth manager helps clients handle their money. They offer advice on investment, tax planning, and retirement planning. They work with high net worth individuals to protect and grow their assets.

Wealth managers need to understand complex financial concepts and markets. They explain options in simple terms so clients can make good decisions.

Wealth management is about more than just investments; it's a comprehensive approach to financial health.

They also keep an eye on economic trends to adjust strategies as needed. This job blends finance skills with strong client relationships.

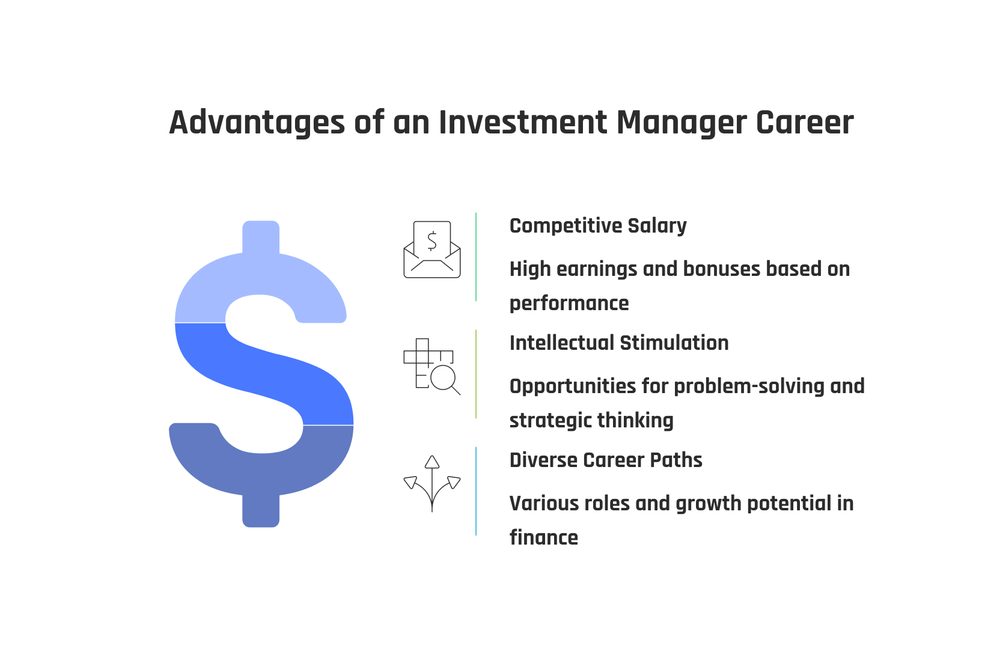

Pros of a Wealth Management Career

Wealth management careers offer high earning potential and the opportunity to build long-term client relationships. They also provide intellectual challenge, autonomy in work structure, a positive impact on clients’ financial security, diverse career opportunities, recognition, and prestige.

High earning potential

A career in wealth management offers a chance to make a lot of money. Many wealth managers earn salaries plus bonuses for meeting or beating financial goals. Top earners in the field can make over six figures yearly, especially when managing assets for ultra high net worth clients.

The more successful you are at growing your client's assets and providing excellent service, the higher your earnings potential.

Earning potential grows with experience and success in investment management, portfolio management, and building strong relationships with clients. Some private wealth managers even start their own firms, which opens up opportunities for even greater earnings.

They also get recognized by top wealth management firms for their ability to explain complex financial concepts simply and help their clients achieve financial security.

Building long-term client relationships

After talking about the high earning potential, another big plus of a wealth management career is making lasting bonds with clients. Wealth managers act as relationship managers. They help people manage their money for years or even generations.

This involves personal financial advisors working closely with clients to understand their needs and goals. Over time, these relationships grow stronger. Clients trust their wealth advisors with big decisions about investing, estate management, and more.

This part of the job means you have to be good at understanding what clients want and need. You also need to keep up with market trends and new investment opportunities. Being a trusted advisor takes strong interpersonal skills and an ability to adapt to changing financial landscapes.

Happy clients often lead to new ones through recommendations. This can make building a client base easier over time.

Intellectual challenge and continuous learning

Aspiring wealth managers must stay updated with the ever-evolving investment products and market trends to provide customized solutions that cater specifically to client needs.

Autonomy in work structure

Wealth managers often have independence in their work. This means they can make decisions independently about how to manage their clients' investments and financial plans without constant supervision.

The freedom to structure their day and manage client relationships gives wealth managers the flexibility to develop unique strategies tailored toward each client's specific needs, contributing positively to long-term success within the wealth management sector.

Independence allows them to adapt swiftly within ever-evolving financial markets and regulatory changes, offering customized services and solutions that align with individual client goals while ultimately building a successful career in private wealth management.

Positive impact on clients’ financial security

Moving from the flexibility in work structure to the positive impact on clients' financial security, wealth managers play a vital role in securing and growing their clients' financial resources.

By providing expert investment advice and strategic financial planning, wealth managers help clients effectively manage their investable assets, handle complex financial data, and tailor personalized strategies that are crafted to improve their financial security.

With a focus on building long-term relationships and recognizing the continually changing needs of clients, these professionals aim not only to safeguard but also boost the overall financial health of their clientele.

Moreover, wealth management professionals unlock opportunities for potential growth while striving to navigate regulatory challenges and volatile markets with meticulous attention.

Their goal is not only about managing money but seeking more than just returns; it's about ensuring that each client's portfolio aligns with their unique goals and risk tolerance by incorporating specialized expertise in tax services, asset management, and technical knowledge within a continually evolving realm of finance.

Diverse career opportunities

Wealth management offers a wide range of career paths, from chartered wealth managers to private wealth advisors. With the right technical skills and financial industry network, one can pursue roles as portfolio managers, financial planners, or business development professionals.

Building the right skill sets can help in gaining experience and potentially working with family offices or other professionals within this ever-evolving industry. The opportunity to work with potential clients from various backgrounds and industries also provides a dynamic environment for those looking for more than just a typical day in their careers.

It's about diving into an exciting profession that offers customized paths towards personal growth and professional success. This diverse landscape reveals numerous opportunities, allowing individuals to explore different aspects within wealth management while understanding the intricacies of the financial world.

Recognition and prestige

Diverse career opportunities in wealth management can lead to recognition and prestige within the industry. Wealth managers who excel often gain respect and admiration, not just from their peers but also from clients and financial institutions.

This can open doors to exclusive professional networks, prestigious industry awards, and high-profile speaking engagements that further elevate a wealth manager's reputation.

Wealth management careers are prestigious because top performers have a chance to interact with high-net-worth individuals, celebrities, or influential business figures. As their expertise grows, they become sought-after experts in the field – a status that brings significant recognition in the finance world.

Entrepreneurial opportunities

Recognition and prestige in the wealth management field can lead to entrepreneurial opportunities. Many successful wealth managers eventually start their own firms, offering personalized services tailored to new clients' financial strategies.

This transition requires a bachelor's degree, relevant qualifications, and strong interpersonal skills necessary to attract potential high-net-worth clients seeking innovative financial advice.

Through networking within the financial industry, wealth managers can gain firsthand experience and establish themselves as reliable advisors with the right personality to unveil the secrets of this career path.

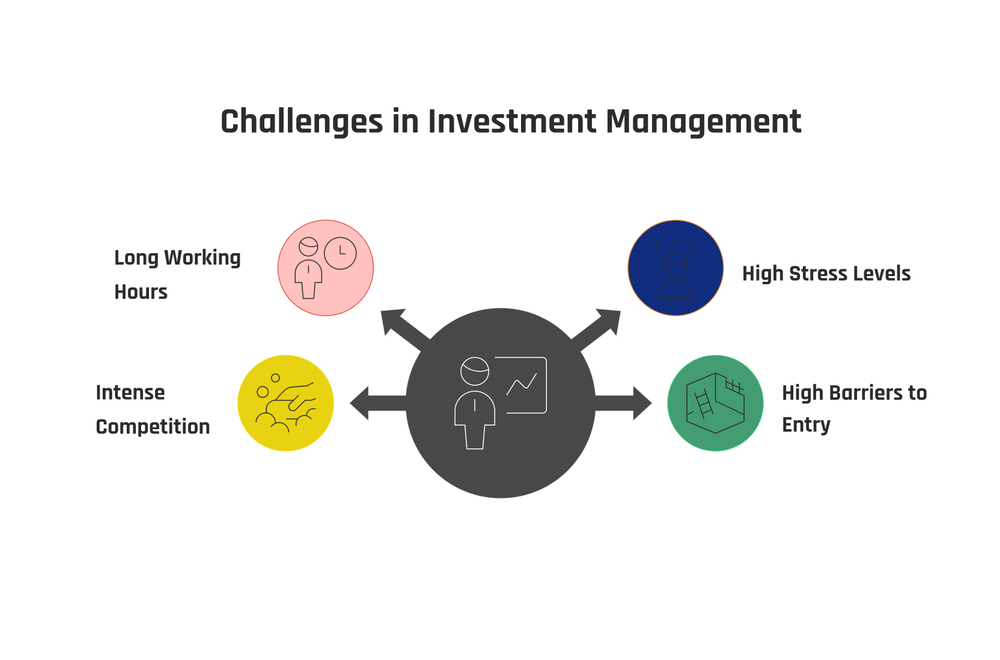

Cons of a Wealth Management Career

Wealth management careers come with high stress levels due to market volatility and demanding clients. Challenges also include addressing regulatory issues and the continuous need for upskilling and training in this dynamic field.

High stress levels

A career in wealth management often comes with high stress levels due to the pressure of managing large sums of money and meeting clients' financial expectations. This stress can be amplified by market volatility, demanding clients, and the need for continuous training to stay updated in a rapidly evolving industry.

Wealth managers frequently face regulatory and compliance challenges that add to their workload, making it a demanding profession requiring resilience and adaptability.

Despite these challenges, many individuals thrive in this fast-paced environment, finding fulfillment in helping clients navigate complex financial landscapes.

Demanding clients

Wealth managers often face the challenge of dealing with discerning clients in their daily interactions. These clients anticipate personalized attention, prompt responses to their inquiries, and customized solutions to their financial needs.

Wealth managers must possess exceptional communication skills and a profound understanding of their clients' individual goals and preferences to effectively address these expectations.

Additionally, handling discerning clients necessitates patience, empathy, and the ability to navigate intricate financial situations while maintaining professionalism. Cultivating strong relationships built on confidence is crucial for wealth managers when managing high-maintenance clientele in the field of wealth management.

The complexities involved in meeting the demands of discerning clients require wealth managers to be proficient at understanding elaborate investment strategies, estate planning options, and risk management techniques relevant to this career path.

The capacity to specifically cater to each client's unique aspirations forms an integral part of optimizing a successful portfolio within this profession—requiring not only advanced financial knowledge but also a keen sense of emotional intelligence essential for addressing personal finance matters effectively.

Volatile and unpredictable markets

The wealth management career involves operating in dynamic and unpredictable markets, presenting significant challenges. Market fluctuations can influence investment returns and client portfolios.

Wealth managers must remain informed about market trends to make prudent decisions, ensuring their clients' financial stability. The impact of global events, such as economic downturns or geopolitical shifts, adds to this unpredictability.

Consequently, wealth managers require an extensive understanding of market dynamics and risk management strategies to protect their clients' investments in the face of these uncertainties.

They must adapt quickly to market changes while aiming for steady growth in their clients' portfolios amidst the constantly evolving financial landscape.

Essentially, maneuvering through volatile markets requires adaptability and sharp decision-making from wealth managers to assist their clients in attaining long-term financial objectives despite potential market turbulence.

Regulatory and compliance challenges

Coming from the world of volatile and unpredictable markets, wealth managers encounter regulatory and compliance challenges in their careers. The financial industry is heavily regulated, requiring wealth managers to uphold strict legal and ethical standards.

Compliance with these regulations demands detailed attention and custom strategies for each client's unique financial situation. Wealth managers must navigate intricate rules set forth by governing bodies like the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Non-compliance can lead to hefty fines, damage to reputation, or even legal repercussions. Staying updated on constantly changing regulatory changes is crucial for maintaining integrity within the field.

Difficulty in building a client base

Building a client base in wealth management can be challenging, especially for those new to the industry. It requires patience and persistence as it involves gaining trust and establishing credibility with potential clients.

Networking within the financial industry is vital in finding prospective clients, alongside showcasing expertise to gain their confidence. It's also crucial to stay updated with the constantly changing market trends, which can help in providing valuable insights to attract and retain clients.

Furthermore, leveraging customized strategies that address individual financial goals fosters client relationships. It's essential to understand that building a strong client base takes time and effort but yields rewarding results in the long run.

Continuous need for upskilling and training

Wealth management careers require continuous learning and training to stay updated in a dynamic financial environment. Private wealth management is always evolving, so professionals need to acquire experience and relevant qualifications to effectively handle its intricacies.

This entails pursuing specialized education paths aimed at refining personal attributes and technical skills critical for success in this field. Networking within the financial industry is essential for gaining firsthand experience and unlocking opportunities.

Continuous learning is also fundamental for entrepreneurial prospects in wealth management careers. Professionals can explore various career paths and job titles while nurturing strong interpersonal connections and serving demanding clients with thorough attention to detail.

It's not just about entering the world of wealth management but actively participating in ongoing education and skill development essential for personal growth and professional advancement in this competitive sector.

Is Wealth Management the Right Career for You?

Wealth management might be the right career if you have strong interpersonal and technical skills, as well as a proactive attitude towards continuous learning. A bachelor's degree can provide a solid foundation for this path, though pursuing relevant qualifications such as CFA or CFP can further enhance your credibility in the field.

Networking within the financial industry is crucial for gaining experience and understanding the challenges of managing private wealth. If you are interested in building long-term client relationships and are genuinely keen on navigating volatile markets, then wealth management might be a suitable career choice for you.

Tips for Getting Started in Wealth Management

To start a career in wealth management, earn relevant qualifications through an undergraduate degree. Build strong interpersonal and technical skills by networking within the financial industry.

Earn relevant qualifications

To pursue a career in wealth management, it's essential to earn relevant qualifications. An undergraduate degree in finance, economics, or business administration provides a strong foundation for this career path.

Moreover, gaining experience through internships or entry-level positions within the financial industry can provide valuable insights and practical skills necessary for success in private wealth careers.

Earning certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) can also enhance credibility and expertise in the field of wealth management.

Acquiring the right qualifications not only demonstrates competency but also opens doors to diverse opportunities within the continually changing realm of wealth management. Strong educational and professional credentials significantly boost one's potential for advancement and success within this challenging yet rewarding industry.

Build strong interpersonal and technical skills

Earning relevant qualifications in wealth management is just the beginning. Equally crucial is developing strong interpersonal and technical skills. When interacting with clients, effective communication and relationship-building are vital.

These abilities allow wealth managers to comprehend clients' needs and deliver tailored financial solutions. Moreover, staying current on industry trends and technological advancements enriches the capacity to provide efficient services, adapting to evolving market conditions.

Continuously honing these skills through networking, training programs, and on-the-job experience will not only benefit individuals but also have a positive impact on their clients' financial journeys.

Emphasizing both facets of skill development establishes a solid foundation for success in the ever-changing field of wealth management.

Network within the financial industry

To excel in the wealth management career path, it's crucial to network within the financial industry. Establish connections with professionals who have experience in this field. By actively engaging and gaining experience through networking, you can develop a better understanding of the industry and discover opportunities for growth and personal development.

Building strong relationships within this sector can provide valuable insights into client needs and preferences, ultimately enhancing your expertise in wealth management.

Conclusion

In the dynamic world of wealth management, there are exciting opportunities alongside challenges. Wealth managers enjoy high earning potential, long-term relationships with clients, and continuous intellectual growth.

However, they also face demanding clients, market volatility, and the need for constant upskilling.

To excel in this field, one must possess strong interpersonal skills paired with relevant qualifications. Networking within the financial industry is crucial for gaining experience and establishing a client base.

With determination and dedication, wealth management can be a rewarding career path for those seeking both financial success and personal fulfillment.

FAQs

1. What personal traits are important for a career in wealth management?

For a successful career in wealth management, one needs to have strong analytical skills, excellent communication abilities, and an aptitude for problem-solving.

2. How can I gain experience in the field of wealth management?

You can gain experience by starting as an intern or entry-level employee at a financial firm. Over time, you will learn about different investment strategies and client relations.

3. What are some pros of choosing a career in wealth management?

The benefits include working with diverse clients, having the potential for high earnings, and gaining valuable knowledge about finance and investments.

4. Are there any cons to pursuing a career in wealth management?

Yes, it could involve long hours at work especially during market volatility periods; also dealing with demanding clients might be challenging sometimes.