Essential Licenses For Financial Planners: Complete List

Many people want to be financial planners but don't know where to start. One key fact is that you need specific licenses to become a financial advisor. This post will show you the essential licenses and how to get them.

Keep reading for all you need to know.

What Are Financial Planning Licenses?

Moving from an introduction to financial planning, we now explore what financial planning licenses are. These licenses allow advisors to sell investment products and give advice on finance.

To work in this field, one must pass exams administered by the Financial Industry Regulatory Authority (FINRA). Different types of investments require specific licenses. For instance, selling mutual funds or variable annuities needs a Series 6 license.

Financial planning licenses ensure that advisors follow laws and regulations. They prove the advisor has the skills and knowledge to help clients reach their financial goals. Each state may have additional rules for these professionals.

Getting certified as a Certified Financial Planner (CFP) is often seen as a top achievement in this career.

Essential Licenses for Financial Planners

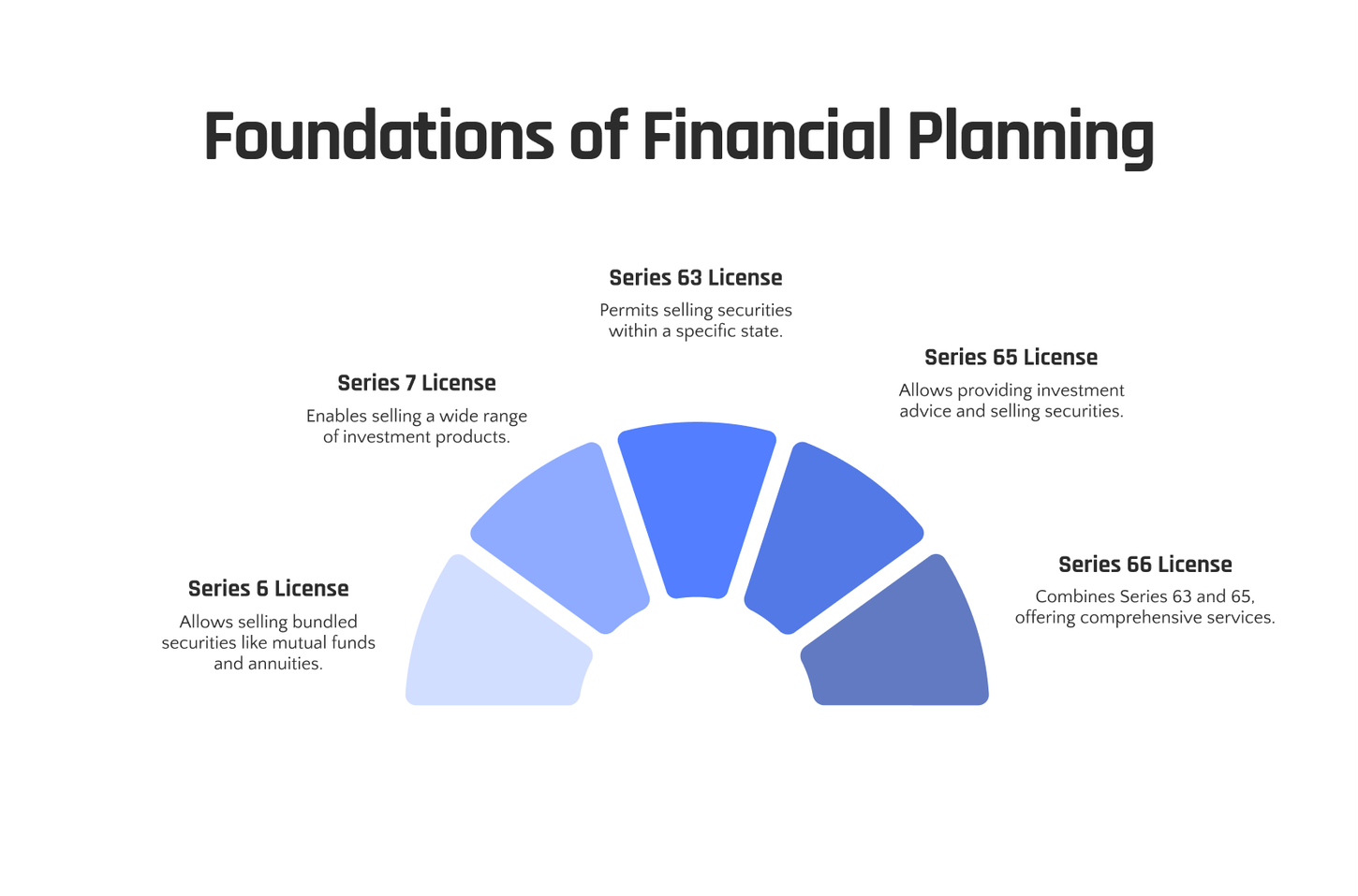

Financial planners need several licenses to offer financial advice and sell securities. These licenses include Series 6, Series 7, Series 63, Series 65, and Series 66; also Certified Financial Planner (CFP) Certification.

Obtaining these licenses entails completing exams such as the Securities Industry Essentials (SIE) Exam and meeting state and federal requirements.

Series 6 License

The Series 6 license permits financial consultants to market bundled securities such as mutual funds, variable annuities, and insurance elements. This certification demands passing an examination organized by FINRA (Financial Industry Regulatory Authority), which focuses on a range of investment product types.

The Series 6 license equips advisors to satisfy their clients' preferences in bundled investment alternatives.

Acquiring this license serves as a milestone towards establishing a practice in investment planning. Both knowledge of the products on offer and their integration into a client's comprehensive financial strategy are necessary.

The ability to market mutual funds or insurance policies is facilitated by the Series 6 license.

Series 7 License

A Series 7 license lets financial advisors sell a wide range of investment products. This includes individual stocks, bonds, and other securities. To get this license, one must pass the General Securities Representative Exam.

This exam is tough and covers topics like selling securities, client advice, and market rules.

Before taking the exam, you need to pass the Securities Industry Essentials (SIE) Exam. Also, a broker-dealer must sponsor you. After passing, you can help clients meet their investment goals by recommending different types of investment products.

This makes the Series 7 an important step for those looking to work in finance.

Series 63 License

The Series 63 License is crucial for financial advisors who want to provide investment advice and sell securities within a specific state. Unlike other licenses, this one doesn't require sponsorship from a firm.

It's administered by FINRA and the North American Securities Administrators Association (NASAA), covering state laws and regulations related to securities. To obtain this license, individuals need to pass the Uniform Securities State Law Examination, which typically consists of 60 multiple-choice questions.

This license complements other licenses like the Series 7 or 6, allowing financial advisors to conduct business specifically related to securities in their state. Moreover, it is essential for those who aim to offer investment advice concerning mutual funds and variable annuities.

Series 65 License

The Series 65 license, also referred to as the Uniform Investment Adviser Law Examination, is vital for professionals providing investment advice. This certification allows financial advisors to legally offer investment guidance and engage in securities sales.

The exam encompasses laws and regulations pertinent to investment advisory practices and is overseen by the Financial Industry Regulatory Authority (FINRA). Furthermore, it's a mandatory qualification in most states for those aspiring to serve as investment advisors.

Series 66 License

The Series 66 license allows financial professionals to sell a wide range of investment products. It combines the benefits of the Series 63 and Series 65 licenses, enabling them to offer both investment advice and sell securities.

Individuals who hold this license can also act as Investment Advisor Representatives, which enables them to provide personalized financial advice to clients for fees.

To obtain the Series 66 license, individuals need to pass the Uniform Combined State Law Examination. This exam covers topics such as state securities regulations and ethical practices in finance.

The goal is to ensure that those holding the license have a comprehensive understanding of both federal and state-specific laws related to securities transactions and investments.

Essentially, obtaining the Series 66 license broadens a financial professional's scope by allowing them to offer more services and expand their client base with a wider array of investment products while meeting regulatory requirements from both federal and state levels.

Certified Financial Planner (CFP) Certification

The Certified Financial Planner (CFP) certification is a professional designation for financial planners. It's widely recognized in the industry and requires passing an exam administered by the CFP Board.

To be eligible, candidates need to hold a bachelor's degree, complete relevant coursework, have three years of professional experience, and adhere to ethical standards. This certification enables financial advisors to provide comprehensive financial planning services which include investment planning, insurance, tax planning, retirement planning and estate planning.

The CFP certification demonstrates that the advisor has met rigorous requirements in terms of education and professional integrity. It signifies that the individual has acquired essential skills and knowledge needed to practice as a competent financial planner.

How to Obtain Financial Planning Licenses

To obtain financial planning licenses, you need to complete the Securities Industry Essentials (SIE) Exam, find a sponsor for licensing exams, and meet state and federal requirements.

Read more about this topic on our blog.

Complete the Securities Industry Essentials (SIE) Exam

To become a financial planner, you need to pass the Securities Industry Essentials (SIE) Exam. This exam tests your knowledge of basic securities industry concepts, including products and their risks, regulations, and how they're traded.

Passing this exam lays the groundwork for obtaining other licenses required in the financial planning field such as Series 6 or Series 7 licenses. With an increasing emphasis on professional standards within the financial services industry, passing this fundamental exam is crucial to open doors for further career growth.

After finishing the SIE Exam section in How to Obtain Financial Planning Licenses, you'll move on to finding a sponsor for licensing exams as part of becoming a certified financial planner (CFP).

Find a Sponsor for Licensing Exams

To take licensing exams, you need a sponsor. This can be a registered broker-dealer or another financial institution. They will help you prepare and apply for the exams. Having a sponsor is essential to fulfill the requirements and proceed with your career as a financial planner.

After finding a sponsor, you can move forward with preparing for the licensing exams.

Meet State and Federal Requirements

To sell packaged securities, financial planners must meet specific licensing requirements. These licenses vary by state and can include the Series 6, 7, 63, 65, and 66 licenses. Moreover, obtaining a Certified Financial Planner (CFP) certification is often necessary for offering comprehensive financial planning services.

To begin this process, it's crucial to understand and comply with the regulations set by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

This understanding ensures compliance with state laws while enabling advisors to provide customized solutions that align with their clients' interests.

Conclusion

In conclusion, acquiring essential licenses for financial planners is a crucial step in the industry. The Series 6, 7, 63, 65, and 66 licenses, along with the CFP certification, constitute the core prerequisites.

Acquiring these licenses entails passing the SIE exam and complying with state and federal regulations. Obtaining these licenses creates opportunities to effectively assist clients in the constantly evolving financial landscape.

FAQs

1. What is the most difficult license for a financial planner to obtain?

The most challenging license for financial planners often involves the securities industry essentials (SIE), administered by the Financial Industry Regulatory Authority (FINRA).

2. Do all states require the same licenses for financial advisors?

No, each state has its own rules and may require certain licenses. It's important to check what your state requires.

3. Can I sell any type of investment product with an investment planner license?

An investment planner license allows you to advise on various products, but broker-dealers or other specific types may need additional common licenses.

4. How can I find out which licenses I need as a bottom line financial advisor?

There are free tools available online that can answer questions about required licensing for bottom line financial advisors.

5. Is an insurance license necessary if I want to offer insurance advice as part of my services?

Yes, in order to provide advice on insurance products, you must hold an appropriate insurance license.