Finding a job as an entry level financial advisor can be tough. The Bureau of Labor Statistics shows growth in this field. This guide will show you how to start your career in financial planning.

Keep reading to learn more!

Key Takeaways

-

Get a Bachelor's Degree in Finance or a related field and consider getting certifications like CFP or CFA. These steps show your commitment and expertise.

-

Gain practical experience through internships to understand real-world financial planning. This can also help you build professional connections.

-

Build strong communication and analytical skills, as these are crucial for explaining complex information simply and making informed decisions.

-

Do not ignore entry-level jobs as they provide valuable experience. Make sure to research employers before applying to tailor your application effectively.

-

Always follow up after interviews with a thank-you note to express your interest and stand out from other candidates.

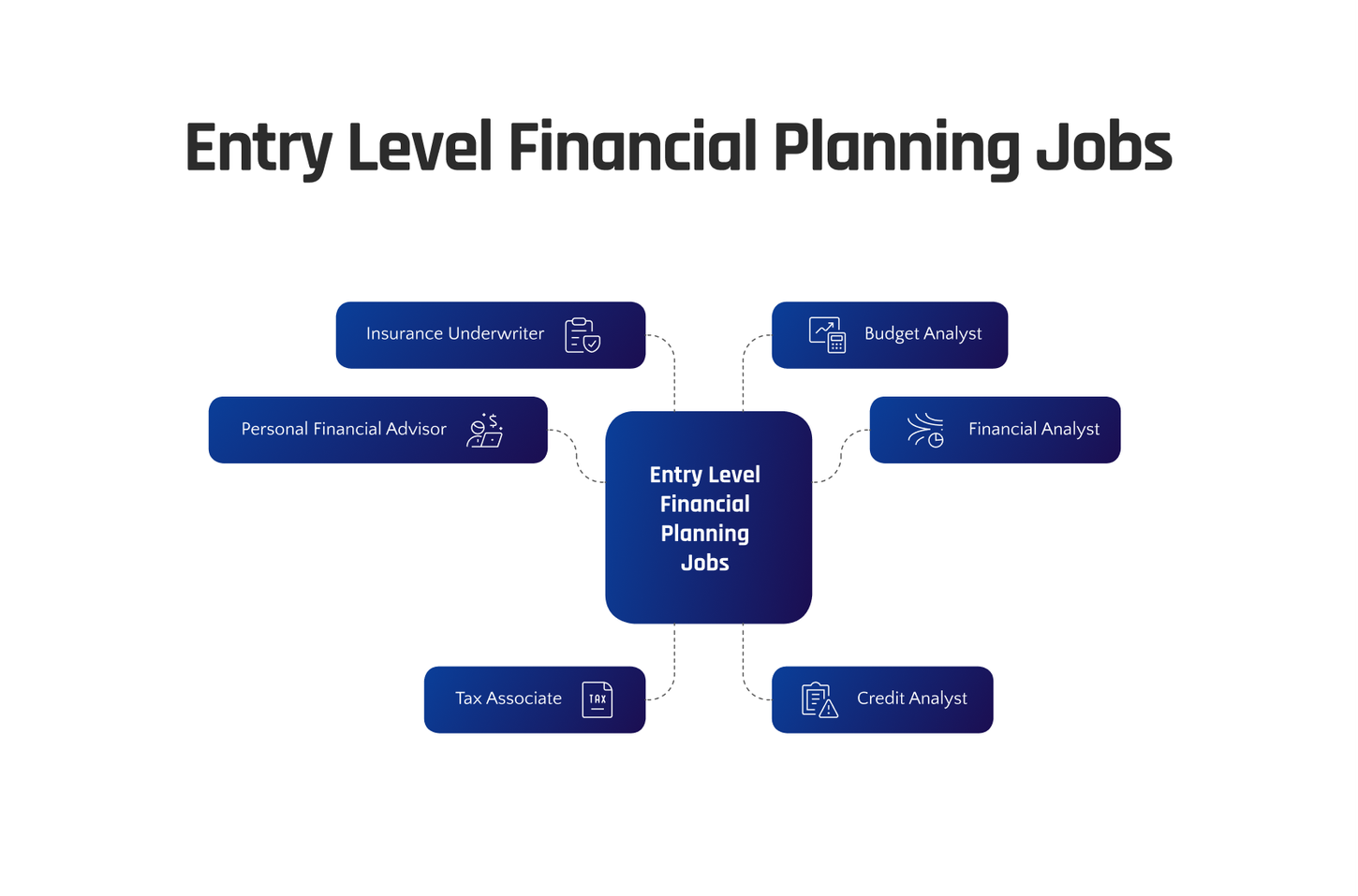

Types of Entry Level Financial Planning Jobs

Entry level financial planning jobs include positions such as personal financial advisor, financial analyst, tax associate, credit analyst, insurance underwriter, and budget analyst.

Each role offers unique opportunities to develop in the finance industry.

Personal Financial Advisor

A personal financial advisor helps clients manage their money. They create plans for wealth management, retirement, and investment opportunities. Personal financial advisors explain complex financial concepts in simple terms.

They focus on building strong client relationships to help meet financial goals.

They also keep up with tax laws and insurance applications to give the best advice. Next, we will talk about Financial Analysts and how they fit into the finance industry.

Financial Analyst

Transitioning from the role of a personal financial advisor, the position of a Financial Analyst brings with it a distinct set of hurdles and benefits. In this role, employees scrutinize data to aid businesses in making astute decisions about their finance.

They keep an eye on market trends, business performance, and other indicators to anticipate financial results. Their task enables clients to meet their financial objectives through enlightened investment choices and wealth management strategy.

Financial analysts also facilitate budgeting and forecasting the financial future of a company. They act as an essential element in business growth by proposing ways to enhance financial performance.

Whether it’s for an Edward Jones office or another entity, these analysts apply their expertise in analysis and problem-solving to support companies in dealing with the complex sphere of finance.

This guarantees that the requirements of both the business and its possible clients are satisfied effectively.

Tax Associate

A tax associate helps clients manage their taxes. They work on tax returns, suggest ways to lower taxes, and explain tax rules. This job is important for people and businesses wanting to save money and follow tax laws correctly.

Tax associates need good math skills and should understand complex tax regulations.

To succeed as a Tax Associate, staying updated with the latest tax laws is key.

They also help companies plan their finances by looking at how taxes affect profits. Working in this role can lead to more jobs in finance or law. A bachelor's degree is often needed to start this career.

Credit Analyst

To become a credit analyst, a bachelor's degree in finance or a related field is required. Certifications such as CFA can enhance your credibility. Practical experience through internships is crucial for understanding credit analysis and risk evaluation.

Strong analytical skills are necessary for assessing the financial status of potential borrowers or clients seeking loans.

Moreover, outstanding communication skills are vital for explaining complex financial information to clients and colleagues.

Insurance Underwriter

An insurance underwriter evaluates insurance applications to decide if the company should provide coverage. They assess risk factors, like health or lifestyle, and use statistical models to determine the likelihood of a claim.

Insurance underwriters also review clients' financial backgrounds and analyze industry trends to make informed decisions about policy approvals and premium rates. Their work helps insurance companies protect their financial stability while providing customers with suitable coverage options.

Insurance underwriters need strong analytical skills to interpret data effectively, excellent communication skills for interacting with clients, and in-depth knowledge of insurance products and regulations.

The median annual wage for an insurance underwriter in 2020 was around $71,790 per year.

Budget Analyst

Budget analysts play a crucial role in assisting organizations with financial planning. They evaluate financial information and assist in developing budgets to improve effectiveness and optimize resources.

Typically, a bachelor's degree in finance or a related field is a prerequisite, with median annual salaries ranging from $56,000 to $86,000. Strong analytical abilities, meticulous attention to detail, and the capacity to work with intricate financial papers are essential qualities for budget analysts.

Moreover, outstanding communication skills are necessary to articulate their conclusions effectively and offer suggestions.

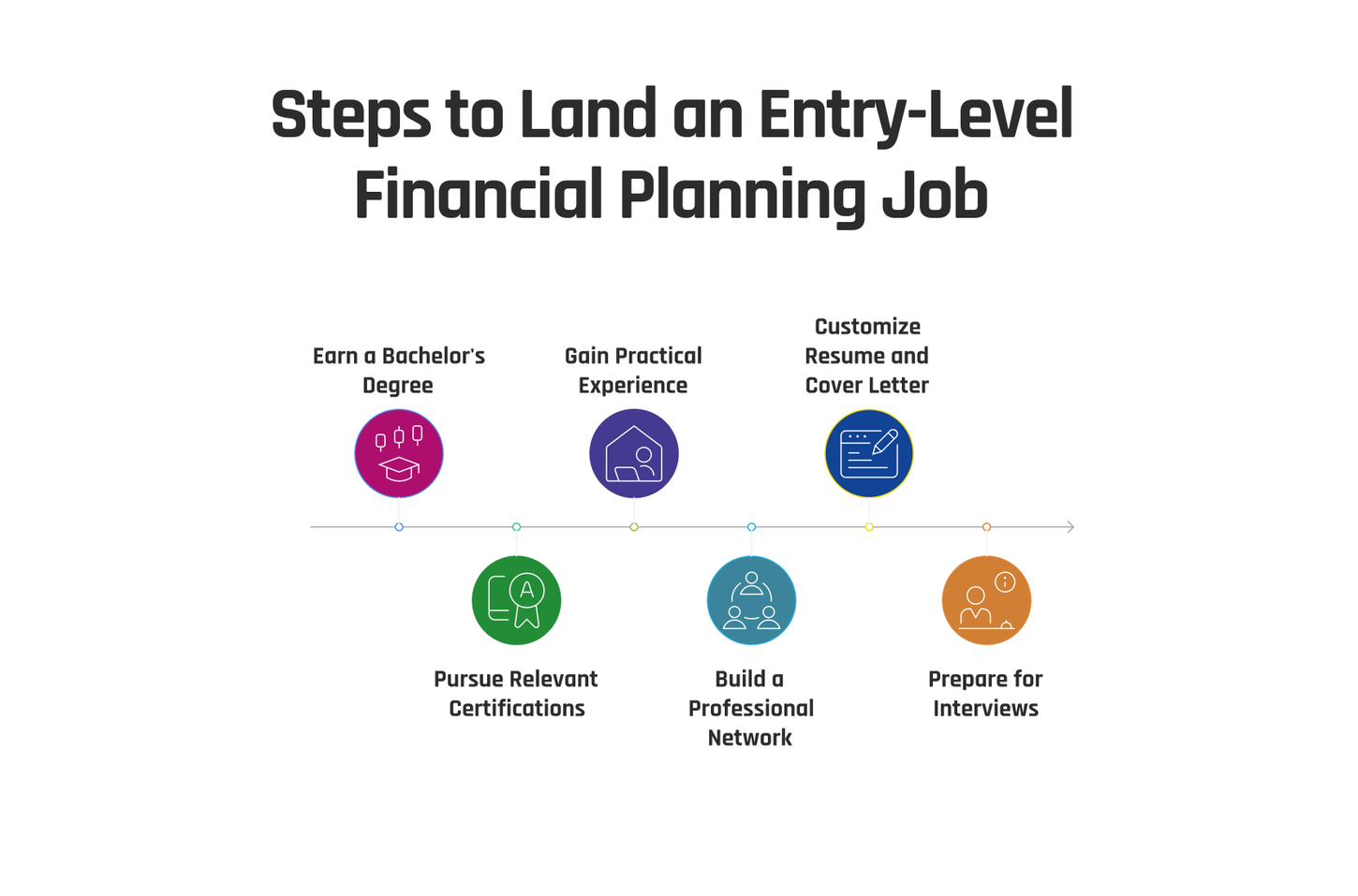

Steps to Land an Entry Level Financial Planning Job

To land an entry level financial planning job, start by earning a Bachelor's Degree in Finance or a related field. Next, pursue relevant certifications such as CFP or CFA to boost your credentials and stand out to potential employers.

Earn a Bachelor’s Degree in Finance or Related Field

Obtaining a Bachelor’s Degree in Finance or a related field is crucial for pursuing entry-level financial planning jobs. This degree offers the foundational knowledge and skills needed to understand financial concepts, accounting principles, and economic theories.

According to the Bureau of Labor Statistics, the median annual wage for entry-level financial analysts was $83,660 in May 2020. Additionally, having a bachelor's degree can significantly improve job prospects and qualify individuals for higher-paying positions within this field.

Moreover, having a formal education in finance equips individuals with critical thinking abilities that are essential for analyzing complex data and making informed investment decisions.

Many entry-level roles require candidates to have at least a bachelor's degree as part of their minimum qualifications. Therefore, earning this degree not only shows commitment but also creates opportunities for career advancement and increased salary potential within the finance sector.

Pursue Relevant Certifications (e.g., CFP, CFA)

To land an entry-level financial planning job, consider pursuing relevant certifications such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These certifications demonstrate your expertise in financial planning and investment management, giving you an edge over other candidates.

According to recent data, professionals with CFP certification have a median wage of $66,000 annually, while those with a CFA designation receive around $80,000 per year. Acquiring these credentials can significantly enhance your credibility and marketability in the competitive field of finance.

By obtaining recognized certifications like CFP or CFA, you position yourself for greater career opportunities and potentially higher salaries in the financial planning industry. With these qualifications under your belt, you'll be well-equipped to offer comprehensive wealth management strategies tailored towards meeting clients' diverse financial needs efficiently and responsibly.

Gain Practical Experience Through Internships

To succeed in entry-level financial planning jobs, gaining practical experience through internships is crucial. Internships offer hands-on exposure to the industry, allowing candidates to apply their knowledge in real-world scenarios and build valuable skills.

It's a chance to work alongside professionals, understand client interactions, and grasp the day-to-day responsibilities of financial planners. These experiences can also lead to potential full-time opportunities as many companies use internships as a pipeline for recruiting top talent into permanent roles.

Additionally, interns gain insight into specific areas like investment options, sales strategies, and comprehensive training programs that are essential for understanding the financial impact on clients' assets and overall success.

Throughout these internships, individuals should focus on developing strong interpersonal skills to effectively communicate with colleagues and potential clients while honing their product knowledge to provide tailored services aligned with clients' needs.

Ultimately, internships serve as a platform for aspiring financial planners to gain relevant expertise necessary for launching successful careers within this ever-evolving realm.

Build a Strong Professional Network

To land an entry-level financial planning job, it is crucial to build a strong professional network. Connect with industry professionals through networking events, social media platforms like LinkedIn, and alumni networks.

Join finance-related groups or associations to meet potential mentors and colleagues who can offer insights into the industry. Attend career fairs and informational interviews to expand your network of contacts within the financial planning field.

Moreover, in addition to online networking, consider reaching out to local financial planning firms or attending workshops and seminars related to finance and investment. Building a robust professional network not only opens doors for potential job opportunities but also allows you to gain valuable advice and mentorship from seasoned professionals in the field.

Customize Your Resume and Cover Letter

When customizing your resume and cover letter for an entry-level financial planning job, emphasize relevant coursework or internships in finance. Highlight key skills such as analytical thinking, communication, and problem-solving abilities to stand out.

Incorporate keywords like "financial modeling," "forecasting," and "budget analysis" to align with the job description.

Craft your cover letter to showcase your passion for financial planning and eagerness to learn from industry professionals. Use data-driven examples of how you've contributed to successful projects or teams during internships or coursework.

For instance, mention any experience in budgeting, investment analysis, or financial reporting that demonstrates your readiness for the role. Adapt each application to the specific company's needs by referencing their mission statement or recent achievements.

By tailoring your documents carefully towards each role's requirements and showcasing practical experience through internships or coursework, you can improve your chances of landing interviews and ultimately securing an entry-level position in financial planning.

Prepare for Behavioral and Technical Interviews

Prepare for behavioral and technical interviews by practicing common interview questions. Demonstrate your problem-solving skills by providing examples of how you managed challenging situations in the past.

Also, update your technical knowledge related to financial planning, such as understanding financial modeling and forecasting techniques. In addition, investigate the company's values and culture to showcase your fit during the interview process.

Illustrate your adaptability and willingness to learn by discussing how you've tackled new challenges or acquired knowledge of new software programs in previous roles or through internships.

Utilize specific examples of times when you effectively communicated complex information with clients or colleagues during interviews. Lastly, ensure to express enthusiasm for the role and ask thoughtful questions about the company's approach to financial planning during the interview process.

Skills Needed for Financial Planning Roles

To excel in financial planning roles, you need strong problem-solving and analytical skills, excellent communication abilities, knowledge of financial modeling, and adaptability; to learn more about the essential skills for a successful career in financial planning, read our full blog post!

Strong Analytical and Problem-Solving Skills

Entry-level financial planning jobs require strong analytical and problem-solving skills. This implies the ability to analyze complex data, identify trends, and effectively resolve financial issues.

With the rise of data-driven decision-making in finance, possessing these skills is crucial for individuals aiming to excel in this field. Also, professionals with robust analytical capabilities are better equipped to forecast market trends, evaluate investment opportunities, and create strategic financial plans that align with client goals.

Additionally, problem-solving skills are essential for addressing challenges such as managing risk factors or developing innovative solutions customized to clients' individual financial needs.

Moreover, having a talent for critical thinking and being skilled at applying logical reasoning enables individuals in entry-level financial planning roles to navigate through complexities within the finance realm.

For instance, when evaluating different investment options or identifying potential risks associated with particular strategies, precise analytical skills play an instrumental role in making informed decisions that can significantly impact a client's overall portfolio performance.

By integrating new techniques for analyzing market changes and evaluating investments meticulously, individuals can continually improve their analytical abilities while utilizing technology tools tailored to make sense of vast amounts of data pertinent in today’s everchanging landscape.

Excellent Communication and Interpersonal Skills

To excel in an entry-level financial planning job, it's crucial to possess excellent communication and interpersonal skills. As a personal financial advisor, being able to explain complex concepts in simple terms is key.

Financial analysts need strong communication to present their findings effectively to clients or senior management. Tax associates often interact with clients daily, hence effective interpersonal skills are vital in building relationships.

Credit and budget analysts must communicate potential risks and financial insights clearly to decision-makers. Lastly, insurance underwriters rely on clear communication when assessing risks for policies.

In summary, strong communication allows finance professionals to convey complex information simply while effective interpersonal skills help build trust and rapport with clients and colleagues in the financial industry.

Knowledge of Financial Modeling and Forecasting

Financial modeling and forecasting are crucial skills for entry-level financial planning jobs. Understanding these concepts helps in analyzing data to make informed financial decisions.

It involves using historical data to predict future outcomes, such as company profits or stock prices. Knowledge of Excel and other software is essential for creating models and interpreting their results.

Moreover, familiarity with statistical methods aid in accurate forecasting.

Having a grasp of financial modeling allows professionals to create scenarios for potential business ventures, budgeting, and risk assessment, while forecasting enables them to anticipate market trends and plan accordingly.

These skills are highly sought after by employers in the finance industry as they directly contribute to making sound investment choices and strategic financial planning.

Adaptability and Willingness to Learn

Adaptability and willingness to learn are essential for entry-level financial planning jobs. The finance industry is always changing, so being adaptable will help you succeed. Employers look for candidates who can quickly learn new skills and adapt to different situations.

Willingness to learn shows your commitment to growth in the field, which can set you apart from other applicants. As an example, staying updated on new financial regulations and tools demonstrates your willingness to stay informed about the industry's changes.

In these roles, being adaptable means embracing change and learning from it while readiness to expand your knowledge showcases a proactive attitude that potential employers value highly in prospective candidates seeking entry-level positions in finance.

Common Mistakes to Avoid During the Job Search

Don't ignore entry-level opportunities. Make sure to research potential employers before applying and always follow up after interviews.

Overlooking Entry-Level Opportunities

When searching for entry-level financial planning jobs, it's crucial not to overlook opportunities that may seem basic. Entry-level positions can provide valuable experience and a foot in the door of the industry.

Many successful candidates have started their careers in these roles and worked their way up to higher positions within the company.

Neglecting entry-level opportunities means missing out on gaining practical experience and building a strong foundation for future career growth. These roles also offer a chance to learn from experienced professionals, understand how businesses operate, and develop essential skills required for more advanced financial planning positions.

Therefore, it's important to consider all available entry-level job openings as potential stepping stones toward your desired career path.

Neglecting to Research Potential Employers

When applying for entry-level financial planning jobs, overlooking the research of potential employers can be a costly mistake. Thorough research of potential employers is essential as it enables job seekers to comprehend the company culture, values, and work environment.

It also permits candidates to customize their application materials and interviews to align with the employer's needs and expectations. Failing to conduct comprehensive research can result in submitting generic applications that do not establish a strong connection between the candidate's skills and the company's requirements.

Furthermore, it may lead to missed opportunities for highlighting how the candidate can add value to the organization. Thus, dedicating time to thoroughly research potential employers before applying or interviewing for an entry-level financial planning position is crucial for enhancing one's chances of securing a desirable role.

Failing to Follow Up After Interviews

After interviews, failing to follow up can hinder your chances. Sending a thank-you email is vital. It shows professionalism and gratitude. Use this opportunity to reiterate your interest in the role.

Keep it concise and error-free.

If you fail to follow up after an interview, you miss out on reinforcing your enthusiasm for the position. A timely thank-you note also sets you apart from other candidates, making a lasting impression on potential employers.

Next: Conclusion

Conclusion

Ready to kickstart your career in financial planning? With the right steps and skills, you can land that entry-level job. Take action by earning a relevant degree, gaining practical experience, and honing those essential analytical and interpersonal abilities.

Avoid common mistakes like overlooking entry-level opportunities or neglecting research on potential employers. Now go out there and make it happen!

FAQs

1. What entry level jobs are available in financial planning?

Entry level jobs in financial planning often involve business development, helping clients achieve their goals and attracting new clients.

2. How does one start a new career in financial planning?

Starting a new career in financial planning involves getting the necessary education, gaining experience through internships or similar roles, and applying for entry-level positions.

3. Is there a base salary range for an entry-level job in financial planning?

Yes, the base salary range depends on many factors like location and company size but typically it's competitive with other industries.

4. Are all individuals eligible to apply for these jobs regardless of gender identity or sexual orientation?

Absolutely! Companies value diversity and do not discriminate based on veteran status, gender identity or sexual orientation when hiring for positions.

5. Does marketing play any role within the field of Financial Planning?

Yes indeed! Marketing is essential as part of business development strategies to attract new clients and grow your own business.

![How To Land An Entry Level Financial Planning Job [Guide]](https://cdn.sanity.io/images/l79olr63/production/7230c3f636502e896a760f7487abf6031a782f77-1456x816.jpg)