Choosing between a custodian and a broker-dealer can be confusing for advisors.

Both play big roles in the financial services industry but work differently. This post will explain their differences and help you decide which one fits your needs.

What Is a Custodian?

Switching from foundational understanding, we're going to discuss the role of a custodian. A custodian is a bank or financial firm responsible for protecting people's securities against loss or theft.

These entities may be traditional banks, mutual fund custodians, or custody services residing within larger financial enterprises. They are instrumental in defending assets and providing safekeeping for all types of investors, from individuals to institutional ones such as pension funds and government organizations.

Custodians are also involved in other critical operations like finalizing purchases of securities, accumulating income owed on investments such as dividends or interest, and offering services like account administration.

This assistance contributes to ensuring that investment assets are secure and properly managed following international markets' protocols and regulations.

What Is a Broker-Dealer?

A broker-dealer is a person or company in the finance industry that buys and sells securities for clients and their own account. This means they can act as both an agent (broker) and a principal (dealer).

Brokers help clients buy and sell securities like stocks, bonds, and mutual funds. As dealers, they sell securities from their own inventory. This dual role allows them to execute trades quickly.

Broker-dealers are registered with the Securities and Exchange Commission (SEC) and are members of the Financial Industry Regulatory Authority (FINRA). They must follow strict rules to protect investors.

Many also offer related services such as investment advice, market research, and financial planning. They play a key role in keeping the markets running smoothly.

Broker-dealers connect buyers with sellers in financial markets.

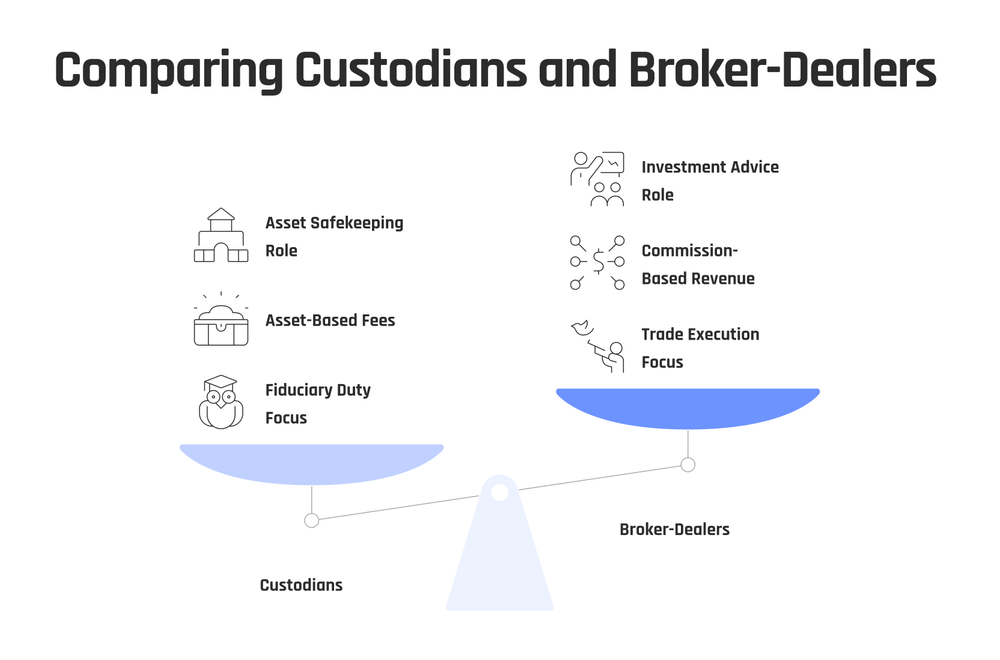

Key Differences Between Custodians and Broker-Dealers

Custodians and broker-dealers differ in regulatory standards, revenue models, and asset protection. To learn more about these important distinctions, continue reading the full blog post.

Regulatory Standards

Custodians and broker-dealers must follow different rules set by agencies like the SEC (Securities and Exchange Commission). Custodian banks need to keep client assets safe. They have a fiduciary duty, which means they must act in their clients' best interests.

Broker-dealers, on the other hand, work under both SEC regulations and rules from bodies like FINRA (Financial Industry Regulatory Authority). They facilitate trades, offer investment advice, and sell securities.

This setup demands that broker-dealers focus more on trade execution and compliance with trading laws.

These differences show why understanding each role's responsibilities is vital for financial professionals. Next comes exploring how these entities make money—through "Revenue Models".

Revenue Models

Custodian and broker-dealer revenue models differ significantly. Broker-dealers often earn money through commissions on transactions, fees for investment advice, or by selling financial products.

On the other hand, custodians typically make money from holding clients' assets and charging account maintenance fees. For example, some custodians charge a percentage fee based on the total value of the assets they hold.

Broker-dealers commonly generate revenue through commissions or advisory fees while custodians generally profit from account maintenance charges and asset-based fees.

Asset Protection and Safekeeping

Moving on from discussing revenue models, let's talk about asset protection and safekeeping. When it comes to safeguarding financial assets, custodians are responsible for holding and protecting client assets.

They play a crucial role in ensuring the security and integrity of investments through safekeeping measures.

Custodian banks like Deutsche Bank are among the largest custodians globally, overseeing trillions of dollars in assets owned by institutional investors, government entities, and individual clients.

These institutions diligently follow regulatory standards set forth by organizations such as the Securities Investor Protection Corporation (SIPC) to protect client assets should a custodian face financial distress or insolvency.

This ensures that even in turbulent market conditions or unforeseen events, client investments remain shielded under the umbrella of protective regulations.

Custodian vs. Broker-Dealer: Which Should Advisors Choose?

Advisors should select custodians and broker-dealers based on their specific needs. Custodians are responsible for safeguarding assets, while broker-dealers handle securities transactions and trading.

When it comes to regulatory standards, custodians adhere to stringent regulations for asset protection, whereas broker-dealers focus on executing trades. For advisors seeking more than just trade execution, custodians offer a higher level of asset protection and safekeeping services compared to broker-dealers.

However, if advisors prioritize fast and efficient trade executions in the market, broker-dealers may be the preferred choice.

Can Advisors Use Both Custodians and Broker-Dealers?

After weighing the pros and cons of custodians and broker-dealers, some advisors choose to work with both. This strategy can offer diversification in services, broadening the range of investment options for clients.

By using both, advisors can leverage the strengths of each financial institution while mitigating their weaknesses. For example, a custodian may excel in providing secure asset protection and safekeeping, while a broker-dealer might offer access to specific investment products or markets that the custodian does not.

Diversifying between these institutions allows advisors to tailor their approach according to client needs.

Some practical reasons motivate many advisors' decisions in utilizing both types of institutions effectively; from maximizing efficiency by leveraging various platforms for different aspects of wealth management to providing clients with a more comprehensive set of tools and resources for managing their investments.

Tips for Advisors When Working With Custodians or Broker-Dealers

-

Understand the regulatory standards of your custodian or broker-dealer to ensure compliance with industry requirements.

-

Regularly review revenue models to assess how they align with your business goals and client needs.

-

Prioritize asset protection and safekeeping by evaluating the security measures offered by custodians and broker-dealers.

-

Consider the track record and reputation of custodians and broker-dealers in safeguarding assets and facilitating trades.

-

Seek clarity on how custodians and broker-dealers can support your investment decisions, especially concerning alternative investments.

-

Stay informed about market trends that may impact the services provided by custodians or broker-dealers.

-

Establish clear communication channels with custodians or broker-dealers to address any concerns promptly and effectively.

Conclusion

When it comes to navigating the financial sector, advisors must comprehend the disparities between custodians and broker-dealers. Selecting one over the other is contingent on regulatory standards, revenue models, and asset protection.

Advisors can also collaborate with both custodians and broker-dealers to optimally address their clients' requirements. It's imperative for advisors to remain careful in their decision-making process when choosing these financial institutions.

FAQs

1. What is a broker-dealer?

A broker-dealer is a financial institution, like investment banks or discount brokers, that buys and sells securities owned by their clients or for its own account.

2. How does the role of an investment advisor differ from that of a broker dealer?

Investment advisors provide advice to clients on where to invest their assets for optimal returns while broker dealers facilitate trades in global markets as market makers.

3. Can you explain what custodian means in the context of finance?

In finance, custodians are large institutions such as the largest custodian banks which hold customers' securities for safekeeping to prevent them from being stolen or lost.

4. What kind of services do brokerage firms offer?

Brokerage firms offer services like opening savings accounts and brokerage accounts, helping with security trades and ensuring regulatory compliance among others.

5. How does asset management fit into this picture?

Asset managers, often found in full service brokers or investment management firms work with individual investors and corporations to develop strategies for growing their wealth over time.

6. Are there any fees associated with using a brokerage firm's services?

Yes! Brokerage firms usually charge fees known as brokerage fees for providing various types of investment services including income collection from investments.