Are you struggling to attract new clients as a financial advisor? One fact is clear: digital marketing strategies are key. This blog will guide you on ad campaigns that can bring in more prospective clients.

Key Takeaways

-

Financial advisors need a clear marketing plan that includes digital ads, content marketing, and social media to attract clients.

-

Effective ad campaigns focus on understanding the target audience and offering them clear value propositions.

-

SEO and PPC advertising are important for making services more visible online.

-

Content like blog posts, videos, and webinars helps engage potential clients.

-

Using CRM software and analytics tools can help measure success and manage client relationships effectively.

Ad Campaign Essentials for Financial Advisors

Financial advisors need a clear marketing plan to reach potential clients. This plan should include digital advertising, content marketing, and social media strategies. A successful marketing strategy for financial advisors focuses on the target market and creates ads that speak directly to their needs and goals.

A defined marketing strategy helps financial advisors connect with ideal clients, making every marketing dollar count.

Using tools like search engine optimization (SEO) can boost a website's ranking on search engines. This makes it easier for potential clients to find financial advising services online.

Paid advertisements or PPC ads also play a big role in getting more eyes on your services quickly.

Components of Effective Ad Campaigns

Components of Effective Ad Campaigns involve targeting the right audience, clearly stating your value proposition and setting measurable goals. These are crucial to a successful ad campaign strategy for financial advisors.

Identifying Target Audiences

Identifying target audiences is crucial for financial advisors aiming to tailor their marketing efforts. Most financial advisors need to understand who needs their services, such as small business owners, individuals planning for retirement, or those seeking personalized financial assessments.

Knowing the specific group helps in creating ads that speak directly to potential clients' needs and goals. It ensures that the marketing spend reaches the right people on platforms like social media channels and through email marketing.

Once you know your audience, developing a clear value proposition becomes the next step. This involves explaining how your advisory services stand out from others in the financial industry.

Developing a Clear Value Proposition

A clear value proposition tells potential clients why they should pick you for financial advisory services. It explains how your service stands out from others. For a financial advisor, this might mean focusing on personalized retirement planning or showcasing client success stories.

Your value proposition makes it easy for people to see the benefits of choosing you.

Your message must be simple and direct. Say what makes you different in a way that matters to your audience. This step sets the stage for setting goals that are both clear and measurable.

Know what makes you different, and let your clients see it.

Establishing Measurable Goals

Setting measurable goals is crucial for financial advisor ad campaigns. These goals must be specific, achievable, and tied to key performance indicators (KPIs). For example, if the goal is to increase website visitors through digital ads, a specific target number should be set within a defined timeframe.

By linking these goals to KPIs such as click-through rates and conversion rates, financial advisors can effectively measure the success of their ad campaigns. This approach provides clear benchmarks for evaluating the impact of marketing efforts and allows for adjustments to enhance overall campaign performance.

Digital Marketing Tactics for Financial Advisors

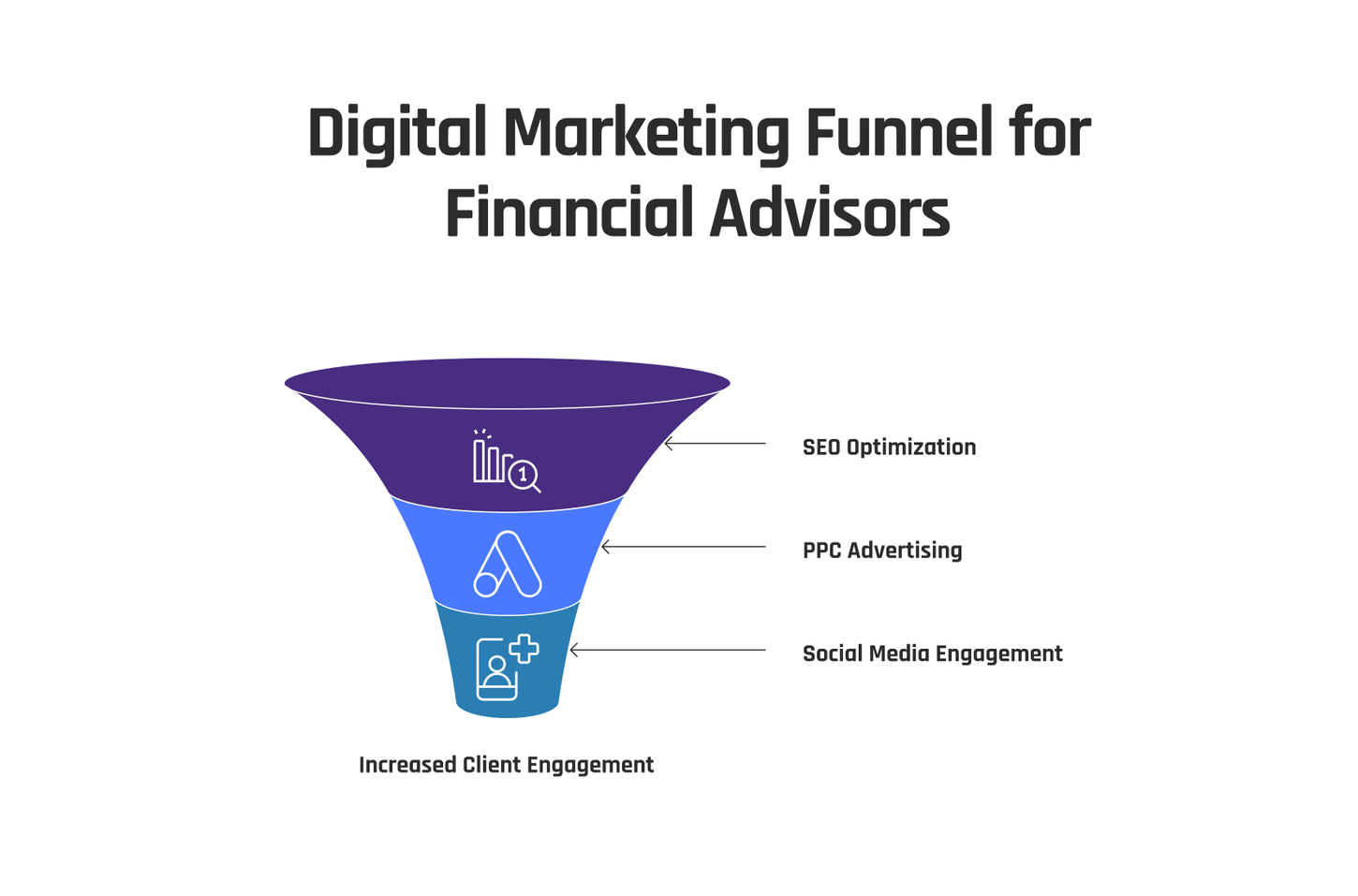

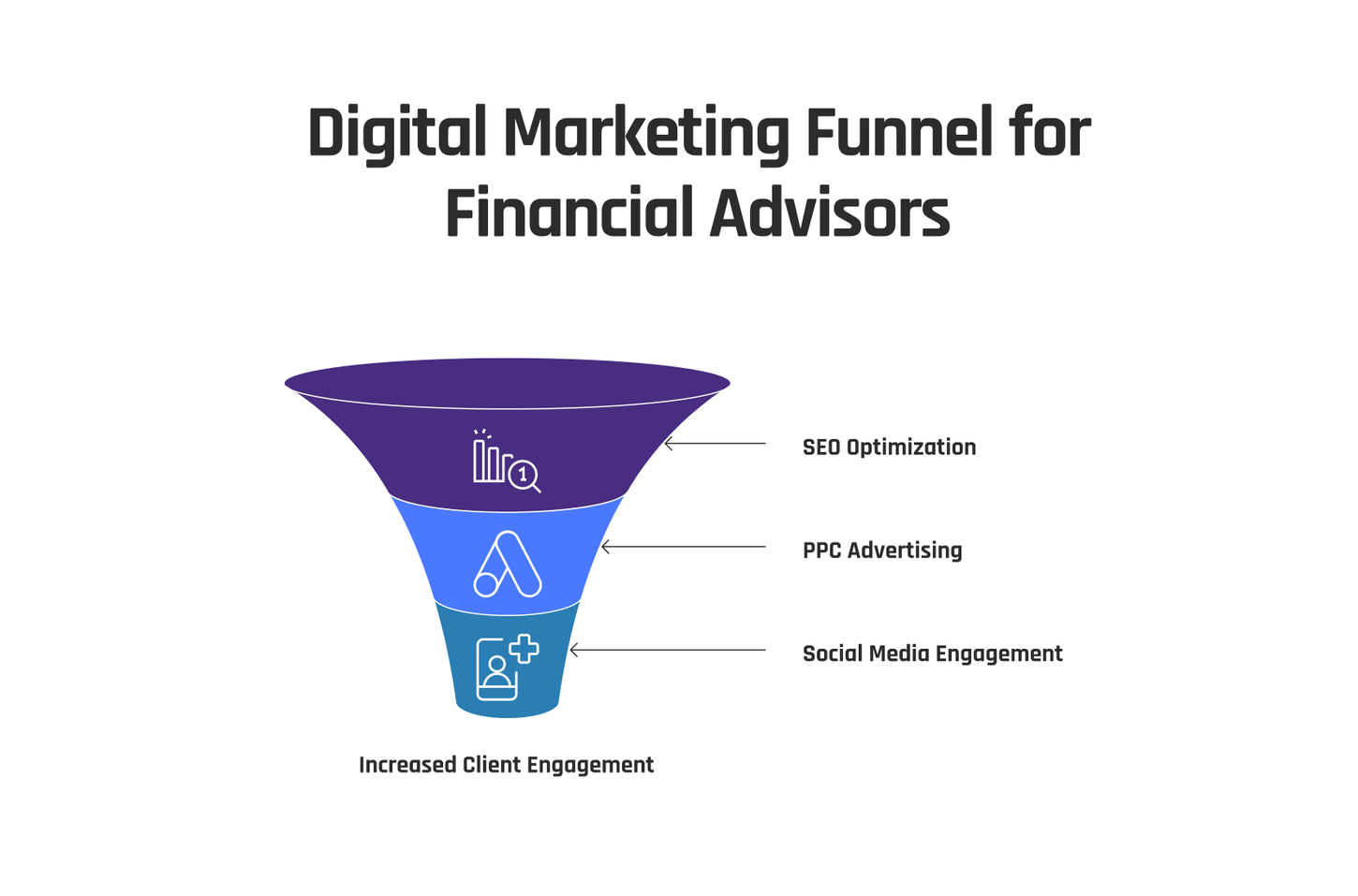

Digital marketing tactics for financial advisors include boosting visibility through SEO, implementing PPC advertising, and engaging audiences via social media. Read more on our blog to explore effective strategies to elevate your marketing efforts!

Enhancing Visibility Through SEO

To enhance visibility through SEO as a financial advisor, it's vital to optimize your website and content with relevant keywords like "financial planning" and "financial advisor advertising".

This contributes to improving search engine ranking and increasing brand awareness. For example, by creating blog articles around relevant topics such as "client acquisition" or "marketing objectives", you can attract more traffic to your site.

Moreover, integrating SEO strategies into your online ads and social media posts can lead to an increase in organic reach. By consistently producing valuable content customized to the needs of your audience, you can strengthen your online presence, which is increasingly important in today’s digital landscape.

SEO also plays a crucial role in driving lead generation for financial advisors. By including local keywords such as “independent financial advisors” or “advisor marketing”, you can effectively target potential clients within specific geographic areas.

This targeted approach not only increases the chances of reaching individuals seeking tailored solutions for their unique financial needs but also boosts the likelihood of meeting potential clients looking for customized solutions tailored to their unique financial needs.

Implementing PPC Advertising

When implementing PPC advertising for financial advisors, it's crucial to focus on relevant keywords such as "financial advisor ads" and "paid advertising" to effectively reach potential clients.

Using platforms like Google Ads can maximize visibility, ensuring the ads are visible to individuals actively seeking financial advice. By setting a specific budget and monitoring key performance indicators (KPIs) such as click-through rates and conversion rates, financial advisors can optimize their PPC campaigns for improved results.

Transitioning from PPC advertising, let's explore engaging audiences through Social Media as part of digital marketing tactics for financial advisors.

Engaging Audiences via Social Media

Engaging with audiences through social media as a financial advisor involves utilizing various platforms to connect with potential clients. Sharing pertinent content and interacting with followers can help establish brand awareness and confidence.

For example, sharing valuable insights about investment strategies or creating video promotions highlighting your advisory business's achievements can draw in more clients. Furthermore, organizing online events like webinars on social media can offer existing and potential clients valuable information while demonstrating your expertise in the financial advising field.

Strategic use of social media can also lead to cost-effective marketing that produces results.

Implementing Content Marketing Strategies

Content marketing strategies for financial advisors involve creating engaging blog articles, white papers, and employing video marketing techniques to appeal to the target audience.

Hosting webinars and online events can also enhance client engagement and trust in your expertise.

Creating Blog Articles and White Papers

To craft compelling blog articles and white papers as part of financial advisor marketing strategies, it's crucial to create content that resonates with the target audience. Customize blog posts and white papers to cover topics such as retirement planning, investment guidance, or market trends.

Use keywords strategically within the content to enhance SEO and improve visibility on search engines. Moreover, utilize data from industry reports and statistical analysis to support claims and offer valuable insights in the content.

By including a blend of educational resources and actionable advice in these articles, financial advisors can position themselves as thought leaders in their field while engaging potential clients seeking relevant information.

Including white papers can further establish credibility by offering in-depth analysis or research findings on intricate financial topics such as tax implications of investments or long-term wealth management strategies.

These comprehensive pieces should be thorough yet accessible, providing a valuable resource for readers seeking solutions to their financial concerns. By prioritizing quality over quantity, these blog articles and white papers can serve as valuable tools for building brand awareness and nurturing client relationships through informative content creation.

Employing Video Marketing Techniques

Video marketing is a potent tool for financial advisors to connect with their audience. It enables you to convey your message in a visually captivating way. Crafting informative and relevant video content can attract potential clients and enhance engagement on social media platforms, ultimately boosting visibility.

Video ads are also budget-friendly, making them a practical strategy for financial advisors seeking to expand their reach affordably. Incorporating video marketing into your overall digital marketing strategy enables you to effectively demonstrate your expertise and establish credibility with existing clients while capturing the attention of new ones.

Hosting Webinars and Online Events

Financial advisors can also utilize webinars and online events to connect with clients and prospects. This can offer a convenient way to provide valuable financial advice and engage with the audience in real-time. Here's how hosting webinars and online events can benefit financial advisors:

-

Interaction: Webinars allow direct interaction between the advisor and the audience, fostering engagement and trust.

-

Expertise Showcase: Advisors can showcase their expertise by presenting relevant and valuable content during these events.

-

Lead Generation: Webinars serve as effective tools for generating new leads and expanding the client base.

-

Educational Opportunities: Online events provide an opportunity for educating clients on complex financial topics, demonstrating thought leadership, and building credibility.

-

Networking: Hosting online events enables advisors to connect with other professionals, potentially leading to referrals or partnerships.

-

Cost-Effective Marketing: Compared to traditional seminars, hosting webinars is more cost-effective while reaching a wider audience.

-

Data Collection: Webinar platforms often provide analytics that can be used to understand attendee interests and behavior, enabling advisors to tailor future marketing strategies.

-

Customer Retention: Regularly hosting webinars allows advisors to maintain and strengthen relationships with existing clients by providing ongoing value through educational content.

Strategies for Email Marketing Success

Email marketing success depends on developing a quality email list and tailoring email outreach to effectively engage your audience. By integrating personalized approaches, financial advisors can effectively cultivate client relationships and stimulate business growth.

Cultivating a Quality Email List

To develop a quality email list, financial advisors should concentrate on constructing a database of engaged and interested recipients. Offering valuable content such as educational resources or webinars aligned with the interests and needs of the target audience is an effective approach.

Utilizing various marketing channels like social media, events, or blog articles, financial advisors can attract individuals interested in their services and nurture them into loyal subscribers.

Regularly maintaining the email list by removing inactive or disengaged contacts is crucial to uphold high deliverability rates and engagement levels. Moreover, implementing segmentation based on clients' preferences and behaviors enables more personalized communication tailored towards specific groups within the larger email list.

Customizing Email Outreach

To engage potential clients effectively, financial advisors should customize their email outreach. Here's how:

-

Personalize Content: Tailor emails to address specific client needs and concerns, increasing relevance and engagement.

-

Segmented Campaigns: Divide the email list into segments for targeted messaging based on client demographics or investment goals.

-

A/B Testing: Experiment with different subject lines, content, and calls-to-action to determine the most effective approach.

-

Automated Follow-Ups: Implement automated responses to nurture leads and maintain regular communication with potential clients.

-

Compliance Adherence: Ensure all email communications adhere to industry regulations regarding client correspondence.

By customizing email outreach in these ways, financial advisors can enhance client relationships and improve conversion rates.

Classic Marketing Techniques

Classic marketing techniques for financial advisors include direct mail campaigns and organizing networking events and seminars. These strategies can help in reaching potential clients and building professional relationships within the industry.

Executing Direct Mail Campaigns

Direct mail campaigns remain a valuable marketing strategy for financial advisors. The targeted nature of direct mail allows advisors to reach specific demographics effectively, creating personalized connections with potential clients.

By utilizing compelling designs and engaging content, financial advisors can deliver their message directly to the recipient's mailbox, standing out from digital clutter and leaving a lasting impression.

This method also provides tangible results through response rates and conversions, offering measurable returns on investment that can be tracked using analytics tools.

Financial advisor firms should consider integrating direct mail into their overall marketing plan as part of a comprehensive multichannel approach. When combined with other digital tactics such as social media marketing and PPC advertising, direct mail campaigns can significantly enhance brand visibility and engagement with varied audiences, ultimately expanding the firm's client base in a cost-effective manner.

Organizing Networking Events and Seminars

Financial advisors can enhance their marketing efforts by organizing networking events and seminars as part of their advertising strategies. This helps in building connections, credibility, and confidence with potential clients. Networking events and seminars provide a platform for financial advisors to showcase their expertise and connect with a broader audience.

-

Utilize professional platforms: Use online tools such as Eventbrite or LinkedIn to arrange and promote the event, reaching out to a broader audience.

-

Engage guest speakers: Invite industry experts or successful clients to speak at the event, adding value and drawing interest from attendees.

-

Provide valuable content: Offer insightful presentations on financial topics that are relevant to your target audience's concerns or aspirations.

-

Facilitate meaningful interactions: Create opportunities for attendees to engage with each other and your team, fostering relationships that may lead to future business opportunities.

-

Follow up effectively: After the event, continue engagement through personalized emails or phone calls to nurture potential leads gathered during the seminar or networking event.

These steps form an integral part of creating a strong marketing strategy by leveraging face-to-face interactions to build confidence and establish expertise within the financial services realm while also strengthening client-advisor relationships.

Effective Tools for Campaign Management

Manage campaigns efficiently by integrating CRM software and utilizing analytics and tracking tools. These processes enable streamlined organization and informed decision-making for successful marketing outcomes.

Integrating CRM Software

Integrating CRM (Customer Relationship Management) software is essential for financial advisors to efficiently manage client relationships. This tool enables advisors to store and organize client information, track interactions, and identify opportunities for personalized communication.

By streamlining these processes, financial advisors can increase their productivity and provide better service to clients.

CRM software also allows financial advisors to analyze customer data, monitor sales performance, and measure the success of marketing campaigns. With features like lead scoring and automated workflows, this technology helps in identifying potential clients and nurturing them through targeted marketing efforts.

Moreover, integrating CRM software provides valuable insights into client behaviors and preferences, enabling advisors to tailor their services according to individual needs. In conclusion, incorporating CRM software into marketing strategies empowers financial advisors with the tools they need to build strong client relationships while efficiently managing their business operations.

Utilizing Analytics and Tracking Tools

To measure the success of ad campaigns, financial advisors should utilize analytics and tracking tools. These tools assist in tracking key performance indicators (KPIs) such as website traffic, conversion rates, and audience engagement.

By integrating CRM software, advisors can efficiently manage client data and interactions to improve marketing strategies. Furthermore, the use of analytics tools provides valuable insights into audience behavior, enabling advisors to optimize their marketing efforts for better results.

Financial advisors should also use tracking tools to monitor ad placements and measure the effectiveness of different marketing channels. This allows them to make data-driven decisions in allocating their marketing budget effectively for cost-effective strategies that deliver meaningful results.

Overcoming Marketing Challenges for Financial Advisors

Navigating industry regulations presents a significant challenge for financial advisors. Additionally, budget management for marketing is another task that requires careful consideration and strategic planning.

Navigating Industry Regulations

Financial advisors face many industry regulations in their marketing strategies. These regulations are essential to comply with federal and state laws that apply to financial promotions, advertising, and client communications.

Marketing materials need to be accurate and not misleading. Financial advisors must ensure they meet the standards set by regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

Key strategies for addressing industry regulations include staying informed about updates in regulatory guidelines, maintaining clear records of all marketing activities, obtaining pre-approval from compliance departments for advertisements where necessary, and ensuring that all digital communications adhere to data privacy laws such as the General Data Protection Regulation (GDPR).

It's crucial for financial advisors to stay up-to-date with these constantly changing rules while devising effective ad campaigns.

These efforts help financial advisors build confidence with clients by adhering to best practices within a complex regulatory environment – an essential aspect of any cost-effective marketing strategy.

Budget Management for Marketing

Marketing budget management is crucial for financial advisors. Allocating funds effectively ensures maximum ROI. It's crucial to identify cost-effective strategies and tools. Implementing a well-structured plan can help in achieving marketing goals without overspending.

Financial advisors may consider diversifying tactics like PPC marketing, content creation, and email marketing to reach a wider audience within their budget constraints. Furthermore, utilizing analytics and tracking tools allows for careful monitoring of expenses and performance, leading to informed decision-making when allocating resources efficiently.

By managing the budget wisely based on detailed analysis of each tactic's performance, financial advisors can optimize their marketing efforts while staying within their allocated funds.

Evaluating the Success of Ad Campaigns

To measure the effectiveness of ad campaigns, tracking key performance indicators (KPIs) is crucial. Optimizing conversion rates also helps in understanding the impact and success of the campaigns.

Tracking Key Performance Indicators (KPIs)

Financial advisors need to monitor key performance indicators (KPIs) to assess the success of their ad campaigns. Here are the crucial KPIs to monitor:

-

Conversion Rate: Evaluate the percentage of website visitors who complete a desired action, such as filling out a contact form or making an inquiry.

-

Cost Per Lead: Calculate the expense incurred for each generated lead through the ad campaign to ensure cost-effectiveness.

-

Return on Investment (ROI): Measure the profitability of the ad campaign by assessing the revenue gained against the overall investment.

-

Click-Through Rate (CTR): Analyze the effectiveness of ad copy and visuals by assessing the proportion of users who click on an ad after viewing it.

-

Lead Quality: Assess the quality of leads obtained through the campaign to ensure they align with the target clientele.

Monitoring these KPIs provides financial advisors with valuable insights to refine their marketing strategies for optimal results.

Optimizing Conversion Rates

To optimize conversion rates, here are key strategies:

-

Use A/B testing to compare different ad elements and determine the most effective ones.

-

Improve website user experience to make it easier for visitors to convert.

-

Implement clear and compelling call-to-action buttons on landing pages.

-

Analyze data to identify potential bottlenecks in the conversion process.

-

Personalize content and offers based on customer behavior and preferences.

-

Streamline the checkout process for financial products or services.

-

Leverage customer testimonials and case studies to build trust and confidence.

Conclusion

In today's competitive financial advisor market, a well-thought-out ad campaign is crucial for success. By pinpointing target audiences and crafting compelling value propositions, advisors can develop effective campaigns to reach potential clients.

Digital marketing tools like SEO, PPC ads, and social media are cost-effective strategies to enhance visibility and engagement.

Content marketing through blogs, videos, and webinars further strengthens the advisor's online presence. Email outreach provides a direct line to clients with personalized content.

Classic techniques such as direct mail campaigns and networking events also play vital roles in building connections.

Implementing CRM software and tracking tools are essential for evaluating campaign performance. Challenges like industry regulations require careful navigation for successful marketing endeavors.

Examining key performance indicators helps fine-tune strategies for optimal results.

Adopting these ad campaign strategies will enhance financial advisors' market positioning while attracting satisfied clients seeking tailored financial solutions.

FAQs

1. What is a financial advisor marketing plan?

A financial advisor marketing plan is a strategy that many financial advisors use to promote their services, attract new clients and maintain satisfied ones.

2. How can I differentiate my ad campaign from other financial advisors?

You can stand out by using various marketing strategies such as creating relevant content that resonates with your target audience or offering unique services that meet their needs better than the competition.

3. Is it cost effective to have a detailed marketing plan?

Yes, having an effective strategy for your ad campaign reduces unnecessary expenses and ensures you reach your desired audience in the most efficient way possible.

4. How does relevant content affect my ad campaign's success?

Creating relevant content helps engage potential clients and keeps existing ones satisfied, making it a key factor in any successful financial advisor marketing plan.