Choosing the right Social Security software for advisors can be hard. Many tools claim to help, but not all are good. This post shows the best software for making smart decisions about social security benefits.

Keep reading to find your perfect tool.

Key Takeaways

-

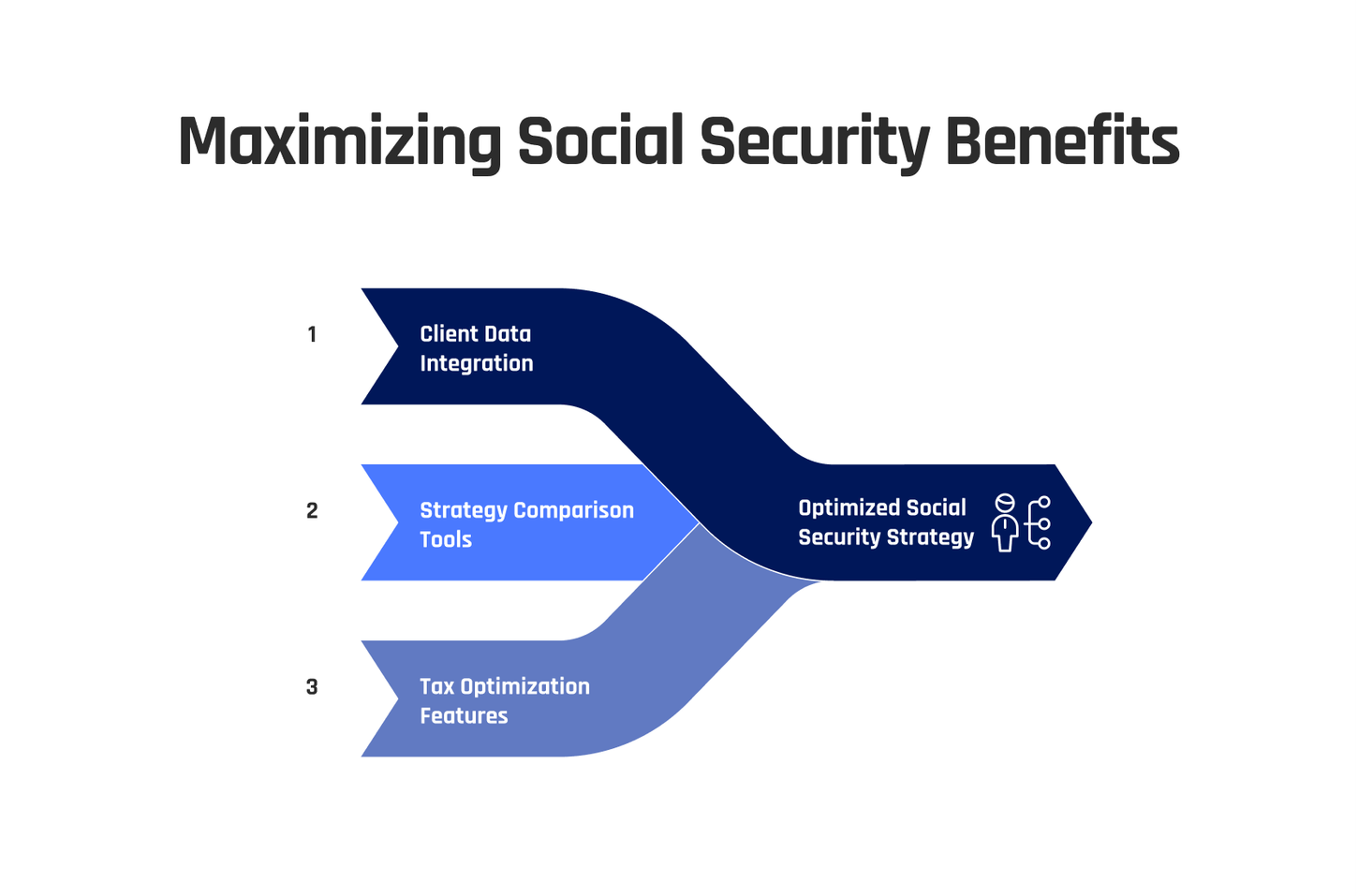

Look for software with client data integration, strategy comparison tools, and tax optimization features. These help advisors make smart decisions about social security benefits.

-

SSAnalyzer, Social Security Pro, Social Security Timing, and MaxiFi Planner are great tools for advisors. They offer ways to maximize benefits based on individual client needs.

-

Using these software tools saves time and improves advice. Advisors can give clients clear reports on the best options for their social security benefits. This builds trust and helps clients make informed choices.

Key Features to Look for in Social Security Software

When selecting social security software, it's crucial to consider client data integration and tax optimization features. Effective tools should also include strategy comparison options for financial advisors to maximize benefits for their clients.

Client data integration

Client data integration lets financial advisors easily access and manage all their clients' social security information in one place. This feature helps advisors quickly see a client's retirement age, marital status, monthly benefit amounts, and other key details without having to sort through separate files or systems.

It makes creating personalized filing strategies for clients faster because the advisor can compare different scenarios based on accurate client data.

This tool also simplifies tracking changes in a client's life that might affect their social security strategy, like getting married or changing jobs. With all the necessary information at their fingertips, advisors can offer better advice on maximizing social security benefits.

Strategy comparison tools

Strategy comparison tools in social security software let advisors explore different filing strategies. They show how each choice affects a client's income over time. This feature is crucial for making smart decisions about when to claim social security benefits.

It helps find the best strategy to get the most money in the long run.

Finding the right claiming strategy can mean thousands of extra dollars.

These tools compare options side by side. They take into account full retirement age, life expectancy, and taxes. Advisors use them to show clients clear comparisons. This makes it easier for clients to decide on their social security filing strategy.

Tax optimization features

Tax optimization features in social security software help advisors plan how clients can pay less tax on their social security income. These tools analyze different strategies for claiming benefits.

They also look at the impact of retirement accounts and investments on taxes. This helps find the best way to increase extra money from social security.

Using these features, advisors can show clients how timing affects their taxes. For example, they might suggest waiting longer to claim benefits to reduce taxation details. The software compares various scenarios and outcomes quickly and clearly.

This makes it easier for advisors to guide clients through complex financial decisions about social security rules and cumulative benefits.

Top Social Security Software Tools for Advisors

Explore SSAnalyzer, Social Security Timing, Social Security Pro, and MaxiFi Planner to reveal the strategies of social security optimization for your clients. These tools provide interactive sliders and user-friendly interfaces customized for assessing future earnings and tax optimization for married couples.

SSAnalyzer

SSAnalyzer simplifies intricate social security strategies while offering customized solutions for maximizing benefits.

Social Security Pro

Social Security Pro is a vital tool for advisors, offering a user-friendly interface and powerful features. It empowers advisors to easily view benefits, develop strategies, and determine the most effective approach for clients interested in their social security.

This program equips advisors with the necessary tools to calculate optimal benefit claiming strategies while also providing training and support tailored to enhance their practices.

Social Security Pro significantly simplifies the process of navigating the constantly changing realm of social security administration. Additionally, it ensures that advisors can offer personalized service to their clients by integrating tax optimization features and strategy comparison tools.

This ultimately leads to more informed decisions for both advisors and their clients alike.

Social Security Timing

Now let's shift our focus to "Social Security Timing." This tool is designed to help social security advisors create strategies for their clients. It offers an easy-to-use interface, allowing advisors to input client data and assess the best timing for claiming social security benefits based on each individual's situation.

The software also provides insights into tax optimization, addressing concerns about when to claim benefits in a way that minimizes tax implications. By using Social Security Timing, advisors can assist clients in deciding the most favorable time to start receiving their social security benefits while considering tax implications and potential financial impact.

MaxiFi Planner

MaxiFi Planner is a powerful tool for advisors because of its comprehensive client data integration. It allows advisors to input detailed financial information for clients, including assets, income, and expenses.

This helps in creating personalized Social Security claiming strategies based on the specific financial situations of individual clients.

Moreover, MaxiFi Planner excels with its tax optimization features. It enables advisors to analyze different scenarios and optimize their clients' Social Security strategies by considering tax implications.

This aspect provides a more holistic approach to advising, taking into account not just Social Security benefits but also how they fit into the larger financial picture.

Benefits of Using Social Security Software for Advisors

Using social security software can provide advisors with a streamlined process for analyzing complex client data, comparing different strategies, and optimizing tax outcomes. These tools enable advisors to present clients with comprehensive reports that clearly outline the best options for maximizing their social security benefits based on their individual circumstances.

This not only saves time but also helps build confidence with clients by offering them accurate and personalized advice.

Moreover, social security software allows advisors to stay up-to-date with the latest regulations and changes in the system. By leveraging these tools, advisors can ensure that they are providing clients with the most relevant and accurate information that aligns with current laws and policies.

Ultimately, this empowers advisors to offer better-informed recommendations tailored to each client's unique situation while demonstrating expertise in navigating the complexities of social security planning.

Conclusion

Social Security software tools are a game-changer for advisors. These tools streamline client data integration and compare strategies with ease. The top picks like SSAnalyzer, Social Security Pro, and others bring tax optimization features to the table.

Using these tools has clear benefits; they save time, enhance client service, and boost productivity. Advisors can't afford to miss out on these powerful resources!

FAQs

1. What are Social Security Software Tools for Advisors?

Social Security Software Tools for Advisors are digital programs that help advisors manage and optimize their clients' social security benefits.

2. Why should advisors use these software tools?

Advisors can use these software tools to make precise calculations, provide accurate advice, and ensure maximum benefit for their clients' social security needs.

3. Can you name some of the best Social Security Software Tools available?

There is a wide range of top-notch software tools available today. The choice depends on specific needs such as user-friendliness, features offered, and cost-effectiveness.

4. Do all advisors need to use this type of software tool?

While not mandatory, using such a tool can greatly enhance an advisor's ability to serve their clients effectively by providing accurate information about social security benefits.