Choosing a career can be tough. Many people think about becoming a financial advisor. This blog will look at the pros and cons of a financial advisor career. Keep reading to learn more.

What Does a Financial Advisor Do?

Having reviewed the foundations, let's progress to understanding the roles of a financial advisor. A financial advisor assists individuals in managing their finances. They provide insights on saving, investing, and wealth generation strategies.

They also chart out retirement plans and help clients specify their financial aspirations. These professionals take into consideration your comprehensive financial landscape—including your income, expenses, and debts—to deliver custom advice.

Financial advisors require knowledge about diverse investment possibilities and associated risks. They deal with shares, bonds, mutual funds, and more intricate solutions like annuities or insurance policies.

Most of them interact with clients face-to-face to comprehend their requirements better. These experts stay updated with market trends to provide optimal investment recommendations.

Their aim is to guide you in making insightful choices that support your aspirations, such as buying a house or retiring with ease.

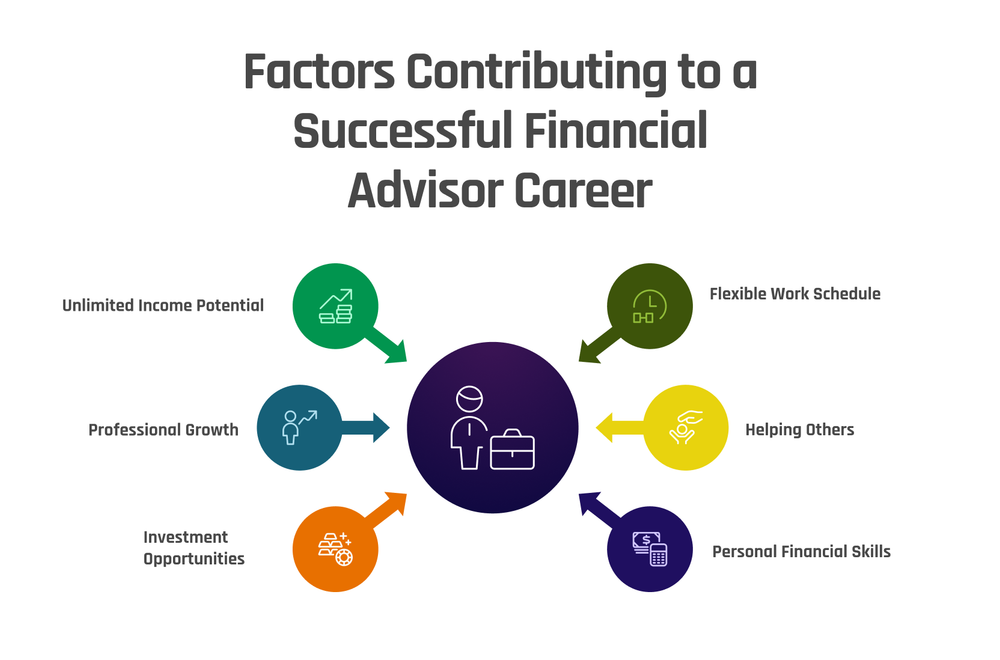

Pros of a Financial Advisor Career

Financial advising offers unlimited income potential and a flexible work schedule, along with opportunities for professional growth and the ability to help others achieve their financial goals.

As a financial advisor, you also get access to various investment opportunities and can enhance your personal financial management skills.

Unlimited Income Potential

A career as a financial advisor provides the opportunity to earn commensurate to your effort. Your income has no ceiling. Essentially, the larger the number of clients you assist and the more investment guidance you provide, the greater your earnings can be.

Everything hinges on the amount of effort you exert and the number of people who rely on you for their financial planning.

Earning potential in financial advising is virtually limitless.

Many advisors take pleasure in knowing that their personal income escalates as they aid others in fulfilling their financial objectives. Whether it pertains to retirement planning, portfolio management, or wealth management specialized services, every fruitful interaction can elevate your income.

This inspires many to go beyond the surface level in finance-related fields and provide customized advice that genuinely makes a difference in lives.

Flexible Work Schedule

Having a flexible work schedule is a big plus in the financial advisor career. Advisors can plan their meetings and work hours around what fits best for them and their clients. This flexibility helps balance personal life with professional duties.

It also lets advisors attend important family events or hobbies.

This benefit draws many to the financial advisory business. People value managing their own time while still helping others with their financial future. They enjoy not being tied down to a typical 9-to-5 job.

Instead, they create schedules that work for everyone involved, making it easier to build strong relationships with clients.

Opportunities for Professional Growth

As a financial advisor, there are abundant opportunities for professional growth. With specialized expertise and continuous learning, financial advisors can enhance their careers. They can invest in professional certifications to stand out in the constantly changing financial industry.

Networking skills play a pivotal role, providing access to potential clients and investment opportunities. Moreover, staying updated on market trends is crucial as it enables advisors to develop tailored strategies for their clients' diverse financial needs.

Financial advisors with strong networking skills tend to have more significant career growth than those who aren't actively networking within the finance-related fields. By integrating these tips into their practice, financial advisors can expect faster career progression and unveil the secrets to sustained success in the continually evolving world of finance.

Ability to Help Others Achieve Financial Goals

Financial advisors play a pivotal role in helping individuals reach their financial goals. They provide personalized advice and strategies to assist clients in managing complex investment planning and financial matters.

Advisors offer tailored solutions designed not only to increase wealth but also to provide the best guidance for their clients' unique situations and goals. Their expertise allows them to reveal the insights of the constantly changing financial markets, ultimately aiming for long-term stability in addition to financial growth.

Prospering in the industry requires managing high-stress challenges within a wealth management niche customized for individual investors. This involves offering investment-related advice and personal finance guidance while meeting rigorous licensing requirements.

In a time where investing carries risks, there's a rising need for reliable professionals who can offer comprehensive support in understanding market risks and devising strategies that align with individual financial circumstances.

Access to Investment Opportunities

Financial advisors have the advantage of gaining access to various investment opportunities for their clients. They can offer advice on a wide range of investment options such as stocks, bonds, mutual funds, and real estate.

This allows them to tailor strategies based on individual financial goals and risk tolerance. As a result, financial advisors can provide valuable insights into potential market trends and handle the complexities of investing through firsthand experience.

Furthermore, by accessing different investment opportunities, financial advisors can help their clients diversify their portfolios and make informed decisions about their finances based on current market conditions.

This provides an extra layer of security against potential risks associated with specific investments or market volatility. Overall, this access enables them to not just enhance long-term wealth accumulation but also navigate the ever-evolving investment landscape.

Personal Financial Management Skills

Financial advisors must possess strong personal financial management skills. These skills encompass effectively managing their own finances and assisting clients with their financial situations.

They should also be well-versed in investment strategies and market trends to offer the best advice for their clients' investment needs. Understanding and developing these skills are fundamental to a successful career as a financial advisor, enabling them to provide personalized solutions aligned with each client's specific financial objectives.

Furthermore, possessing solid personal financial management skills is critical in this dynamic industry, where investing carries risks and potential downsides. By dedicating time to refining these abilities, advisors can assist not only themselves but also their clients in attaining long-term financial success through informed decision-making based on solid personal finance principles and investment expertise.

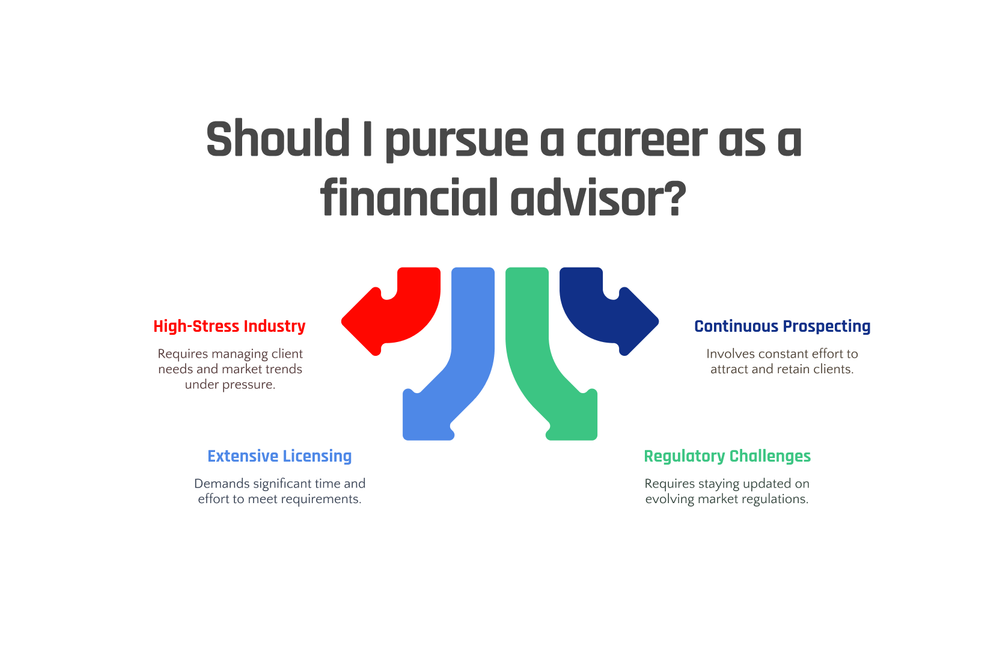

Cons of a Financial Advisor Career

The financial advisor career can be high-stress with continuous prospecting for clients and extensive licensing and certification requirements. You can learn more about the challenges of this career in our detailed blog post.

High-Stress Industry

Financial advisor careers operate in a high-pressure industry. Meeting client needs, staying updated on market trends, and managing financial risks can be demanding. Furthermore, the continually changing regulatory landscape adds to the complexity, creating a challenging work environment for many financial advisors.

In addition, financial advisors also encounter unpredictable market risks that can significantly impact their clients' investments. This combined pressure emphasizes the need for careful attention to detail and staying well-informed about various finance-related fields within this constantly changing field.

As a result, those considering entering this profession should be ready to handle high stress levels while navigating potential career challenges.

Continuous Prospecting for Clients

Transitioning from the high-stress industry of financial advising, a crucial aspect is the continuous search for clients. Financial advisors must actively pursue new clients to sustain their business and income.

This involves building strong networking skills, staying updated on market trends, and investing in professional certifications to attract potential clients. The competition is intense as not all financial advisors can offer investment-related advice or work exclusively as fee-based advisors.

Moreover, they face the challenge of spending valuable time in face-to-face meetings while developing strategies tailored to individual client needs.

Prospecting for clients also involves regulatory compliance challenges alongside navigating market risks and unpredictability. For instance, financial advisors operating under a registered investment advisor are required to adhere to extensive licensing and certification requirements from approved degree programs, which encompass coursework and exam obligations set by relevant bodies such as the Certified Financial Planner Board or the Securities Exchange Commission (SEC).

As a result, this adds pressure to an already demanding industry where successful financial advisor practice demands unwavering dedication amidst ever-evolving finance-related fields with limitless earning potential.

Extensive Licensing and Certification Requirements

Transitioning from the challenges of continuous client prospecting, it's crucial to understand the rigorous process of becoming a financial advisor. The financial services industry enforces strict licensing and certification requirements for those aspiring to offer investment-related advice.

Advisors are expected to have a bachelor's degree in finance-related fields and complete coursework and exam requirements as part of their approved programs. This includes developing strategies towards regulatory compliance, which supports both the responsibility to provide advice and managing market risks with precision.

Furthermore, successfully navigating the intricacies of this industry demands not just specialized skills but also an awareness of constantly evolving market trends.

Financial advisors must invest substantial time in undertaking extensive licensing processes, as well as gaining a deep understanding of complex regulatory frameworks and recognizing that investing involves risk.

Moreover, they are mandated to uphold ethics within their practice, engaging in comprehensive knowledge about wealth management while dedicating time to crafting personalized financial solutions for clients.

Regulatory and Compliance Challenges

Financial advisors encounter extensive licensing and certification requirements as part of their regulatory and compliance challenges. They must meet the standards set by governing bodies to provide investment advice.

In addition, financial advisors need to stay updated on market regulations which are constantly evolving. Adhering to these rules is crucial in ensuring that they can offer investment-related advice legally and ethically while safeguarding their clients' interests.

The licensing process for financial advisors also involves thorough registration procedures, such as passing approved programs designed to enrich an advisor's knowledge of the intricacies within the finance-related fields.

Furthermore, fee-based advisors need to navigate through customized compliance to offer comprehensive financial solutions. Addressing these challenges ultimately establishes trust between advisors and their clients by integrating firsthand experience into rendering investment advice effectively.

Market Risks and Unpredictability

Financial advisors encounter market risks and unpredictability due to the ever-changing nature of the finance-related field. The industry presents significant challenges, such as maneuvering through market risks when offering investment-related advice to clients.

Advisors need to stay updated on market trends to develop strategies that align with their clients' personalities and financial goals. Additionally, they encounter intricacies in managing regulatory and compliance challenges, especially regarding investment products.

Ultimately, financial advisors must carefully navigate these factors while striving for a work-life balance amidst the high-stress industry.

The unpredictable nature of the market directly impacts a financial advisor's ability to offer sound advice and effectively manage their client's wealth. It remains essential for aspiring advisors to recognize that not all investments may yield positive results due to potential market fluctuations.

Moreover, financial advisors should be adept at uncovering investment opportunities while being aware of potential risks associated with each option they present to their clients. Furthermore, staying informed about changes in regulations is crucial for maintaining compliance in an ever-changing economic environment where unforeseeable events can have far-reaching implications for one's financial house.

Tips for Aspiring Financial Advisors

Here's a tip for aspiring financial advisors: Build strong networking skills and stay updated on market trends to increase your chances of success. To discover more, read the full article.

Build Strong Networking Skills

To succeed as a financial advisor, building strong networking skills is crucial. Networking is essential for establishing connections with potential clients and industry professionals, paving the way for business opportunities.

Creating a powerful network can significantly boost referral prospects and lead generation activities, contributing to the growth of an advisor's client base. Staying connected to other professionals in related fields such as accounting or law can also improve one's ability to offer comprehensive financial solutions to clients.

By actively participating in industry events, conferences, and local business groups, financial advisors can consistently expand their network and stay updated on market trends while potentially gaining valuable referrals from fellow professionals.

Financial advisors should concentrate on developing relationships within their community by utilizing social media platforms like LinkedIn to connect with potential clients and share relevant content about finance-related topics.

Engaging in local community events and charity organizations not only provides a chance to give back but also presents opportunities to meet new people who may become future clients or refer others looking for financial advice.

Stay Updated on Market Trends

Staying updated on market trends is essential for financial advisors. It enables them to offer investment-related advice that aligns with current market conditions, maximizing potential returns for clients.

Being aware of market trends also helps advisors to identify potential risks and opportunities in different investment options, ensuring they provide well-informed guidance to their clients based on the latest market data.

In this constantly changing environment, being ahead of the curve by monitoring market trends allows financial advisors to make proactive decisions that can positively impact their clients' portfolios and overall financial goals.

Financial advisors must stay updated on various sectors such as finance-related fields and wealth management to provide comprehensive advice. This includes being knowledgeable about unlimited earning potentials within accepted programs offering a flexible work-life balance while managing high-stress industry challenges derived from extensive licensing requirements, regulatory changes, and unpredictable market risks.

Financial advisors need to understand both their client's personalities and individual needs while simultaneously addressing complexities associated with entering a career path towards fee-based advisory services or potential advisor business models tailored towards hourly fee structures and current competitive trends among other advisors within the finance industry.

Invest in Professional Certifications

Investing in professional certifications as a financial advisor can open up new opportunities and boost credibility. Many clients seek out advisors with recognized credentials, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

These certifications not only showcase expertise but also demonstrate commitment to upholding high professional standards. For example, holding the CFP certification may lead to an 18% increase in earnings compared to non-certified professionals.

With extensive licensing and certification requirements being a disadvantage of this career, earning these designations can position you ahead of the competition and instill confidence among potential clients.

Moreover, obtaining additional accreditation like the Series 7 license for selling securities or the Series 65 for becoming an investment advisor representative broadens your scope of services and increases your value in the market.

Investing time and effort into gaining these qualifications enables you to provide comprehensive financial advice while strengthening your position within the industry; it's a crucial step towards building a successful career as a financial advisor.

Is Becoming a Financial Advisor Worth It?

Becoming a financial advisor has its advantages and disadvantages. On one hand, financial advisors have the potential for unlimited income and flexible work schedules. They also get to help others achieve their financial goals and gain access to various investment opportunities.

However, it's crucial to consider that the industry is demanding, with continuous prospecting for clients, extensive licensing requirements, regulatory challenges, and market unpredictability.

Aspiring advisors should focus on building networking skills and staying updated on market trends as they navigate this career path.

In considering whether becoming a financial advisor is worth it, individuals should carefully consider both the rewarding aspects of helping others with their finances alongside the demanding nature of the industry.

It's essential to be aware of the potential challenges while pursuing this career choice.

Conclusion

Considering a career as a financial advisor can offer various benefits, such as unlimited income potential and the chance to help others achieve their financial goals. However, it also comes with challenges like high stress and continuous client prospecting.

Aspiring advisors should focus on building strong networking skills, staying updated on market trends, and investing in professional certifications to succeed in this field.

The world of financial advising holds promise for those who seek an ever-evolving industry where they can make an impact while navigating through complexities. It's about tailored towards offering personalized financial advice that supports the unique needs of clients.

In conclusion, becoming a financial advisor requires dedication and resilience when facing both opportunities and challenges. With the right approach and skills, individuals can thrive in this high-stakes yet rewarding profession while maintaining a healthy work-life balance.

FAQs

1. What are the pros and cons of hiring a financial advisor?

Hiring a financial advisor has both pros and cons. Pros include receiving investment-related advice from an expert, which can help you grow your wealth. Cons may include high fees if the advisor operates on a fee-based model, not all advisors offer the same services.

2. How does one start their career as a financial advisor?

A career as a financial advisor typically begins with obtaining relevant licensing in finance related fields, then gaining experience by offering investment related advice to clients.

3. Do all financial advisors work exclusively for their clients?

No, not all advisors work exclusively for their clients. Some sell investment products or services on behalf of companies while others known as fee-only advisors provide advice without selling any products.

4. What challenges do most financial advisors face?

Financial advising is often seen as a high stress industry due to the need to spend valuable time in person meetings with clients and managing investments carefully. Balancing this workload alongside personal life can be challenging for work-life balance.

5. How do I find the right financial advisor that suits my needs and personality?

You should consider how an advisor works - whether they're fee-based or fee-only - along with how well they understand you and your client's personalities before choosing them as your wealth manager.