Many people want to manage their own business in the financial industry.

One fact about this field is that independent financial advisors have more control over their work life. This guide shows you how to become an ifa, step by step.

Increased flexibility and control

Working as an independent financial advisor offers more control over your career. You decide on the clients you want to work with and the services you provide. This means you can focus on areas that match your expertise, like risk management or investment strategies.

You're also in charge of setting your schedule. This flexibility lets you balance work with personal life better.

Being an independent advisor means being your own boss and making decisions that align directly with your professional goals and values.

You also get to choose the technology and tools that best support your business needs. Whether it's for managing client relationships or analyzing financial products, having control over these choices helps improve service quality.

Plus, running your own firm allows for direct communication with clients, building stronger trust and a solid client base.

Potential for higher income

Being a self-governing financial advisor often leads to a higher income than working within an institution. You determine your own fees and elect the services you provide. This implies that a larger share of your earnings stays with you, as opposed to being shared with a bigger company.

For advisors who oversee investments, their income is typically based on the volume of assets under their management. Greater volumes of managed investments likely result in an elevated income.

A large number of advisors find victory by concentrating on particular sectors or providing unique services, such as retirement planning or guidance on mutual funds. This specialism might draw more clients who are prepared to pay for professional advice in certain fields.

Moreover, establishing strong connections with present clients often leads to recommendations and new business without the necessity for additional marketing activities.

Licensing and Certification Requirements

To become an independent financial advisor, you must pass the Series 65 Exam and earn a Certified Financial Planner (CFP) certification. These credentials are essential for providing comprehensive financial advice to clients and ensuring compliance with regulations.

Series 65 Exam

The Series 65 exam is a must for anyone wanting to be an independent financial advisor. This test checks your knowledge about providing investment advice and managing clients' funds.

It is designed by the Financial Industry Regulatory Authority (FINRA). You need to pass this test to get a license as an Investment Advisor. The exam has multiple choice questions on laws, regulations, and various types of investments.

Studying for the Series 65 takes time and effort. You don't need a sponsor from a company or any specific work experience to take it. However, preparing well increases your chance of passing.

Once you pass, you can legally give financial advice in the securities industry. This step is key in becoming an independent advisor who helps clients achieve their financial goals.

Certified Financial Planner (CFP) certification

The Certified Financial Planner (CFP) certification is a key requirement for independent financial advisors. It's essential for providing comprehensive and competent financial advice to clients, as it covers areas like investment planning, retirement and estate planning, tax strategies, insurance, and employee benefits.

With the growing complexity of financial markets and regulations, having this certification demonstrates a high level of expertise and professionalism. According to recent statistics, CFP professionals have witnessed an average income increase of 30% after obtaining the certification.

Obtaining the CFP certification has become increasingly crucial in today's competitive financial advisory landscape.

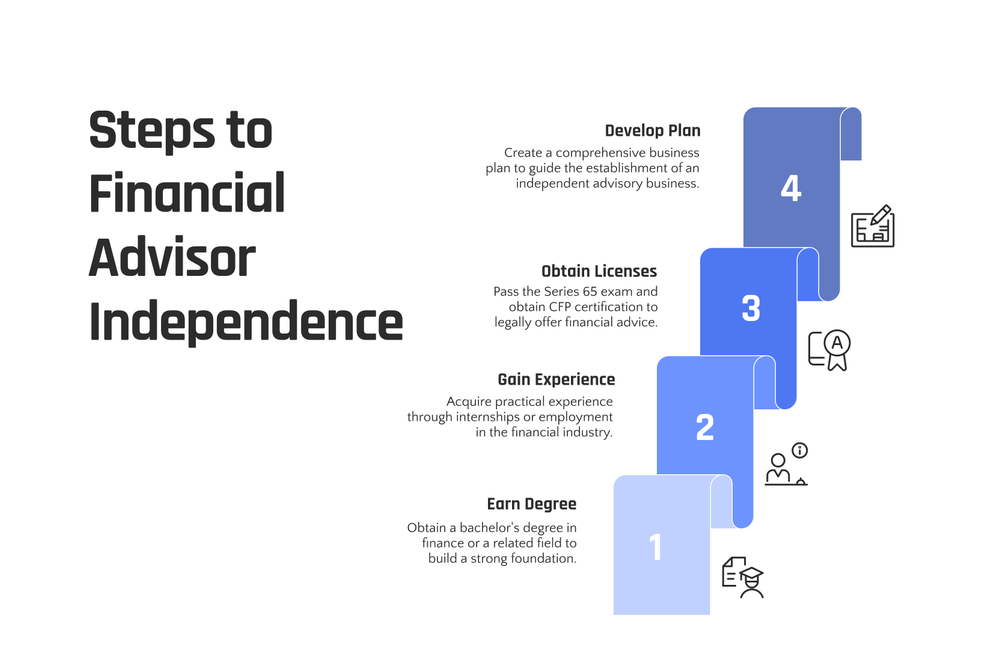

Steps to Becoming an Independent Financial Advisor

To become an independent financial advisor, you need to earn a bachelor's degree in finance or a related field and gain experience through internships or employment. You'll also need to obtain required licenses and certifications and develop a business plan.

Earn a bachelor's degree in finance or a related field

To become an independent financial advisor, you should have a bachelor's degree in finance or a related field. This education provides the necessary foundation for understanding investment products, managing risk, and providing financial advice to clients.

Common certifications such as the Series 65 Exam and Certified Financial Planner (CFP) certification also require a strong educational background in finance. Furthermore, having a bachelor's degree can enhance your credibility with potential clients and support services.

Becoming an independent financial advisor demands proficiency in financial analysis and an understanding of investment opportunities. A bachelor’s degree equips individuals with the knowledge to provide personalized financial advice for future success in the essentials of the securities industry.

Gain experience through internships or employment

After completing a bachelor's degree in finance or a related field, gaining experience through internships or employment is crucial for aspiring independent financial advisors. This practical exposure provides insight into the day-to-day operations of the financial services industry and hones essential skills in providing financial advice.

Working under experienced professionals allows individuals to learn about managing risk, building client relationships, and understanding the intricacies of securities and investments.

Furthermore, it offers an opportunity to network within the industry and gain exposure to different types of clients and financial products.

The firsthand experience acquired during internships or employment not only enhances knowledge but also demonstrates an individual's commitment and capability to potential employers or future clients.

It is recommended for those considering becoming independent investment advisors to seek diverse experiences that will contribute towards their entrepreneurial spirit, business development, and overall readiness for establishing an advisory practice.

Obtain required licenses and certifications

To become an independent financial advisor, you need to acquire the required licenses and certifications. This usually involves passing the Series 65 exam and obtaining the Certified Financial Planner (CFP) certification.

The Series 65 exam permits you to offer investment advice, while the CFP certification showcases your proficiency in financial planning. These qualifications are vital for legally offering financial advice and services to clients within the securities industry.

Develop a business plan

Developing a business plan is crucial for starting an independent financial advisory business. Firstly, it involves outlining your target market, services offered, and financial projections to attract potential investors or lenders.

Next, consider the costs associated with setting up your business such as office space, technology tools for efficiency, and initial marketing expenses. This comprehensive plan will serve as a roadmap to guide you through the critical early stages of establishing your independent financial advisory business.

Afterwards, conduct thorough research on competitors in your area and identify what sets you apart. Customize your marketing strategy towards attracting new clients while retaining current ones by showcasing your unique value proposition.

Selecting the Right Custodian

When choosing a custodian for independent advisors, it's essential to consider various factors that can impact your business positively. To learn more about the importance of selecting the right custodian and how it can benefit your independent financial advisory business, make sure to read further.

Importance of a custodian for independent advisors

Choosing the right custodian is essential for independent advisors. A custodian provides the infrastructure and support needed to execute trades, process paperwork, and maintain compliance with regulations.

Furthermore, they safeguard client assets and provide reporting tools. It's crucial to consider factors like the range of investment offerings, technology integration capabilities, and overall support when selecting a custodian.

An ideal custodian should offer a wide array of investment products like securities industry essentials (SIE) or variable annuities alongside strong technological solutions for efficiency in managing clients' portfolios.

Moreover, ensuring that the chosen custodian aligns with an advisor's business model and offers competitive pricing can significantly impact an advisor's ability to serve their clients effectively while maximizing their own potential for growth in the ever-evolving financial advisory landscape.

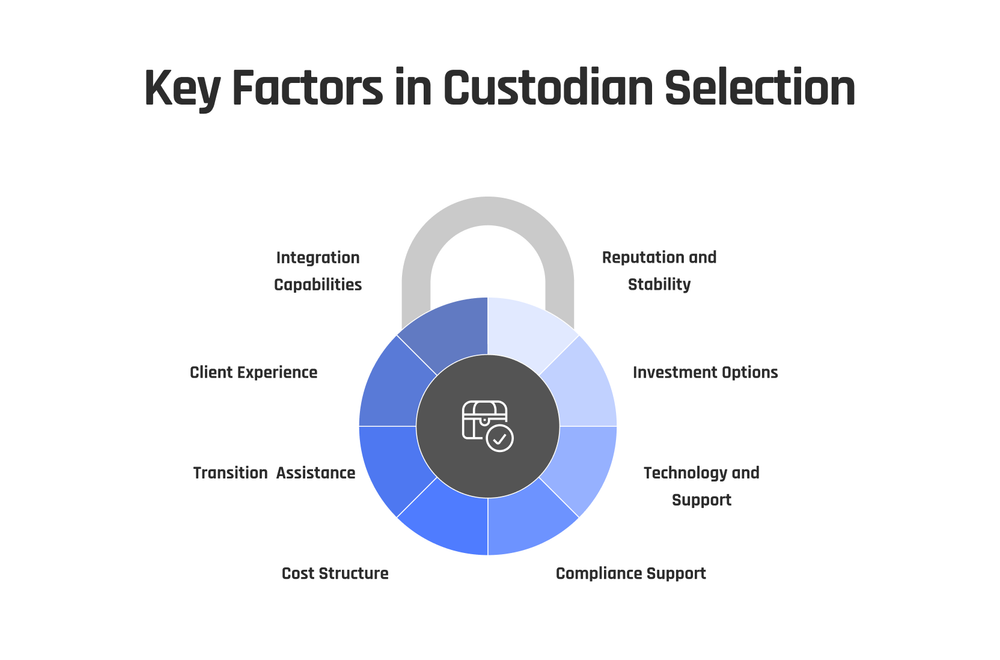

Factors to consider when choosing a custodian

When selecting a custodian for your independent financial advisory business, you should take into account the following factors:

-

Reputation and Stability: Ensure the custodian has a strong reputation and financial stability to safeguard your clients' assets.

-

Range of Investment Options: Seek a custodian offering diverse investment alternatives to meet the needs of your clients and allow for flexibility in managing their portfolios.

-

Technology and Support: Assess the custodian's technology platform and support services to ensure they align with your business requirements and can improve operational efficiency.

-

Compliance and Regulatory Support: Select a custodian that provides robust compliance support to help you stay aligned with industry regulations and ethical standards.

-

Cost Structure: Consider the cost structure of the custodian, including fees, transaction costs, and any additional charges, to ensure it fits within your business model while providing value to your clients.

-

Transition Assistance: Seek a custodian that offers smooth transition support when transferring client accounts, ensuring minimal disruption during the process.

-

Client Experience: Evaluate how the custodian's platform and services contribute to enhancing the overall client journey, including reporting capabilities and accessibility.

-

Integration Capabilities: Ensure that the custodian's systems integrate smoothly with your existing tools and technology stack, facilitating efficient operations within your advisory practice.

Building and Retaining a Client Base

Develop a marketing strategy and foster strong client relationships to succeed in building and retaining a loyal client base. Read more about how to effectively grow your clientele as an independent financial advisor.

Developing a marketing strategy

Developing a marketing strategy as an independent financial advisor is crucial for attracting and retaining clients. Utilize digital marketing tools like social media and email campaigns to reach potential clients.

Creating educational content on personal finance topics can position you as an expert in the field, helping to build trust with your audience. Networking with other professionals, such as attorneys or accountants, can also lead to referrals for new clients.

Lastly, consider attending industry events or hosting workshops to connect with individuals seeking financial advice.

As an independent financial advisor, developing a strong marketing strategy means leveraging digital tools like social media and email campaigns while creating educational content and networking with other professionals in related fields.

Attending industry events or hosting workshops can help broaden your client base.

Fostering strong client relationships

To nurture strong client relationships, it's essential to prioritize clear communication and understanding. Actively listen to clients' financial goals and concerns, then offer personalized advice aligned with their needs.

Providing regular updates on market trends and investment performance keeps clients informed and shows that you are actively managing their portfolios. Building trust through transparent and ethical practices is crucial for long-term client loyalty.

Offering exceptional customer service can set you apart from other advisors.

Stay connected with your current clients by regularly checking in and offering educational resources or workshops that align with their financial interests.

Do not underestimate the power of referral business; satisfied clients can be a reliable source of new leads for your practice, ultimately contributing to its growth.

Investing time in building strong client relationships not only enhances client satisfaction but also contributes positively to your business's bottom line.

Managing Your Independent Financial Advisory Business

Manage your independent financial advisory business efficiently with the right tools and technology, as compliance with regulations and ethical standards is pivotal - Read on for more valuable insights.

Tools and technology for efficiency

To run an efficient independent financial advisory business, digital tools and technology are essential. These tools encompass customer relationship management (CRM) software for organizing client data and interactions.

Furthermore, financial planning software aids in devising investment strategies customized to individual client objectives. In addition, automated marketing platforms can streamline client communication and lead generation efforts.

The integration of these tools ensures smooth operations and improved service delivery while maintaining compliance with industry regulations.

Staying compliant with regulations and ethical standards

Transitioning from the efficient use of tools and technology to staying compliant with regulations and ethical standards is crucial for independent financial advisors. In today's regulatory environment, it's vital to follow the rules set forth by governing bodies such as the SEC and FINRA.

As an independent financial advisor, obtaining the necessary licenses and certifications is essential; this includes passing the Series 65 exam and securing a Certified Financial Planner (CFP) certification, meeting a requisite ethical standard.

Compliance with these regulations not only ensures that you are legally allowed to provide personalized investment advice but also fosters confidence with clients. Upholding ethical standards reinforces your commitment to acting in your client’s best interest while maintaining transparency in all financial dealings.

Strictly adhering to these requirements will help build long-term credibility within the industry, attracting more clients seeking trustworthy financial guidance.

Conclusion

So, there you have it - the comprehensive guide to becoming an independent financial advisor. From licensing requirements to building a client base and managing your business, this guide has covered everything you need to know.

Keep in mind, it's a journey that requires dedication and hard work but offers increased flexibility, potential for higher income, and the chance to provide impactful financial advice.

FAQs

1. What does becoming a financial advisor involve?

Becoming a financial advisor involves taking multiple steps, including passing a multiple choice exam and getting registered as an investment advisor.

2. How do I provide financial advice independently?

To provide financial advice independently, you need to become a registered investment advisor and possibly align with an independent broker dealer.

3. Are there additional certifications required for becoming an independent financial advisor?

Yes, many advisors also obtain additional certifications like certified public accountants (CPAs) to boost their credibility.

4. Can all financial advisors work independently?

Not all can work independently right away. The ability to be an independent financial advisor depends on experience, credentials, and often going through the process of going independent from broker dealers.

5. Does my credit history matter in becoming a Financial Advisor?

Yes! Credit history plays a vital role in establishing trust with clients; thus it's essential for someone looking at becoming an Independent Financial Advisor.