Choosing the right estate planning software for financial advisors can be hard. This software helps create important legal documents. Our blog lists the top 5 estate planning solutions to make your job easier.

Key Takeaways

-

Estate planning software helps advisors create legal documents quickly and with fewer errors. It makes the process easier by automating tasks like data entry.

-

Security and compliance are very important in this software to protect client information and follow laws. Software must encrypt data and have secure systems.

-

Collaboration tools in estate planning software make it easy for clients and advisors to work together. This helps everyone understand plans better.

-

Customization options let advisors change the software to meet each client's unique needs, making their service more personal.

-

Some estate planning software can join up with financial planning tools. This gives a full view of a client's finances, helping advisors make better plans.

Key Features to Look for in Estate Planning Software

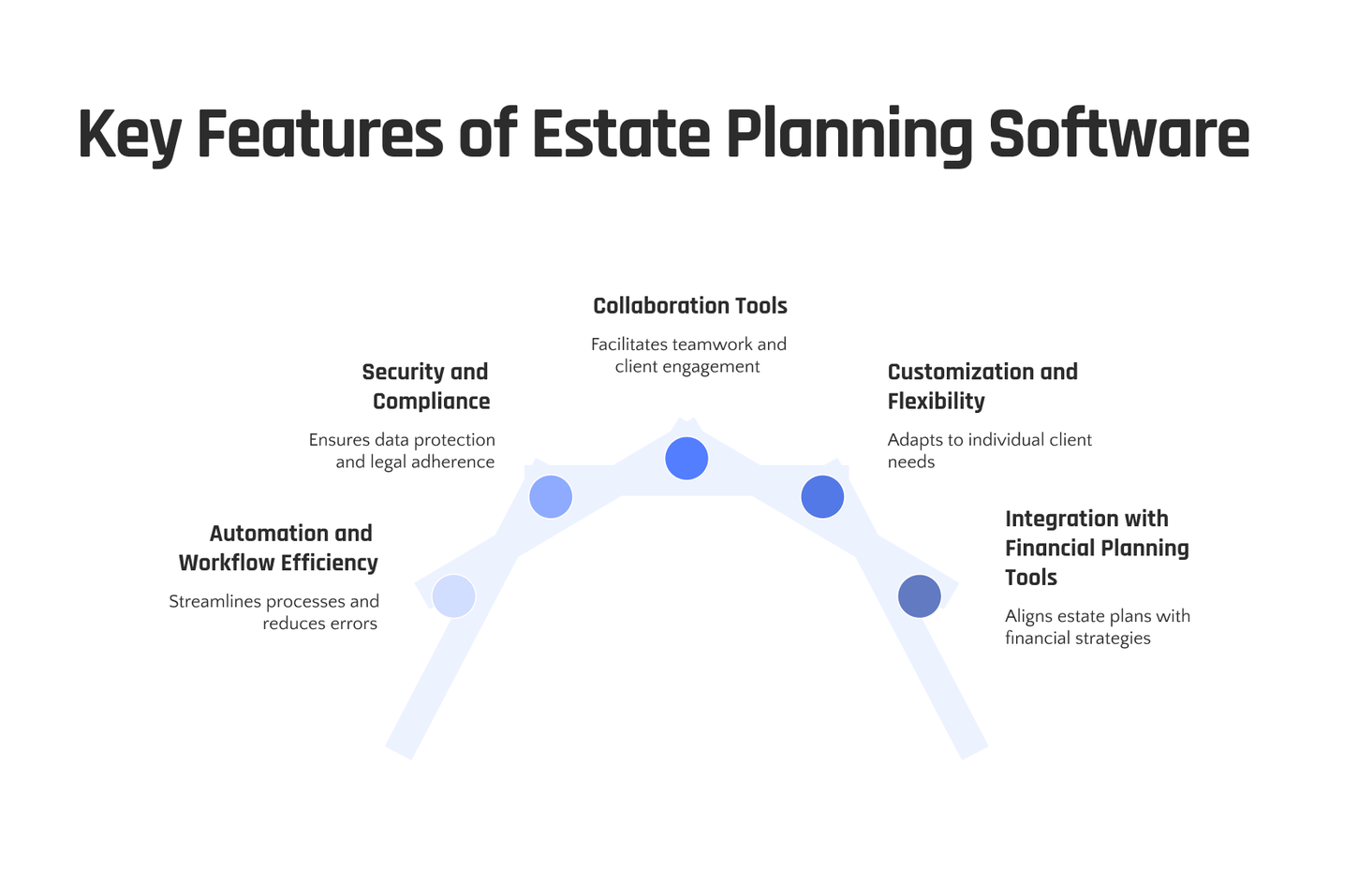

When selecting estate planning software, prioritize features such as automation and workflow efficiency, security and compliance measures, collaboration tools, customization and flexibility options, as well as integration with financial planning tools.

These features play a crucial role in enhancing productivity and ensuring the seamless management of clients' estate planning needs.

Automation and workflow efficiency

Estate planning software boosts workflow efficiency for advisors and law firms. It speeds up the estate planning process, making it easier to create estate plans, manage documents, and handle client intake.

This saves time and reduces errors, allowing advisors to focus more on client relationships and providing legal advice.

Automation in estate planning software transforms how attorneys and financial planners serve their clients by simplifying complex tasks into manageable actions.

With features like guided workflows for creating wills, trusts, healthcare directives, and more, these tools ensure all necessary steps are covered without missing key details. Advisors can automate repetitive tasks such as data entry and document creation.

This makes the process faster while ensuring accuracy across different asset types and financial information.

Security and compliance

Security and compliance are key for estate planning software. These programs must keep client information safe from unauthorized access. They need to follow laws on data protection too.

This means they should encrypt data and have secure login systems. For advisors, this security lets them share estate planning documents safely with clients.

Compliance is also about making sure the software does not do something illegal, like giving legal advice if it's not allowed to. So, the software follows rules to avoid issues like unauthorized practice of law.

Advisors can trust these tools to handle sensitive estate tax details and financial power documents while staying within legal boundaries.

Collaboration tools

After ensuring estate planning software is secure, look for collaboration tools. These tools help lawyers and clients work together smoothly. Clients can easily share documents with their attorneys.

This saves time and makes creating estate plan documents faster.

Collaboration tools also let multiple team members view or edit plans at the same time. This improves the client experience by making it easy to understand complex strategies. It ensures everyone involved, from advisors to loved ones, stays on the same page during estate planning processes.

Customization and flexibility

Estate planning software should offer customization and flexibility to tailor the tools to fit each client's unique circumstances. This involves adapting the software program to support various estate planning services, such as living trusts or revocable trust funding, and integrating with other financial planning tools and existing documents.

This saves time and offers a more personalized service that addresses specific needs.

The flexibility of the software solution is crucial in the ever-evolving realm of estate planning. It should provide support for current and future needs, allowing advisors to navigate complexities with ease and provide guidance tailored to unlocking wealth value and business assets.

This ensures that clients receive a comprehensive service crafted to enhance their estate plans in a way that suits them best.

Integration with financial planning tools

Estate planning software that integrates with financial planning tools can simplify the advisor's workflow and enhance client experience. It allows advisors to seamlessly incorporate clients' estate plans within their overall financial strategy, ensuring a comprehensive approach.

By leveraging such integration, advisors can provide more accurate projections for wealth distribution and tax implications, thereby enhancing the effectiveness of estate plans. This integration also facilitates collaboration between legal and financial professionals, streamlining the process for creating customized estate plans tailored to each client's unique financial situation.

Moreover, integrating with financial planning tools enables real-time updates to reflect changes in a client's financial status or goals without manual adjustments. As a result, advisors can offer more dynamic and responsive estate planning services while maintaining accuracy and compliance with evolving regulatory requirements.

Such seamless integration supports holistic wealth management by aligning an individual's estate plan with their broader financial objectives and investments.

Asset-Map

Asset-Map is a user-friendly software that creates visual reports for client's estate planning. It streamlines the process, saving time and allowing for human expertise to shine.

Features & Description (Asset-Map)

Asset-Map is crafted to enhance your estate planning process. It offers visual reports that simplify the comprehension and communication of intricate financial information with clients.

The software seamlessly integrates with financial planning tools, saving time and ensuring accuracy in clients' estate planning documents. Asset-Map also offers collaboration tools for the support team, which aids human expertise in reviewing plans efficiently.

The platform aims to unveil the intricacies of a client's estate planning by including visual data, which has proven valuable for many attorneys seeking advanced software features.

Furthermore, Asset-Map emphasizes robust security measures, addressing compliance needs and safeguarding sensitive client information throughout the entire process.

Pros & Cons (Asset-Map)

Transitioning from the detailed features and descriptions of Asset-Map, let's closely examine its advantages and disadvantages to provide advisors a clearer insight into what this estate planning software offers.

| Pros | Cons |

|---|---|

| Visual mapping tools enhance client understanding. | Limited to visualizations with lesser emphasis on in-depth analysis. |

| Improves client engagement with interactive charts. | May require an initial learning curve for new users. |

| Facilitates collaborative planning sessions with clients. | Subscription model might be costly for small firms. |

| Integrates with leading financial planning platforms for streamlined workflows. | Customization options can be overwhelming for beginners. |

| Offers a unique approach to estate planning discussions. | Not as widely compatible with every financial tool. |

EncorEstate Plans

EncorEstate Plans offers a user-friendly interface with customizable features and integration with financial planning tools. This software streamlines estate planning processes, saving advisors time and providing comprehensive solutions for their clients' needs.

Features & Description (EncorEstate Plans)

EncorEstate Plans offers comprehensive estate planning tools, enabling estate planning attorneys to streamline their processes and save time. It includes features such as automated tasks, ensuring workflow efficiency with less time spent on administrative duties.

The software also provides advanced security measures and compliance tools to safeguard sensitive client data, giving peace of mind to users. Furthermore, it seamlessly integrates with financial planning tools for a more holistic approach.

The flexibility and customization options of EncorEstate Plans make it suitable for tailoring solutions towards individual client needs while collaborating effectively with other professionals.

This next-generation software aims to enhance the overall experience for both advisors and clients by providing a user-friendly interface while improving productivity through its intuitive design.

Turning now to the discussion about "Just In Case Estates"...

Pros & Cons (EncorEstate Plans)

EncorEstate Plans offers a comprehensive solution for estate planning advisors. Here's a quick look at its advantages and disadvantages:

| Pros | Cons |

|---|---|

| User-friendly interface makes it easy to navigate | Limited customizability for highly complex estates |

| Integrates well with several financial tools | Subscription cost can be high for small firms |

| Enhances workflow with automation features | Learning curve for new users |

| High-level security features protect client data | Requires internet connection for cloud-based features |

| Collaboration tools facilitate teamwork | May not support all regional estate laws globally |

Just In Case Estates

Just In Case Estates offers a user-friendly interface and customizable features for efficient estate planning. It also provides robust security measures to safeguard sensitive client information.

Features & Description (Just In Case Estates)

Just In Case Estates is a user-friendly estate planning software that assists advisors effectively manage their clients' estates. This software provides tools for creating and managing legal documents, including wills, trusts, and powers of attorney.

Just In Case Estates also offers a secure platform for storing essential documents and information securely.

Furthermore, Just In Case Estates presents an intuitive interface that allows advisors to collaborate effectively with their clients. The software's customization options enable advisors to personalize the estate planning process to each client's unique needs and preferences.

Just In Case Estates also seamlessly integrates with financial planning tools, streamlining the overall workflow for advisors. With its focus on automation and security, this software ensures compliance with industry standards while enhancing productivity for advisors.

Pros & Cons (Just In Case Estates)

Just In Case Estates provides estate planning solutions aimed at streamlining the process for advisors. Here is a breakdown of its advantages and disadvantages:

| Pros | Cons |

|---|---|

| Intuitive design simplifies estate planning. | Limited integration with external financial planning tools. |

| Ensures secure sharing of documents. | May require initial learning for optimal use. |

| Features collaboration tools for advisors and clients. | Subscription model might be costly for small firms. |

| Offers customization options for varying needs. | Features may be more than needed for basic planning. |

| Streamlines workflow with automation features. | Customer support response times can vary. |

Snug

Snug is a thorough estate planning software crafted to improve efficiency and collaboration. It provides customization and flexibility, making it a top choice for advisors looking for more than just automation.

Features & Description (Snug)

Snug presents a comprehensive estate planning software that aims to streamline the planning process for advisors and their clients. Its intuitive interface and strong features offer automation tools that improve workflow efficiency.

The software prioritizes security and compliance to ensure the protection of sensitive client information. It seamlessly integrates with financial planning tools, providing a holistic approach to estate management.

Customization options enable advisors to tailor plans according to individual client needs, fostering flexibility in creating personalized solutions.

The user-friendly design of Snug enhances collaboration between advisors and clients while maintaining data integrity and privacy. The integration with financial planning tools ensures the consideration of all aspects of an individual's wealth when developing an estate plan.

Additionally, Snug offers human review capabilities as part of its offerings for clients seeking more than just automated solutions.

Pros & Cons (Snug)

Snug offers a user-friendly interface, making it easy for advisors to create and manage estate plans efficiently. Its intuitive design simplifies the process, saving time and reducing errors. Some users may, however, perceive Snug's customization options as limited compared to other software in the market. Furthermore, while its ease of use is beneficial for many advisors, it may lack advanced features that some users require for complex estate planning scenarios.

Transitioning to NaviPlan, let's delve into its features and benefits.

NaviPlan

NaviPlan helps advisors create detailed and accurate financial plans. It streamlines the planning process, ensuring fast and efficient delivery of comprehensive estate plans. NaviPlan empowers advisors to provide customized and flexible solutions for their clients' estate planning needs.

Features & Description (NaviPlan)

NaviPlan is a popular estate planning software that provides comprehensive solutions for financial advisors. It offers intuitive automation and workflow efficiency to streamline the estate planning process, enabling advisors to save time and focus on client needs.

NaviPlan prioritizes security and compliance, ensuring that sensitive client data is protected, giving peace of mind to both advisors and their clients.

The software also excels in collaboration tools, allowing seamless communication between advisors and clients throughout the planning process. Its integration with financial planning tools enhances its adaptability and enables a more holistic approach towards effective estate planning strategies.

With NaviPlan's next-generation features, it stands out as a robust solution for advisors seeking efficient estate planning software.

Moving onward to EncorEstate Plans...

Pros & Cons (NaviPlan)

Now we'll look at the upside and downside of using NaviPlan in estate planning. This software comes with a user-friendly interface that makes it easy for advisors to input client data and generate comprehensive financial plans quickly. Plus, NaviPlan provides robust collaboration tools which allow advisors to work seamlessly with their clients on estate planning strategies. On the flip side, some users have found that NaviPlan's pricing structure can be a bit complex, potentially leading to higher fees for those managing more assets.

In summary, NaviPlan offers an intuitive platform for creating detailed financial plans and facilitates smooth collaboration between advisors and clients. However, its pricing model may pose challenges for those handling larger asset portfolios or seeking transparent fee structures.

Conclusion

In conclusion, these five estate planning software options offer various features that can help advisors streamline their workflows and serve their clients effectively. Each software has its advantages and disadvantages, so it's crucial for advisors to thoughtfully assess their individual needs before deciding.

Whether it's automation, collaboration tools, or customization, there are choices to fit different preferences and requirements. Advisors should thoroughly investigate these tools to discover the one that most closely matches their business goals and client needs.

With the appropriate estate planning software, advisors can improve efficiency and provide personalized solutions for their clients' financial futures.

FAQs

1. What is the best estate planning software for advisors?

The best estate planning software for advisors would be one that offers a next generation solution, such as Asset Map.

2. How can I contact sales of these software solutions?

You can usually find options to contact sales on the website of each estate planning software provider.

3. Can you tell me more about Asset Map?

Asset Map is a top-rated estate planning tool that provides a visual map of all assets, making it easier for advisors to plan and strategize.

4. Why are next generation tools important in choosing an estate planning software?

Next generation tools offer advanced features and improved user experience which makes them vital when selecting an ideal estate planning software.