Financial advisors often struggle to attract and keep clients. They spend a lot of time and money on marketing, but their efforts don't always pay off. A well-designed Financial Advisor Sales Funnel can solve this problem.

It helps advisors get more leads and turn them into loyal clients.

This guide will teach you how to create an effective funnel for your financial advisory business.

You'll learn about the different stages of a sales funnel and how to use them to grow your client base.

What is a Financial Advisor Sales Funnel?

A financial advisor sales funnel is a step-by-step process that guides potential clients from awareness to becoming loyal customers. It maps out the journey of turning leads into paying clients, helping advisors track and improve their marketing efforts.

Traditional vs. Digital Marketing Funnels

Traditional marketing funnels rely on old-school methods like print ads and cold calls. They often cast a wide net, hoping to catch a few fish. Digital funnels, on the other hand, use online tools to target specific groups.

These new funnels track user actions and adjust in real-time, making them more effective.

Digital funnels offer better data and faster results than their old counterparts. They use things like social media ads and email campaigns to reach people. This allows financial advisors to connect with potential clients more easily.

Plus, digital funnels can be changed quickly based on what works best.

Essential Components of Effective Funnels

Effective sales funnels for financial advisors need key parts to work well. These parts help turn leads into clients step by step. A good funnel starts with a strong landing page that grabs attention.

It then uses clear calls-to-action to guide people through the process. Email marketing plays a big role too. It keeps leads warm and builds trust over time. Content like blogs, videos, and webinars are also vital.

They show the advisor's know-how and help leads learn more.

Another key part is a system to track leads and their actions. This helps advisors know when to reach out and what to say. A good funnel also has ways to get feedback and improve. Surveys and analytics tools can show what's working and what's not.

Also Read: 5 Essential Financial Advisor Marketing Strategies

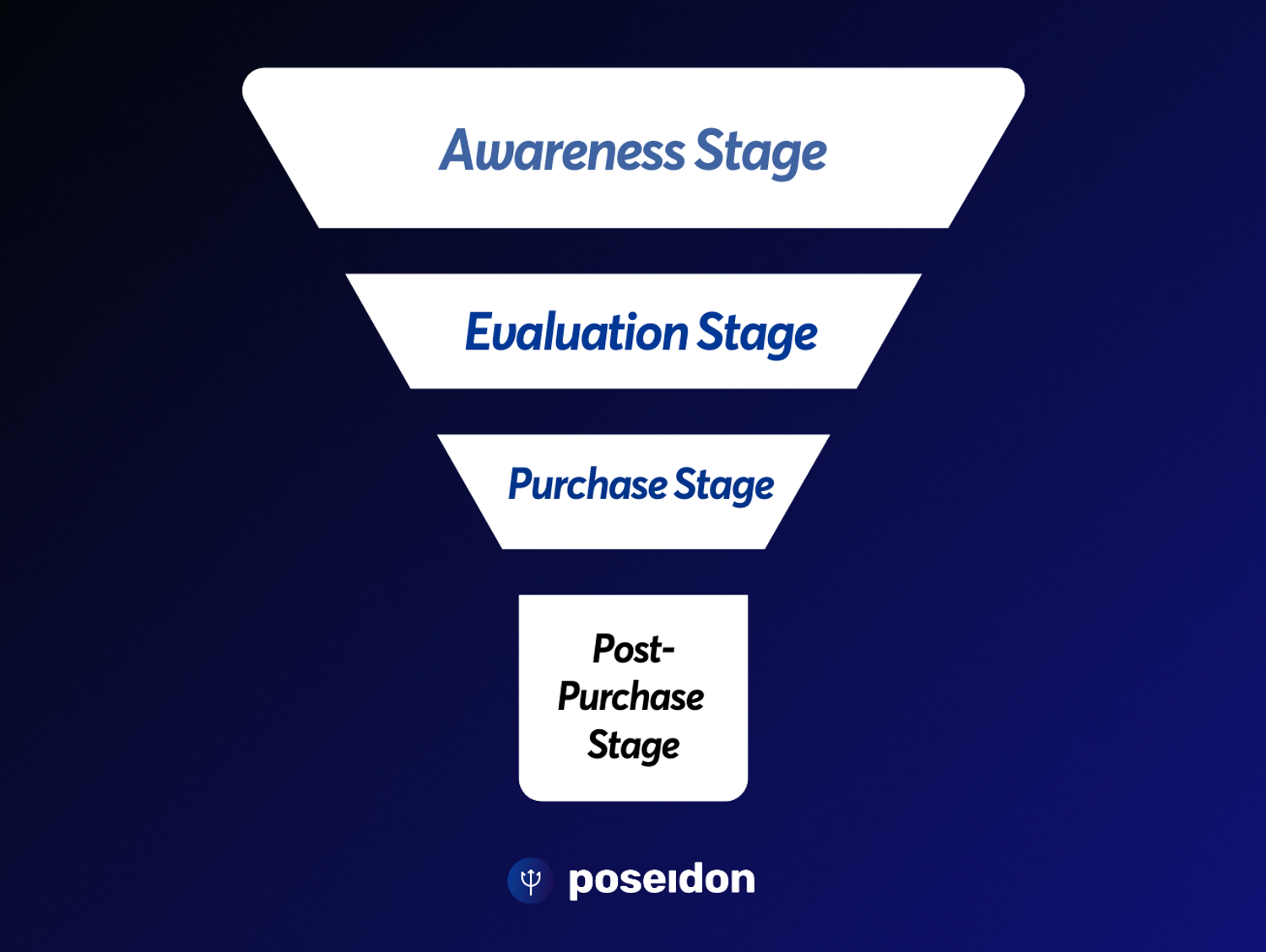

4 Stages of a Financial Advisor Sales Funnel

The Financial Advisor Sales Funnel has four key stages. These stages guide clients from first contact to long-term loyalty.

1. Awareness Stage

The awareness stage kicks off the sales funnel for financial advisors. It's where you grab people's attention and make them aware of your services. You need to create content that speaks to their money worries and goals.

This could be blog posts, social media updates, or ads that show how you can help.

Your goal is to stand out from other advisors and show your value. Share useful tips and insights about personal finance. This builds trust and gets potential clients interested in learning more from you.

As you create awareness, you set the stage for moving leads further down your sales funnel.

2. Consideration/Evaluation Stage

After grabbing attention, financial advisors move to the next step. This is where potential clients weigh their options. They look at different advisors and financial services. They compare costs and benefits.

Clients ask questions and seek more info.

At this stage, advisors must show their value. They can offer free consultations or webinars. They might share case studies or client success stories. The goal is to stand out from other advisors.

Advisors need to prove they can meet client needs best.

3. Purchase Stage

The purchase stage is where clients decide to work with you. Here, you show your value and build trust. You might offer a free consultation or a sample financial plan. This helps clients see how you can help them.

You also need to be clear about your fees and services. Make it easy for clients to say yes and start working with you.

During this stage, you should address any last concerns. Answer questions fully and honestly. Share success stories from other clients. This proves you can deliver results. Be ready to guide new clients through paperwork and next steps.

A smooth start builds confidence in your services.

4. Post-Purchase Stage

After a client signs up, the work isn't over. Smart advisors keep in touch with their new clients. They send welcome emails and check in often. This builds trust and keeps clients happy.

Happy clients are more likely to stick around and tell others about you.

Good advisors also ask for feedback. They want to know what clients like and don't like. This helps them get better at their job. They might send surveys or have quick chats. The goal is to make sure clients feel heard and valued.

This stage is key for keeping clients long-term.

How to Create Successful Financial Advisor Sales Funnel?

Building a successful sales funnel takes careful planning and smart moves. Keep reading to learn the key steps that will help you create a funnel that works.

1. Define Your Target Audience

Knowing your ideal clients is key for financial advisors. Start by looking at your current best clients. What do they have in common? Think about their age, job, income, and money goals.

This helps you create a clear picture of who you want to reach. Use this info to make your marketing speak right to them.

Next, research where these ideal clients spend time online and offline.

Are they on LinkedIn or Facebook? Do they read certain magazines or go to local events? This knowledge helps you put your message where they'll see it.

With a clear target, you can make content and offers that really grab their attention.

2. Build Awareness

Strategic marketing builds awareness for financial advisors. It helps them reach more people who need their services. Smart advisors use many ways to get noticed. They might write blogs, make videos, or post on social media.

These efforts show what they know and how they can help. The goal is to be seen as an expert who can solve money problems.

Good marketing also targets the right people. Advisors focus on those who match their ideal client profile. They create content that speaks to these people's needs and worries. This could mean talking about retirement plans for older folks or saving for college for young parents.

3. Generate Leads with High-Value Content

High-value content draws in leads for financial advisors. This content can be blogs, videos, or guides that solve client problems. It shows your skills and builds trust. Offer free reports, webinars, or tools to get contact info from potential clients.

These leads can then be nurtured into paying customers.

Creating useful content takes time but pays off. It helps you stand out from other advisors and proves your worth. Make sure your content speaks to your target audience's needs and worries.

4. Nurture Leads into Prospects

Turning leads into qualified prospects takes time and care. You need to build trust and show your value. Send helpful emails with tips on money matters. Share stories of how you've helped others reach their goals.

Offer free chats to answer questions and ease worries. This slow and steady approach helps leads warm up to you.

Keep track of how leads respond to your efforts. Note which emails they open and what content they like best. Use this info to tailor your messages. As leads engage more, invite them to events or webinars.

5. Convert Leads into Paying Customers

Converting qualified leads into paying customers is key for financial advisors. To do this, you need to build trust and show value. Start by offering free advice or a sample plan. This allows leads to experience your skills directly.

Then, follow up often with helpful tips and market updates. Make sure to listen to their needs and goals. Customize your services to fit each lead's unique situation. This personal touch can make them feel valued and more likely to choose you.

Clear pricing and easy-to-understand service packages can also help convert leads. Many people feel uncertain about financial matters. By breaking down your services into simple steps, you make it easier for leads to take action.

Always be ready to answer questions and address concerns. The more comfortable a lead feels, the more likely they are to become a paying customer.

Leveraging Technology in Sales Funnels

Technology boosts sales funnels for financial advisors. Smart tools make work easier and faster. Read on to learn how tech can help you grow your business.

Automation Tools for Efficiency

Financial advisors can boost their sales with smart tools. These tools do many tasks on their own, saving time and effort. They can send emails, post on social media, and track leads without human help.

This lets advisors focus on talking to clients and growing their business.

Some top tools for financial advisors include HubSpot, Mailchimp, and Hootsuite. These make marketing easier and more effective. They help advisors reach more people and turn them into clients faster.

With these tools, advisors can work smarter, not harder, and see better results.

Tools for Lead Management

Moving from automation tools, let's talk about CRM systems for lead management. These systems help financial advisors track and nurture leads. A good CRM stores client info, tracks interactions, and sets reminders for follow-ups.

We recommend using Poseidon to send personalized outreach messages to your prospects with effective tracking and follow-ups.

It makes it easy to see where each lead is in the sales funnel.

Analytics for Performance Tracking

Analytics tools help financial advisors track how well their sales funnels work. These tools show which parts of the funnel are doing great and which need work. They give data on things like how many people visit a website, click on ads, or sign up for emails.

This info helps advisors make smart choices to improve their funnels and get more clients.

Using analytics, advisors can see which marketing efforts bring in the most leads. They can also find out where people drop off in the sales process. With this knowledge, they can fix problems and make their funnels better.

3 Advanced Strategies for Financial Advisor Funnels

Advanced strategies take financial advisor funnels to the next level. These methods boost client growth and make your funnel stand out from the crowd.

1. Intent-Based Branding (IBB)

Intent-Based Branding (IBB) helps financial advisors stand out. It focuses on what clients want and need. IBB uses data to create messages that speak to clients' goals. This method builds trust and shows how advisors can solve problems.

Financial advisors can use IBB to attract ideal clients. They craft content that matches what people search for online. This smart approach boosts lead quality and conversion rates.

2. Webinar and Seminar Funnels

Webinars and seminars are powerful tools for financial advisors to reach new clients. These events let advisors share their knowledge and build trust with potential customers. A well-planned funnel for these events starts with eye-catching ads and emails to get people to sign up.

During the webinar or seminar, advisors can offer helpful tips and show their expertise. After the event, follow-up emails and calls can turn interested viewers into paying clients.

3. Lead Magnet Development

Lead magnets are key tools for financial advisors to attract new clients. These free offers, like e-books or webinars, give value in exchange for contact info. Good lead magnets solve a specific problem for your target audience.

They should be quick to consume and show your expertise. Popular options include checklists, templates, and short video courses.

Creating an effective lead magnet takes planning. Start by picking a topic your ideal clients care about. Make sure it aligns with your services. Keep it focused and actionable. Design it to look professional.

Poseidon Done-for-you Services for Financial Advisor Sales Funnel

You're a financial expert, not a sales person. That's why our done-for-you services are designed to take the guesswork out of growing your firm. We've partnered with leading financial advisors to fine-tune their sales and marketing efforts, helping them unlock their "secret sauce" to attract and retain clients.

Our services are tailored specifically to financial advisors, providing you with a hassle-free solution to grow your business and boost revenue.

Here's what you can expect:

-

Custom Sales Funnels -- We create optimized sales funnels to guide prospects from initial contact to becoming loyal clients, helping you close more deals with less effort.

-

Targeted Email Campaigns -- Nurture leads and stay top of mind with tailored email sequences that speak directly to your audience's needs, driving engagement and conversions.

-

LinkedIn Outreach -- We'll manage your LinkedIn presence, from content creation to direct outreach, connecting you with ideal prospects and building your professional network.

-

SEO & Content Marketing -- We craft SEO-optimized blogs, guides, and resources that position you as a thought leader, improving your website's visibility and attracting quality leads.

Conclusion

Financial advisor sales funnels are key to growing your business. They help you find and keep clients. A good funnel brings in leads and turns them into loyal customers. With the right tools and steps, you can make a funnel that works well.