Managing your wealth can be hard, but AI use can simplify the process, improving your return on investment. There are many choices and market changes. Artificial Intelligence (AI) helps make these tasks easier in wealth management, particularly through AI applications that streamline processes.

A fact to consider is AI improves Decision-making is enhanced through the power of generative AI by analyzing lots of data quickly.

This blog will show how AI changes wealth management for the better, from client onboarding to making smart investment choices. Get ready to see what AI solutions can do for you in the realm of financial services.

Understanding AI in Wealth Management

AI in wealth management uses another area where AI can also improve efficiency. smart technology to handle investments and financial advice better. It looks at market trends, client data, and other important factors to make good investment decisions.

This type of system can learn and get better over time, which helps it give personalized advice That fits each person's needs and enhances customer relationship management.

This technology also helps keep track of laws and rules in finance, making sure clients' money is handled safely and wisely, which is crucial for asset managers. With AI, wealth managers can spot risks or chances in the market quickly.

This means they can protect or grow their client's money more effectively than before.

Key Differences: Traditional vs. AI-Based Wealth Management

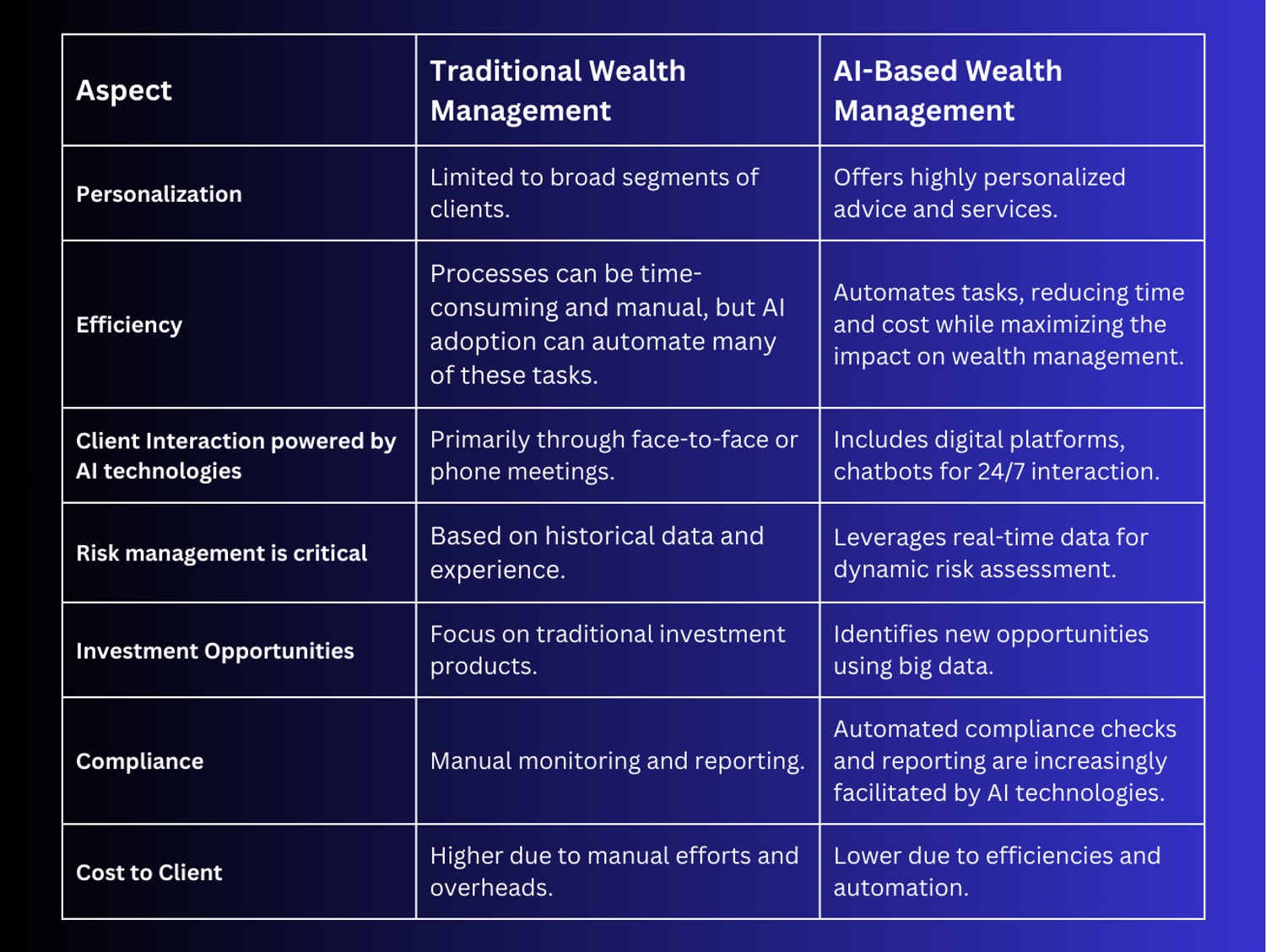

Transitioning from a basic understanding of AI in wealth management, we now explore the distinctive aspects between traditional and AI-based approaches.

The evolution of technology has introduced significant changes in how wealth management services are delivered and experienced.

These differences showcase the transformative impact of AI on wealth management, offering a blueprint for what the future of financial advisory might look like.

Through automation, personalization, and enhanced decision-making capabilities, generative AI-based wealth management stands out as a more efficient, cost-effective, and dynamic solution in the wealth and asset management industry.

How AI Transforms Wealth Management

AI changes wealth management in big ways. It makes client onboarding faster and easier. Advisory services become simpler and more effective. Investment portfolio management improves with smart tools.

Financial planning and compliance can be automated, saving time and effort, particularly through AI in wealth and asset management. These changes help both clients and advisors work better together. Want to learn more about these transformations?

Streamlining Client Onboarding

Client onboarding is quicker with AI in wealth management. It streamlines the process for both clients and advisors. New clients can complete forms online swiftly. AI tools confirm information instantly, reducing wait times.

These systems also enhance client experience. They deliver Personalized services are enhanced by the impact on wealth management through advanced AI technologies. from the beginning. Clients receive personalized financial advice tailored to their needs and preferences through advanced AI applications. customized investment advice based on their needs and goals. This helps establish confidence early on in the relationship. AI is transforming how we manage client relationships.

Simplifying Advisory Services

AI simplifies advisory services in wealth and asset management, offering personalized advice. It helps advisors deliver quick and accurate information to their clients, enhancing communication through AI use. With AI, advisors can analyze market changes faster.

This leads to better investment decisions AI applications are essential for managing client assets efficiently and effectively.

Roboadvisors provide financial products and services. automated advice based on individual needs. They use algorithms to create personalized investment plans without the need for constant human input. Clients receive customized recommendations quickly, making the process more efficient and user-friendly in the financial services landscape.

The shift from traditional methods to AI brings a new level of service that improves overall satisfaction.

Enhancing Investment Portfolio Management

AI enhances investment portfolio management by analyzing large amounts of financial data quickly. It identifies patterns and trends in the market that humans might miss. This helps advisors make better investment decisions.

With machine learning, AI can adjust portfolios based on market changes. It keeps investments aligned with clients' goals and risk levels. Clients receive personalized investment advice suited to their needs.

This creates a more efficient process for managing client assets in wealth management settings.

Automating Financial Planning and Compliance

AI plays a significant role in relationship management by enhancing communication between clients and asset managers. automating financial planning and compliance.

It helps manage complex tasks faster and more accurately by leveraging AI technologies. With AI, wealth managers can create personalized financial plans This approach is beneficial for clients without heavy manual work, enhancing the role of financial advisors.

Algorithms analyze data quickly, making it easier to spot trends and recommend actions.

Compliance is also simplified by AI systems. These systems keep track of regulations that often change, ensuring compliance through effective data management. They alert firms to any updated rules, reducing the risk of penalties.

This automation saves time and minimizes human error, allowing advisors to focus on what truly matters: helping clients grow their assets with confidence.

Core Use Cases of AI in Wealth Management

AI plays a big role in wealth management today. It offers useful tools like robo-advisors and smart chatbots, making services faster and more effective for clients.

Robo Advisors for Automated Investments

Robo advisors use technology to manage investments automatically across various asset classes. They create investment plans based on the client's goals and risk level. Users answer questions about their finances and preferences.

Then, the robo advisor builds a portfolio using algorithms.

These tools offer low-cost access AI may revolutionize investment management by providing real-time Data insights generated by AI in wealth and asset management can significantly improve decision-making processes. and predictive analytics. They can adjust portfolios as markets change, ensuring they meet client needs over time in the financial services sector. Robo advisors provide personalized investment advice without requiring much human interaction.

This makes investing easier for many people.

AI-Driven Risk Assessment and Management

AI-driven risk assessment helps managers spot and evaluate risks quickly through advanced AI algorithms. It analyzes large amounts of financial data to find trends. This process is faster than traditional methods.

AI can assess market changes and predict potential losses. Using algorithms, it provides insights that help in decision-making, particularly through the application of AI algorithms.

Management can customize strategies based on these insights. Clients receive advice that suits their unique needs. This approach improves investment safety and boosts confidence among clients.

Understanding these tools leads to better planning for the future of wealth management. Next, we will explore how chatbots enhance client interaction in wealth management operations.

Tailored Tax Planning Using AI

Tax planning is not easy. Every year, people face many tax rules and changes. AI can help make this process simpler. With smart algorithms, AI analyzes financial data quickly. It can spot deductions or credits that clients might miss.

AI systems can guide personalized tax strategies based on individual needs. They look at income, expenses, and investments to create plans that fit well with a person's situation. This helps clients save more money and avoid mistakes during tax season.

Using AI in tax planning ensures accuracy and efficiency while making life easier for clients in managing their finances with innovative financial products.

Chatbots for Immediate Client Interaction

Chatbots play a big role in wealth management. They provide financial products tailored to individual client needs. immediate responses To client questions, AI can also provide more accurate and timely responses. This saves time for both clients and advisors. Clients can get answers to common issues 24/7 without waiting.

Many firms use chatbots to enhance their services.

These AI-driven tools help with tasks like checking account balances or scheduling meetings. They also gather information, making it easier for advisors to understand client needs.

Chatbots streamline communication and improve overall client satisfaction in an industry that relies on quick responses and clear interactions.

Benefits of AI in Wealth Management

AI brings many advantages to wealth management. It AI continues to boost efficiency in wealth management by automating routine tasks and improving accuracy. and cuts costs, allowing firms to serve clients better.

Increased Efficiency and Reduced Costs

AI in wealth management boosts efficiency and cuts costs. Automated systems handle many tasks faster than humans. This means less time spent on paperwork and more focus on client needs, enhancing wealth management operations.

Clients benefit from lower fees due to reduced operational costs. AI tools analyze vast amounts of financial data quickly, leading to better investment decisions. As a result, firms can serve more clients without increasing staff size, making wealth management accessible for everyone through improved management practices.

Improved Client Satisfaction Through Personalization

Personalization boosts client satisfaction in wealth management firms. Clients want advice that fits their needs. AI helps firms offer personalized investment advice. It analyzes financial data quickly.

This leads to better recommendations suited to each client.

Investors gain insights based on their goals and risk levels through AI solutions. Robo-advisors use algorithms for this purpose. They assess market trends and adjust portfolios accordingly. As a result, clients feel more valued and engaged with their investments.

Personalized services enhance their confidence in the firm, leading to stronger relationships and loyalty over time.

Enhanced Decision-Making with Data Insights

Improved client satisfaction through personalization leads to better investment outcomes in asset and wealth management. AI helps wealth managers make smarter decisions using data insights. It analyzes large amounts of financial data quickly.

This analysis reveals market trends and patterns that humans might miss.

AI-driven tools provide clear information for asset management. They suggest the best investment options based on current market changes, informed by AI use cases. Wealth managers can use these insights to guide clients effectively.

With accurate data at hand, decision-making becomes simpler and faster, benefiting both clients and advisors alike.

The Future of AI in Wealth Management

AI will help firms predict market trends and improve investment strategies for clients.

Predictions and Upcoming Trends

Machine learning continues to grow. It helps firms analyze financial data better and faster. Robo advisors play a bigger role in investment decisions within the industry, utilizing generative AI for personalized advice.

Many clients now prefer these automated services for their simplicity.

Upcoming changes include more personalized investment advice based on client needs. Advanced algorithms will predict market changes, helping managers respond quickly. The rise of chatbots means instant answers for clients about their investments.

These tools enhance client satisfaction and streamline processes in asset management.

How RIAs Can Leverage Poseidon for Sustainable Growth

Poseidon empowers RIAs to run operations more smoothly while keeping client relationships personal. With routine tasks handled automatically, teams can dedicate more time to meaningful, one-on-one interactions. This enables RIAs to foster stronger connections with clients and drive growth, all without sacrificing the personal touch that sets them apart.

Poseidon simplifies this process for RIAs, enabling them to expand their outreach effectively. This capability is essential for cultivating impactful relationships on a broader scale.

Conclusion

AI helps clients get personalized advice and makes use of AI models to optimize investment strategies. processes faster. Firms can leverage AI adoption to enhance their services and improve client satisfaction. Save money and increase your assets under management. while improving client care. The future of finance looks bright with AI at its side, transforming the wealth management industry.

More changes are on the way, promising even greater benefits ahead in financial products and services.

FAQs

1. What is AI in wealth management?

AI in wealth management refers to the use of artificial intelligence technologies to enhance investment strategies, manage portfolios, and provide personalized financial advice, especially through generative AI in wealth. This technology analyzes vast amounts of data to inform decision-making.

2. How can AI improve investment strategies?

AI improves investment strategies by analyzing market trends and predicting future performance. It helps identify opportunities for growth while minimizing risks through data-driven insights that human analysts may overlook.

3. What are some specific use cases for AI in wealth management?

Specific use cases include automated portfolio rebalancing, risk assessment models, and client profiling tools that tailor services based on individual needs. These applications help firms deliver better service efficiently.

4. What are the benefits of using AI in this field?

The benefits include enhanced accuracy in predictions, improved customer engagement through personalized interactions, and increased efficiency by automating routine tasks, all thanks to AI applications. As a result, firms can focus more on strategic planning and relationship building with clients.

![LinkedIn Marketing for Financial Advisors [2025 Guide]](https://cdn.sanity.io/images/l79olr63/production/725afc983946ebc799236fe213ff8b3001652c47-1232x928.webp)