Figuring out SEC fee rates can be confusing for financial advisors.

The Securities and Exchange Commission (SEC) uses these fees for different things, like running the agency.

This post will explain what these fees are and how they're set, making it easier to understand your costs.

What Is the SEC Fee?

The SEC fee is a charge on securities transactions. It's a small percentage fee applied to most securities sales to help fund the Securities and Exchange Commission's operations.

Definition and purpose

The SEC fee is a small amount that securities exchanges and brokers must pay to the Securities and Exchange Commission (SEC). This fee relates to the [Securities Exchange Act of 1934](https://www.govinfo.gov/content/pkg/COMPS-1885/pdf/COMPS-1885. pdf).

Its main goal is to cover costs for regulating equity markets and protecting investors. For example, every sale of a security on the New York Stock Exchange involves this fee.

Securities transactions, corporate control transactions, proxy solicitations, and repurchases of securities are some activities where SEC fees apply. Fees also help in overseeing public companies and other issuers' activities like registration of securities under [section 31 of the Securities Act](https://www.law.cornell.edu/cfr/text/17/240. 31).

This ensures markets stay fair for everyone involved.

How it applies to securities transactions

SEC fee rates impact most securities transactions. This means anytime shares are sold on national securities exchanges or over-the-counter markets, a fee is due. For example, if a financial advisor sells $1 million worth of securities, the SEC charges a fee of 27. 80 per million dollars of the sold securities.

These fees also apply to round turn transaction in security futures and covered sales occurring after the trade date but before the settlement date.

Every sale contributes to funding SEC's operations, ensuring fair and orderly markets.

Next, we look at how these fees change each year and when updates occur.

How SEC Fee Rates Are Determined

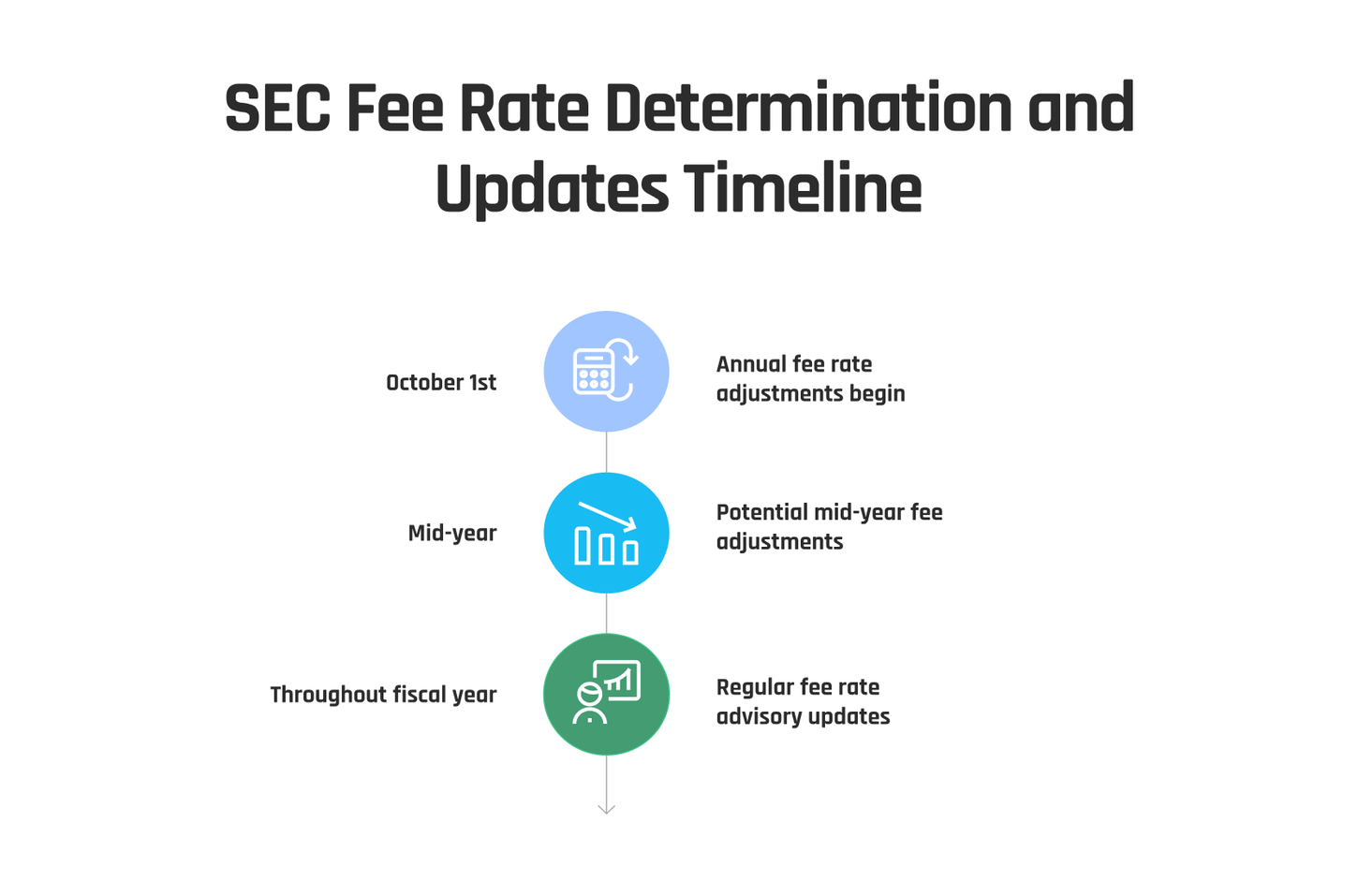

SEC fee rates are determined through annual adjustments and targeted collection amounts. The fee rate advisory updates keep the public informed about any developments relating to fees.

Annual adjustments and targeted collection amounts

Every year, the SEC sets fee rates. These adjustments make sure the SEC collects enough money to cover its budget. The budget is set by Congress. So, if they need more money for their work, fees might go up.

Targeted collection amounts help with this balance.

The SEC uses a formula to decide new fee rates. This formula looks at how many securities are sold and other market activities. Changes in fee rates usually start on October 1st or soon after that date if needed mid-year.

Fee rate advisory updates

The SEC regularly adjusts fee rates to balance collections and meet targeted collection amounts. The commission issues annual notices informing the public of any changes in fee rates. This ensures that brokerage firms and financial advisors remain informed about developments related to the assessment on security futures and securities markets.

The updates are crucial for financial advisors to accurately calculate fees paid under section B of the Securities Exchange Act of 1933. Moreover, these advisory notices are posted throughout the fiscal year so that advisors can stay updated on new rates and any further adjustments made by the SEC.

What Financial Advisors Pay in SEC Fees

Financial advisors pay SEC fees based on specific rates and calculations for each transaction, impacting their portfolios and transactions. The fee applies to the securities they sell or repurchase, with a set charge date for each type of transaction.

Typical fee rates and calculations

Understanding the typical SEC fee rates and how they are calculated is essential for financial advisors. The SEC adjusts these fees annually to meet its targeted collection amounts. Here is a simple breakdown of what financial advisors typically pay in SEC fees, and how these fees are calculated:

| Year | Fee Rate per $1,000,000 | Example Transaction ($) | SEC Fee ($) |

|---|---|---|---|

| 2022 | 22. 90 | 1,000,000 | 22. 90 |

| 2023 | 23. 10 | 1,000,000 | 23. 10 |

| Example | 2,000,000 | Depends on Year Rate |

This table shows how SEC fees could apply to a $1,000,000 and a $2,000,000 securities transaction. Advisors calculate these fees by multiplying the total dollar amount of the sale by the current fee rate, then dividing by 1,000,000. For a transaction worth $2,000,000, just double the fee shown for a $1,000,000 transaction in the corresponding year. These fees impact transactions and, by extension, investor portfolios, emphasizing the need for advisors to keep updated on SEC rate changes.

Impact on transactions and portfolios

SEC fees can affect financial advisors' transactions and portfolios. These fees are determined annually, and as of now, the rate stands at 27. 80 per $1,000,000 on security sales. Financial advisors need to factor these costs into their clients' investment decisions.

SEC fees may also impact portfolio performance because they directly affect transaction costs for buying and selling securities in the market.

Financial advisors typically calculate the SEC fee based on the value of securities sold or repurchased. This has a direct impact on their clients’ portfolios by influencing transaction costs associated with different types of securities.

Therefore, understanding SEC fee rates is crucial for financial advisors to make informed decisions about managing their clients’ investments.

Conclusion

In wrapping up, understanding SEC fees is crucial for financial advisors. These fees affect transactions and portfolios, so it's essential to grasp how they work. Stay informed about SEC fee rates since they can impact investment strategies significantly.

It's vital for financial advisors to stay updated on fee rate advisory announcements. In conclusion, keeping an eye on SEC fees is a fundamental part of managing clients' investments effectively.

FAQs

1. What are SEC fee rates?

SEC fee rates are charges applicable to the registration of securities with the Securities and Exchange Commission (SEC), including security futures transactions.

2. When does the SEC announce its fee rates?

The exchange commission announces its fees, such as transaction fees for over-the-counter markets, typically in October each year, but mid-year adjustments can also occur.

3. Are there any changes in these fees regularly?

While there may be changes due to a full year appropriation or other factors, they often remain unchanged. The public is kept informed of developments relating to this through further notices posted by the commission's division.

4. How do I stay updated about these changes?

You can stay up-to-date on all developments related to SEC fee rates by checking for notices posted by the Commission's division or from information released by the Congressional Budget Office.

5. Do these charges apply only under the Securities Act of 1933?

No, they also apply under other regulations like Investment Company Act and could even influence repurchase of securities among investment companies.