Thinking about changing your career to part-time financial advisor?

Many people are looking for ways to manage their money better. This post will guide you through the pros and cons of being a part-time financial advisor.

What Does a Part-Time Financial Advisor Do?

A part-time financial advisor helps people manage their money and reach their financial goals. They offer expert advice on investments, budgeting, retirement planning, and more. These advisors develop personalized financial plans for their clients.

They take time to understand each client's needs and life goals. Then, they suggest ways to improve their finances.

They also assess risks in investment portfolios and help with decision-making about finance. Working part-time allows these advisors to set their schedules around other commitments.

This flexibility can make the career appealing to many.

Pros of a Part-Time Financial Advisor Career

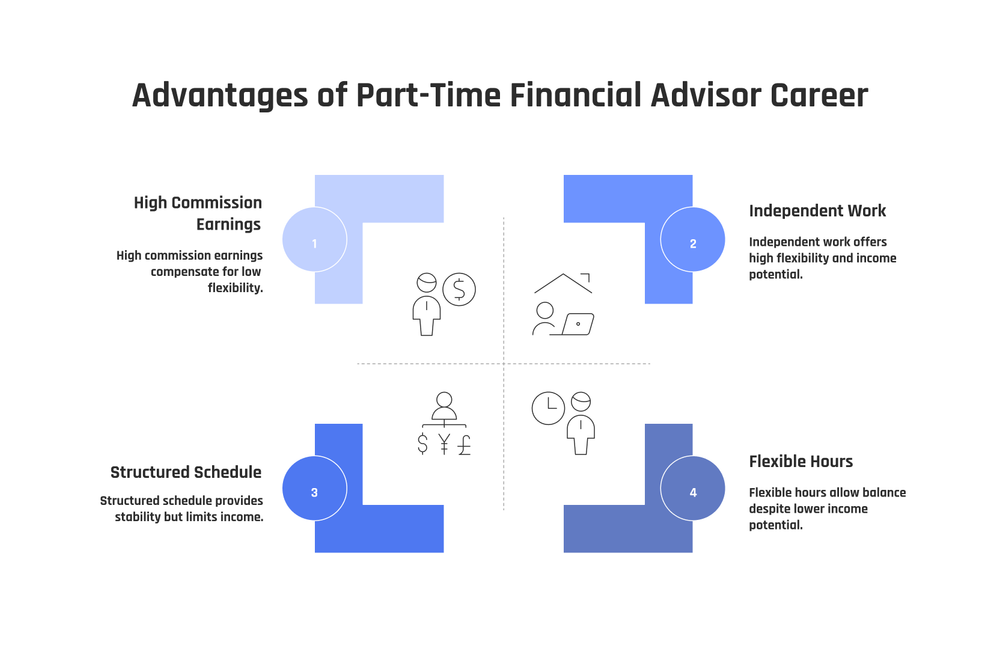

As a part-time financial advisor, you'll enjoy a flexible work schedule and the opportunity to help clients achieve their financial goals. This career also offers the potential for high income and gives you the ability to work independently.

Flexible Work Schedule

A flexible work schedule is a big benefit for part-time financial advisors. They can decide how many hours to work per week and when to meet with clients or do their tasks. This makes it easier for them to balance life and work.

They might choose to work early in the morning or late at night, whatever fits their lifestyle best.

Part-time allows more control over your schedule, making it easy to juggle other commitments.

This kind of flexibility also lets advisors take on other projects or spend more time learning new skills. Some may even have another job at the same time. Being able to work remotely is key here.

Advisors can reach out to potential clients and offer expert financial advice from anywhere, not just an office.

Opportunity to Help Clients Achieve Financial Goals

A flexible work schedule enables part-time financial advisors to dedicate more time to comprehending their clients' necessities. This intense study of personal ambitions aids them in creating exhaustive financial strategies.

These strategies aid individuals in accomplishing landmarks such as home purchase, education saving, or retirement planning.

By concentrating on individualized financial tactics, part-time advisors can propose customized counsel that suits each client's distinct scenario. They lead individuals through investment alternatives and risk control methods.

This assists clients in making well-informed decisions regarding their financial destiny. Through this committed aid, advisors become crucial in assisting others in realizing their aspirations.

Potential for High Income

Part-time financial advisors have the potential to earn a high income through commissions and fees. By offering comprehensive financial planning services, they can access a diverse range of investment opportunities, including 401(k) plans and risk management products.

With the right knowledge and skill set, part-time financial advisors can attract new clients, which is crucial for enhancing their income. Utilizing technology also aids in reaching more customers efficiently, thereby increasing earning prospects.

Overall, this career path presents an opportunity to generate significant income while working part-time hours.

Ability to Work Independently

As a part-time financial advisor, you are empowered to work autonomously. You have the freedom to determine your own schedule and tailor your workload to suit your preferences. This independence allows you to actively seek out clients, harness technology for outreach, and concentrate on specialized markets that resonate with your expertise and passions.

Moreover, working independently offers you the flexibility to juggle other commitments while still pursuing a satisfying career in financial advising. By engaging in strategic planning and taking the lead, you can adeptly navigate the intricacies of the industry and cultivate a thriving client base through ongoing prospecting efforts.

Cons of a Part-Time Financial Advisor Career

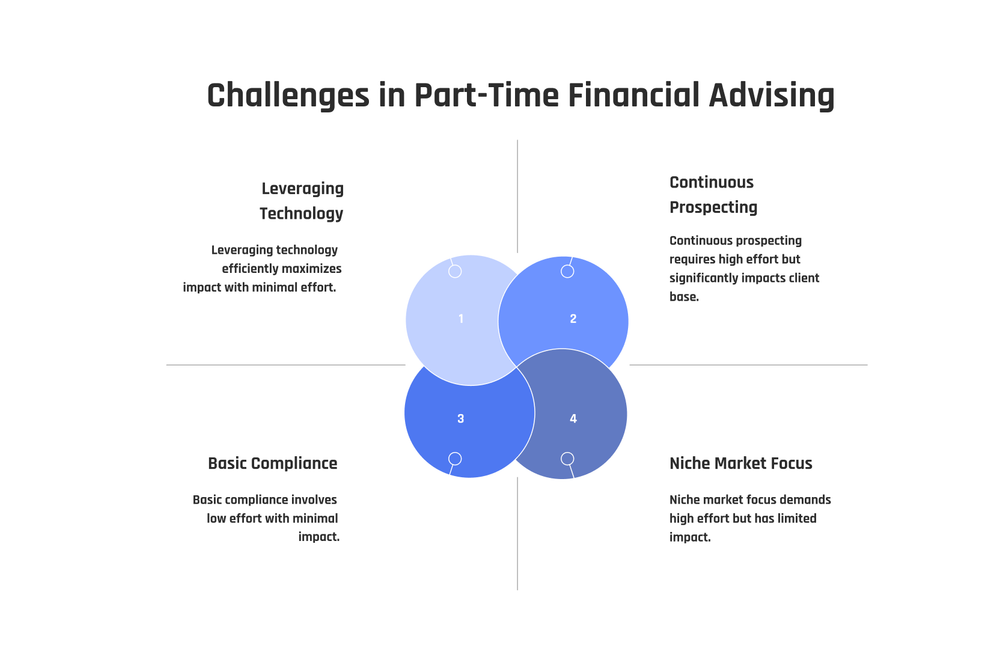

Difficulty Building a Client Base

Building a client base as a part-time financial advisor can be challenging. With many planners vying for clients, standing out is crucial. continuously prospecting is essential to attract new clients and grow your business.

Leveraging technology can aid in reaching potential clients efficiently, while focusing on niche markets could help you stand out amidst competition. Establishing trust and reliability with potential clients takes time but is vital for long-term success.

Looking for alternatives to traditional methods and adapting to the ever-changing market trends are key steps toward building a strong client base in the realm of part-time financial advising.

Understanding the intricacies involved in market risks and economic uncertainty will further guide one towards seeking more than just short-term gains when starting on this career path.

High Regulatory and Compliance Requirements

Part-time financial advisors encounter significant regulatory and compliance requirements. They are obliged to adhere to various regulatory standards, including obtaining licenses like Series 7 and Series 66 to sell financial products.

Comprehending and adhering to industry regulations necessitates a profound understanding of governing bodies such as FINRA and the SEC. Furthermore, a clear comprehension of fiduciary duty is imperative in furnishing clients with transparent, fitting advice within the confines of industry laws.

Financial advisors must also maintain ethical standards established by entities like CFP Board, ensuring their advice is in harmony with clients' best interests while fulfilling compliance obligations.

Beyond keeping abreast of constantly shifting policies from regulatory bodies, part-time financial advisors must allocate time to thoroughly document client interactions and investment recommendations.

Additionally, they bear the responsibility of navigating intricate legal frameworks surrounding investments, retirement accounts like 401(k)s, taxation rules pertaining to various financial products, insurance policies, and more.

Market Risks and Economic Uncertainty

Part-time financial advisors face market risks and economic uncertainty, which can impact their clients' investment portfolios. Fluctuations in the stock market or changes in interest rates can affect the value of investments, creating challenges for advisors to manage their clients' financial futures effectively.

Economic downturns may also make it harder to attract new clients or retain existing ones, impacting the potential income of part-time financial advisors in this field. It's crucial for part-time financial advisors to stay updated on market trends and economic indicators to help guide their clients through these uncertainties and mitigate any negative impacts on their investment strategies and financial goals.

Need for Continuous Prospecting

Continuous prospecting is crucial for part-time financial advisors. Finding potential clients and building a strong client base is essential for success. With high competition, diligent prospecting can help in securing long-term relationships with clients, leading to a steady income stream.

Utilizing technology and focusing on niche markets can aid in effective prospecting, helping part-time financial advisors overcome the challenge of building their clientele.

Regulatory requirements emphasize the need for continuous prospecting as it ensures compliance with industry standards and maintains ethical practices. Despite market risks and economic uncertainty, consistent efforts in prospecting allow part-time financial advisors to grow their business sustainably.

Understanding investment options and leveraging remote work opportunities are also key strategies that contribute to successful prospecting efforts.

Tips for Success as a Part-Time Financial Advisor

Utilize technology to reach clients effectively, and focus on niche markets for better client engagement. Read more about these tips in our blog.

Leverage Technology to Reach Clients

To reach clients effectively, part-time financial advisors can utilize technology tools like customer relationship management (CRM) software for managing client interactions. This enables them to maintain organized client data and track communication history seamlessly.

Moreover, using social media platforms and digital marketing can broaden their reach by targeting specific demographics, thus expanding their potential client base. Video conferencing tools also allow advisors to hold virtual meetings with clients, making it convenient for both parties while maintaining a personal connection.

In addition, incorporating online financial planning and investment platforms provides an accessible approach for clients to access services conveniently on their terms. These technological strategies help part-time financial advisors overcome time constraints and efficiently connect with diverse clients seeking comprehensive benefits such as retirement plans or portfolio management options.

Focus on Niche Markets

Transitioning from leveraging technology to reach clients, part-time financial advisors should concentrate on niche markets to enhance their success. By homing in on specific groups such as small business owners, millennials, or retirees, advisors can personalize their services to meet the distinct needs of these segments.

This targeted approach can aid in building a loyal client base and setting the advisor apart from larger firms. Employing strategic marketing efforts and personalized financial solutions aimed at these niche markets can significantly impact a part-time advisor's success in attracting and retaining clients.

Conclusion

Considering a part-time financial advisor career? It offers flexibility and the chance to help clients meet their financial goals. Plus, there's potential for high income and the ability to work independently.

Alternatively, it comes with challenges such as building a client base and handling market risks. To succeed, leverage technology, focus on niche markets, and stay proactive in prospecting.

Overall, while there are pros and cons to consider, being a part-time financial advisor could be a rewarding venture if approached strategically.

FAQs

1. What is a part-time financial advisor job?

A part-time financial advisor job involves providing personal financial advice to clients on a less than full-time basis. This could involve tasks like helping with 401(k) plans or teaching financial literacy.

2. Do I need any special training or degree to become a part-time financial advisor?

Most planners, including part time ones, typically have at least a bachelor's degree and some form of certification such as being a certified financial planner. Employers often provide the first step in training.

3. Can I start my own business as a part-time financial advisor?

Yes, you can! Many personal financial advisors start their own businesses offering services like 401 k support and building cross-functional teams for companies.

4. How does the pay compare between full time and part time jobs in this field?

Part time jobs generally don't pay as much as full time roles due to fewer hours worked but it depends on your client base and how many hours you are willing to work.

5. Are there opportunities for career growth in this field if I am interested only in working part time?

Yes, even working part time can offer room for growth through expanding your client base or improving skills like internal team coordination and mastering complex tasks such as creating advanced level of financial modeling.