Many financial advisors want to stand out in finance. The FMVA certification helps with that. This blog will show how the certification boosts skills and careers. Keep reading to learn more.

Key Skills Gained Through FMVA Certification

FMVA certification equips financial advisors with advanced financial modeling and valuation expertise. It also enhances their proficiency in using Excel for budgeting and forecasting, making them more adept in analyzing and interpreting financial data.

Financial modeling and valuation expertise

Learning financial modeling and valuation gives people skills to understand businesses better. They learn how to create models that show how a business can make money in the future.

This skill is key for jobs in investment banking, private equity, or corporate finance. People use different tools like discounted cash flow to value companies. This means they figure out what a company is worth based on the money it will make later.

Valuation expertise helps in knowing a company's true value. It uses data from financial statements and other reports to see if a business is good to invest in or not. For example, someone might look at an income statement to see profits or losses over time.

They also might compare this with other companies to find the best investment opportunities. This skill is important for roles like valuation analyst or equity research analyst where making smart choices about investments matters a lot.

Advanced Excel proficiency

After learning about financial modeling and valuation expertise, you also need advanced Excel proficiency. This skill lets you handle complex data easily. You can use Excel for various tasks like creating charts, analyzing trends, and making predictions.

The Corporate Finance Institute emphasizes this skill in the FMVA program. Students learn to use Excel for sensitivity analysis, scenario analysis, and handling historical data.

Excel skills are vital for anyone in finance. They allow professionals to perform variance analysis and calculate weighted average cost efficiently. These abilities help in making better financial decisions.

Both employers and clients value these skills highly. So, getting good at Excel can open new doors in your finance career.

Budgeting and forecasting capabilities

Moving from advanced Excel skills, FMVA certification also teaches financial planners how to handle budgeting and forecasting. This part is key for advising companies on their future money plans.

It's about looking at past finances and predicting future ones. People learn to use numbers to make smart guesses about what might happen next with money.

This skill helps finance professionals advise businesses on how much they can spend or need to save. They look at income statements and other financial reports. Then they figure out the best ways for a company to grow money-wise in the future.

This planning is vital for any business that wants to do well over time.

Competitive Advantages of FMVA for Financial Advisors

FMVA certification opens up new career opportunities and improves earning potential for financial advisors, giving them a competitive edge in the industry. The program emphasizes practical skills like financial modeling and valuation expertise, advanced Excel proficiency, and budgeting and forecasting capabilities to help professionals succeed in the ever-evolving finance industry.

Enhanced career opportunities

FMVA certification offers financial advisors enhanced career opportunities. It opens doors to roles like investment analyst, financial manager, and corporate finance specialist. This credential also expands networking opportunities and increases earning potential for professionals in the finance domain.

With the strong foundation in financial analysis gained through this certification, candidates are well-equipped to take on higher-level roles within the industry.

Increased earning potential

For financial advisors, obtaining FMVA certification can lead to increased earning potential. On average, FMVA professionals have reported a salary increase of 40% after completing the certification.

This significant increase in earnings is attributed to the high demand for experts with advanced financial modeling and valuation skills. The FMVA program equips professionals with the expertise needed to excel in finance and investment roles, leading them to access higher-paying career opportunities in fields like investment analysis, asset management, and corporate finance.

Furthermore, as companies increasingly value specialized qualifications such as FMVA certification, this credential can directly translate into higher salaries and bonuses for financial advisors.

Throughout their careers, those with an FMVA certificate also secure more prestigious roles that offer substantial compensation packages due to their enhanced skills and competitive advantage over non-certified professionals.

Therefore, dedicating the time to acquire an FMVA certification not only enhances one's professional competence but also reveals greater opportunities for increased financial rewards within the industry.

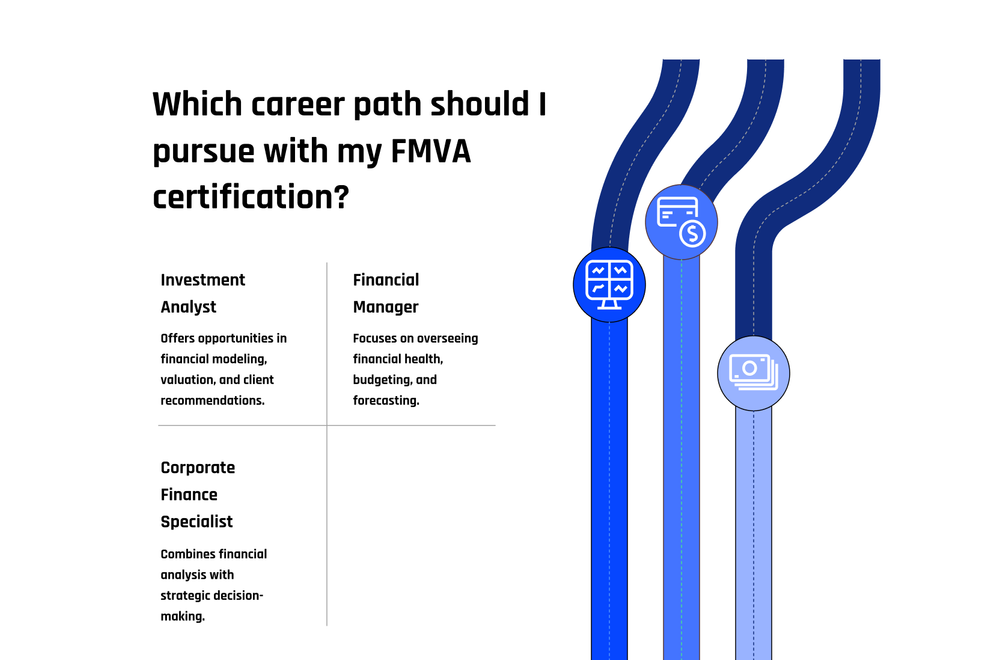

Career Paths for FMVA-Certified Professionals

FMVA certification opens doors to roles like investment analyst, financial manager, and corporate finance specialist. These positions offer exciting opportunities to apply advanced financial skills in real-world scenarios and make tangible impacts on businesses' success.

Investment analyst

Financial advisors who hold an FMVA certification can pursue various career paths. One of these is becoming an investment analyst. This role involves evaluating investment opportunities, analyzing financial data, and making recommendations to clients or employers based on their findings.

Investment analysts need strong financial modeling and valuation skills, which are core aspects of the FMVA certification. With this qualification, they can also gain advanced Excel proficiency and expertise in budgeting and forecasting - essential for excelling as an investment analyst in the competitive financial landscape.

As an investment analyst with FMVA certification, professionals can become more attractive to potential employers due to their enhanced skill set. They may find themselves well-equipped to work within corporate finance teams or even for investment banks.

Moreover, this credential opens up doors towards higher earning potential and offers promising opportunities for career growth within the financial planning and business valuation realm.

Financial manager

FMVA certification equips financial professionals with the skills essential for various career paths, including becoming a financial manager. With a deep understanding of financial modeling, valuation, and advanced Excel proficiency, FMVAs are well-prepared to navigate the challenges of corporate finance.

This certification also allows individuals to improve their budgeting and forecasting capabilities, making them well-suited for overseeing an organization's financial health and performance.

Financial managers with FMVA certification have increased earning potential and access to advanced career opportunities in the ever-changing realm of corporate finance.

The FMVA program focuses on real-world problems and prepares professionals for customized roles towards risk management, investment analysis, or specializing in diverse valuation methodologies within corporate finance.

As such, budding financial analysts seeking more than just traditional accounting expertise are encouraged to consider this certification as they delve into the heart of the finance world.

Corporate finance specialist

Becoming a corporate finance specialist after completing the FMVA certification opens doors to various career opportunities. This includes roles like financial manager, investment analyst, or even an investment banker.

With these positions comes the potential for high earning as well as increased professional growth. The skills gained through the program, such as financial modeling and valuation expertise, advanced Excel proficiency, and budgeting and forecasting capabilities are highly sought after in this field.

Professionals with FMVA certification have a competitive edge due to their strong foundation in financial analysis and strategic decision-making. They can navigate different valuation methodologies effectively which is crucial in the ever-evolving realm of corporate finance.

Ultimately, being an FMVA-certified specialist equips individuals with practical skills tailored towards real-world problem-solving within the complexities of financial performance and valuation analysis.

Conclusion

Financial advisors can greatly benefit from acquiring an FMVA certification. It provides them with essential financial modeling and valuation skills, enhancing their career opportunities and earning potential.

This certification enables them to pursue roles such as investment analyst or financial manager in the finance industry. In summary, FMVA certification is a valuable asset for financial advisors aiming to advance their careers in the competitive financial sector.

FAQs

1. What is the FMVA certification?

The Financial Modeling Valuation Analyst (FMVA) certification is a professional program offered by the Corporate Finance Institute. It helps financial advisors learn key financial ratios and modeling.

2. How does one study for the FMVA certification?

You can self-study at your own pace using online courses, optional prep courses, and study materials provided in the training program.

3. What does the FMVA course include?

The course includes core and elective courses on topics like solar financial modeling. There's an end of course assessment after each module, and a final exam to earn the certification.

4. Is getting an FMVA worth it compared to other certifications like Chartered Financial Analyst?

Yes, it is! The real-world problems tackled in this program give you practical skills that are beneficial for career advancement, making it just as valuable as other financial certifications.

5. How much does it cost to get certified?

For further details about costs including full immersion subscription or individual modules fees, please check out their official website since prices may vary.

6. Who should consider this certification?

Investment bankers or anyone looking forward to enhancing their knowledge in financial modeling valuation should consider getting an FMVA Certification.