Finding out about rules for financial advisors can be hard. A fact to know is that the Investment Advisers Act of 1940 sets a big part of these rules. This guide will show you how to follow these rules easily.

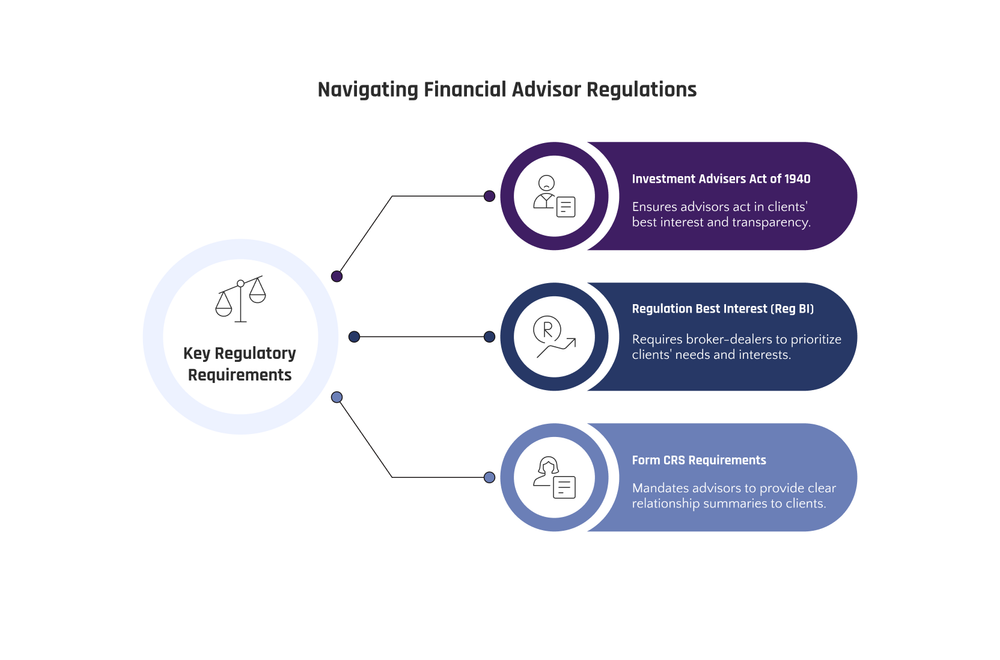

Key Regulatory Requirements for Financial Advisors

Financial advisors must comply with regulations such as the Investment Advisers Act of 1940, Regulation Best Interest (Reg BI), and Form CRS Requirements to ensure they meet legal standards.

Adhering to these key regulatory requirements safeguards client assets and upholds the integrity of financial planning services.

Investment Advisers Act of 1940

The Investment Advisers Act of 1940 sets rules for financial advisors. It makes sure they act in the best interest of their clients. This law requires investment advisers to register with the Securities and Exchange Commission (SEC).

They must follow strict guidelines about how they give advice, handle client assets, and keep records. Advisors need to share any possible conflicts of interest with their clients.

This Act demands transparency and honesty from advisors.

Under this act, advisors have a duty to choose investments that suit their clients' needs. They also must treat all client information as private unless given permission to share it.

The SEC watches over these advisers to make sure they follow the law. If advisors break these rules, they can face serious penalties.

Regulation Best Interest (Reg BI)

Regulation Best Interest (Reg BI) is a rule from the SEC. It makes sure broker-dealers put their clients' needs first. They must act in the best interest of their clients when recommending any investment strategy or product.

Broker-dealers also need to share conflicts of interest and provide clear reasons for their advice.

This rule helps protect investors by making financial advisors more responsible. Advisors have to check that their advice fits each client's goals, situation, and risk level. This means they can't just sell something because it pays them a good commission.

Form CRS Requirements

Form CRS is a rule that the SEC set up for financial advisors and broker-dealers. They must give a short document to their clients that explains if they are acting as an advisor or a broker.

This document, known as a relationship summary, helps clients understand the type of advice, fees, and conflicts of interest that might arise. It also guides them on how to raise complaints or concerns about their investment advisers.

One main goal is to make sure clients can easily compare different financial professionals. The form lists services offered, legal standards of conduct, and how they make money from the advice they provide.

Advisers need to update this form regularly and give it to new clients during the first meeting.

Essential Compliance Practices

Establish internal compliance policies and procedures to ensure adherence. Accurately document and maintain records for thorough oversight. Independently review compliance to maintain integrity.

Create Internal Compliance Policies and Procedures

To establish and maintain effective compliance within financial advisor regulations, it is crucial to develop internal policies and procedures. This helps ensure adherence to regulatory requirements and ethical standards. Here's a comprehensive guide to creating such policies:

-

Clearly define the roles and responsibilities of all staff members involved in compliance efforts, including financial planners, investment advisers, and certified financial planners.

-

Develop a code of conduct outlining expected behavior, ethical standards, and professional obligations for everyone within the advisory firm.

-

Implement procedures for identifying and managing potential conflicts of interest that may arise when providing investment advice or managing client assets.

-

Establish protocols for handling client data with strict confidentiality and security measures to protect sensitive information from unauthorized access.

-

Regularly review and update compliance policies to align with any changes in federal regulations or industry best practices.

Maintain Accurate Documentation and Record-Keeping

To maintain compliance as a financial advisor, accurate documentation and record-keeping are crucial. Here's how you can ensure this:

-

Document all client interactions, including meetings and communications, to comply with regulatory requirements.

-

Keep thorough records of investment recommendations, transactions, and any advice provided to clients for audit purposes.

-

Retain complete copies of marketing materials and disclosures used for promoting investment products or advisory services.

-

Maintain records of licensing requirements for investment adviser representatives and other professionals within the firm.

Ensuring accurate documentation and record-keeping is vital to meet regulatory standards and foster trust with clients.

Conduct Independent Compliance Reviews

To ensure adherence to regulatory requirements and maintain a robust compliance framework, financial advisors need to conduct independent compliance reviews.

-

Regular Internal Audits: Perform periodic audits to assess the effectiveness of internal compliance policies and procedures.

-

Identify Potential Issues: Scrutinize records and documentation to identify any potential compliance issues or discrepancies.

-

Evaluate Training Programs: Assess the adequacy of training programs to ensure that employees are well-versed with regulatory requirements.

-

Review Client Interactions: Examine client interactions and transactions to verify compliance with disclosure and suitability requirements.

-

Address Non-Compliance: Develop corrective action plans for addressing any identified non-compliance issues promptly.

-

Document Findings: Maintain comprehensive documentation of review findings, including any remedial actions taken.

These independent reviews play a crucial role in upholding transparency, integrity, and ethical standards within advisory firms while safeguarding investor interests.

Leveraging Technology for Compliance

Using tech for compliance? Automate monitoring, enhance data security. Learn more about it in the full blog!

Automate Monitoring and Reporting

Automating monitoring and reporting is crucial for financial advisors to stay compliant with regulations. Utilizing technology helps in tracking activities and generating required reports, ensuring accuracy and timeliness.

By leveraging software, financial advisors can efficiently monitor transactions, manage client accounts, and promptly identify any potential compliance issues. This not only saves time but also enhances overall operational efficiency, enabling a proactive approach to regulatory adherence.

This streamlined process reduces the risk of errors and ensures comprehensive oversight over regulatory requirements. Automated monitoring and reporting systems can help in maintaining detailed records of interactions with clients, investment strategies employed, as well as periodic performance reviews - all essential elements to demonstrate compliance with regulatory standards.

Enhance Data Security and Privacy Measures

Improve data security by using encryption and authentication tools, which help in protecting sensitive financial information from unauthorized access. Implement regular security audits to identify and fix vulnerabilities that could expose client data to risks.

Secure client communication with encrypted emails and secure file-sharing platforms, ensuring that only authorized personnel can access confidential documents.

Be compliant with data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), safeguarding clients' personal information.

Restrict access to sensitive financial data only to authorized employees regularly trained on privacy best practices. Utilize advanced cybersecurity measures such as multi-factor authentication and intrusion detection systems to fortify network defenses against potential breaches.

Staying Updated with Regulatory Changes

Stay updated on changes in financial regulations through regular training and monitoring updates from regulatory authorities to ensure compliance. Dive deeper into this topic by reading the full blog post.

Regular Training and Education

Financial advisors should consistently pursue regular training and education to stay updated with regulatory changes and developments in the financial industry. This is essential for staying compliant and informed about best practices. Here are practical ways to integrate regular training and education:

-

Participate in Industry Seminars and Workshops: Engage in seminars and workshops held by regulatory authorities or industry experts.

-

Pursue Professional Certifications: Seek relevant certifications such as CFP, which demonstrates dedication to professional growth in the field of financial advising.

-

Enroll in Continued Education Programs: Join continued education programs that offer insights into new regulations, compliance strategies, and evolving best practices.

-

Organize Internal Training Sessions: Facilitate internal training sessions within your firm to educate staff on the latest regulatory requirements and industry trends.

-

Stay Informed by Subscribing to Industry Publications: Remain updated by subscribing to industry publications that provide insights on changing regulations, compliance standards, and market trends.

These actions will help financial advisors maintain a proactive approach towards staying knowledgeable and compliant within their practice, ultimately improving their ability to serve clients effectively while adhering to regulatory expectations.

Monitor Updates from Regulatory Authorities

Staying informed about updates from regulatory authorities is crucial in the financial advisory realm, ensuring compliance with the latest rules and standards. Here's why it matters:

-

Changes in Regulations: Regulatory authorities frequently update rules and standards that may impact financial advisors and their clients.

-

Implementation Considerations: Understanding how new regulations affect operations and client interactions is essential for smooth implementation.

-

Client Protection: Being aware of regulatory changes helps in safeguarding clients' interests and maintaining transparency in financial dealings.

-

Training Needs: Identifying areas where training or educational programs are necessary to ensure adherence to updated regulations.

-

Proactive Adaptation: Monitoring updates allows for proactive adjustment of internal policies and procedures to align with current regulatory requirements.

-

Compliance Assurance: Regular monitoring ensures that the business remains compliant, avoiding any potential penalties or legal issues.

By staying informed of regulatory updates, financial advisors can uphold their professional standards and provide better service to their clients while remaining legally compliant with industry regulations.

Conclusion

Financial Advisor Regulations can seem complex, but it's crucial for financial advisors to adhere to them. Compliance with regulations such as the Investment Advisers Act of 1940 and Regulation Best Interest is non-negotiable.

Leveraging technology for compliance and staying updated with regulatory changes are pivotal in today's dynamic financial landscape. By embracing these guidelines, financial advisors can navigate their responsibilities effectively while ensuring the best outcomes for their clients.

FAQs

1. What does the term "financial advisor regulations" mean?

Financial advisor regulations refer to federal laws and rules set by state securities regulators. These govern investment counselors, including state registered investment advisers and broker dealers.

2. Who needs to comply with financial advisor regulations?

Those who must comply include asset managers, portfolio managers, wealth managers, private funds operators, and those in charge of mutual funds. Investment companies are also bound by these rules.

3. Why is compliance with financial advisor regulations important?

Compliance ensures that advisors act in the best interest of their clients while providing advice on securities transactions. It helps maintain trust in our securities markets.

4. What kind of written notices do financial advisors need to provide under these regulations?

Advisors must provide a complete copy of Form ADV which includes material facts about their services and fees. They may also need to give a brochure supplement detailing their professional designations.

5. How does compensation affect an advisor's regulatory obligations?

If an advisor receives compensation for advice or has discretionary authority over client assets, they fall under stricter regulation from both federal law and state regulator bodies.

6. Are there specific written policies required for financial advisors?

Yes, certain policies like best execution practices are mandatory for all advisors managing investments on behalf of the general public.