Getting the right insurance is key for financial advisors. E&O insurance helps protect against errors and omissions. This guide will show how this coverage works and why it matters for your business.

What is E&O Insurance for Financial Advisors?

E&O insurance for financial advisors is a type of professional liability insurance. It helps protect advisors from claims made by clients for inadequate work or negligent actions. If a financial advisor makes a mistake or forgets something important, this insurance can cover the legal costs and any settlements.

This means it covers both errors (mistakes) and omissions (things left out). Without it, financial advisors could pay these costs out of pocket.

E&O insurance offers peace of mind to both financial advisors and their clients, knowing that if something goes wrong, there's protection in place.

Financial professionals face many risks while giving advice on investments or planning finances. Errors and omissions insurance helps them focus on their work without worrying about possible lawsuits.

Each policy has different terms so they need to choose one that fits their needs well. This includes knowing what situations are covered and how much the policy pays for defense costs or settlements.

Key Coverage Areas of E&O Insurance

E&O insurance for financial advisors covers:

-

Professional negligence

-

Errors in financial advice or planning

-

Misrepresentation and failure to disclose conflicts

Professional negligence

Professional negligence happens when financial advisors fail to perform their duties well, causing harm to their clients. This can include giving wrong advice or not following a client's wishes.

If a client sues for these mistakes, E&O insurance covers the costs.

This insurance helps pay for legal expenses and any money owed to the client if they win the case. It protects financial planners from losing a lot of money due to errors in their work.

Errors in financial advice or planning

E&O insurance for financial advisors covers errors in financial advice or planning. This means if a financial advisor gives the wrong advice, the insurance can help cover legal fees and damages.

For example, if an advisor recommends an investment that leads to big losses for a client, this insurance acts as protection.

Errors in financial advice or planning are key areas where E&O insurance provides coverage.

This part of E&O insurance helps maintain trust between clients and their advisors. It ensures that mistakes don't end up costing both parties huge amounts of money.

Misrepresentation and failure to disclose conflicts

When a financial advisor fails to disclose conflicts of interest or misrepresents information, it can lead to legal claims. E&O insurance protects financial advisors from the costs associated with these situations.

This coverage ensures that financial advisors are protected when clients claim they suffered financial losses due to misrepresentation or undisclosed conflicts.

E&O insurance for financial advisors specifically covers instances where advisors fail to disclose potential conflicts of interest and misrepresent information. It is vital for protecting both the advisor's reputation and finances in case of legal claims related to these scenarios, reducing the risk and potential impact on the business.

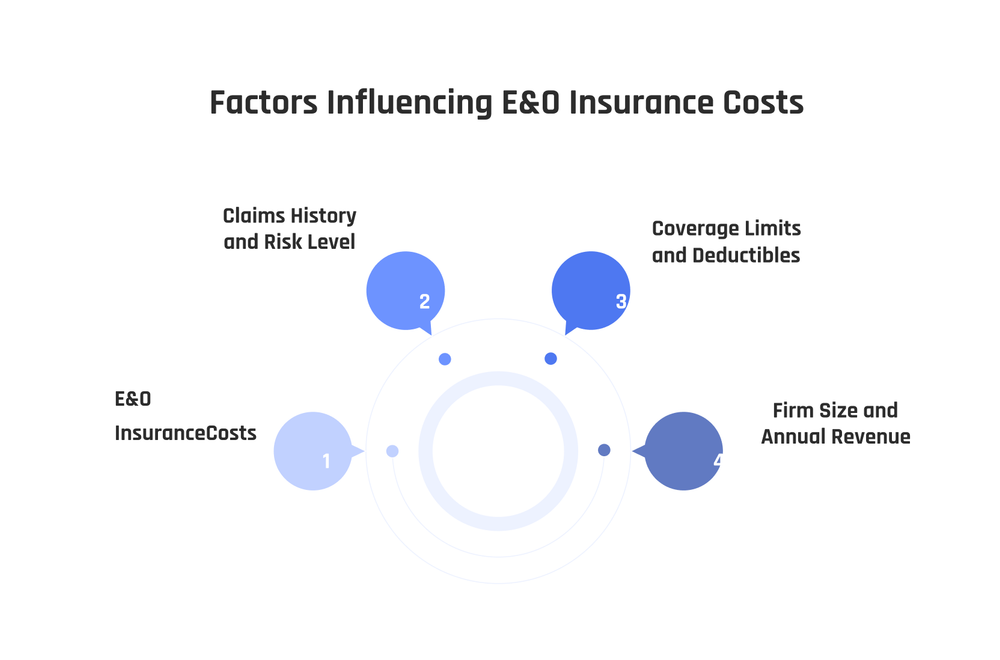

Costs of E&O Insurance

E&O insurance costs include annual premiums and deductibles. To learn more, read on about managing financial risks as a financial advisor.

Annual premiums

Annual premiums for E&O insurance vary based on factors like the size of the firm, coverage limits, and services offered. On average, financial advisors can expect to pay between $500 to $1,000 per year for a policy with a $1 million coverage limit.

However, larger firms with more employees and higher coverage limits can see annual premiums exceeding $5,000 to $10,000.

Insurance companies also consider the state where the business operates as different states require varying levels of insurance protection. Seeking multiple quotes from different insurance providers is advisable to find the best fit for your needs without overpaying.

Deductibles

The deductible is the amount you pay out of pocket before your E&O insurance begins to cover a claim. Opting for higher deductibles can result in lower premiums, while opting for lower deductibles means higher premiums.

For instance, selecting a $5,000 deductible may lead to an annual premium of $750, while a $10,000 deductible could reduce that to $500 annually. When considering the deductible for your E&O insurance policy, it's vital to assess the potential cost savings against the financial impact you might experience if you have to pay a high deductible after filing a claim.

Exclusions in E&O Insurance Coverage

Limitations in E&O insurance coverage are circumstances or incidents not encompassed by the policy. Typical limitations involve deceitful acts, deception, illegal activity, and deliberate misconduct.

Moreover, claims stemming from bodily harm or property destruction are usually exempted from E&O insurance. Another pivotal limitation pertains to losses associated with cyber breaches or data theft, unless explicitly included in a distinct cybersecurity insurance policy.

It's crucial to thoroughly examine the limitations of an E&O policy to grasp which risks may not be included.

Tips for Choosing the Right E&O Insurance Policy

-

Evaluate the annual premiums and deductibles to make sure they align with your budget and risk tolerance.

-

Search for a policy with separate limits for different liability claims, such as bodily injury and property damage.

-

Confirm if the policy covers essential risks, including data breaches and employee theft, to protect your financial institution.

-

Carefully review the policy language to understand the retroactive date and policy period to avoid coverage gaps.

-

Look for a tailored E&O insurance that supports the complexities of the ever-evolving financial advisors' realm.

Conclusion

As a financial advisor, obtaining E&O insurance is essential to safeguard yourself and your business from potential risks. Professional negligence, mistakes in advice or planning, and omission of conflicts are some of the areas addressed by this insurance.

Evaluating the costs, coverage exceptions, and suggestions for choosing the appropriate policy are crucial measures when looking for E&O insurance. Making an informed choice about this insurance is crucial for effectively managing risks in the ever-evolving world of financial services.

FAQs

1. What is E&O insurance for financial advisors?

E&O insurance, short for Errors and Omissions Insurance, provides coverage for registered investment advisors when a client holds them responsible for a service they provided or failed to provide.

2. How does E&O insurance work in the context of professional services like financial planning?

Just like commercial property insurance protects physical assets, E&O insurance safeguards financial institutions against claims arising from their professional services. It covers attorney fees and other costs associated with a covered claim.

3. Is it worth getting an E&O Insurance as an investment advisor?

Yes! For any registered representative offering financial planning advice, having this type of protection can be invaluable in case of allegations such as negligence or misrepresentation.

4. Are there additional protections that accompany E&O Insurance?

Yes! Some policies may include cyber insurance to protect against social engineering attacks while others might offer fidelity bonds providing coverages against employee dishonesty.

5. Does every insurance company offer the same kind of coverage under E & O Insurance?

No two companies are alike; therefore, each policy differs slightly depending on the specific needs and risks associated with your role as a Financial Advisor.