Figuring out the cost of equity can be tough. It's how much profit your equity investors expect. This blog will show easy ways to calculate cost of equity and why it matters. Keep reading to learn more!

What is Cost of Equity?

Moving forward from the introduction, cost of equity is what a company pays its shareholders for their investment risk. This is important because it helps companies understand how much reward investors expect.

Investors put money into a company hoping to get more back in the future. The cost of equity shows how much return they want.

Calculating this isn't simple. It involves factors like market risk and expected return on investment. For any business wanting to raise capital through equity financing, knowing this cost is key.

It represents the earnings needed to meet shareholder expectations without paying out dividends directly from cash flows or profits.

Key Variables in Cost of Equity Calculation

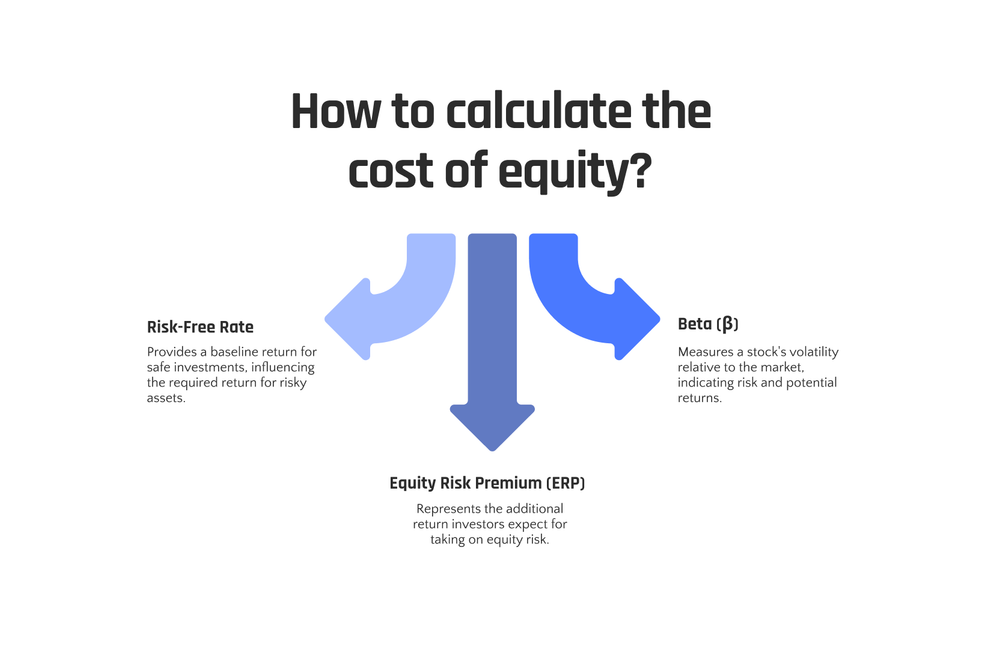

In Cost of Equity Calculation, we look at the Risk-Free Rate, Beta (β), and Equity Risk Premium (ERP). These factors help determine the return investors expect for taking on the risk of investing in a particular company's stock.

Risk-Free Rate

The risk-free rate is what you get from the safest investments, like government bonds. Think of it as the minimum return investors want for any investment. Since these bonds are so safe, their return sets a base for comparing other investments.

For example, U.S. Treasury bills are often used to find this rate in America.

This rate matters because it helps figure out how much more return an investor should ask for risky assets, like stocks. It's key in calculating the cost of equity and influences decisions on where to put money.

Without knowing the risk-free rate, it's harder to judge if an investment is worth its risk compared to just keeping money in something super safe.

Beta (β)

Beta (β) functions as a metric for a stock's volatility when compared to the market as a whole. A beta exceeding 1 signifies that the stock demonstrates more movement than the market.

Conversely, a stock with a beta of less than 1 indicates less movement than the market. For instance, a 1. 5 beta implies that for each 1% fluctuation in the market, the stock adjusts by 1. 5%.

This tool is used by investors to evaluate systematic risk.

Investors often perceive stocks with high beta as having a higher risk, yet they also present opportunities for substantial returns. Those desiring stability might find stocks with lower beta appealing.

By examining the historical performance of a particular company, along with the trends in its sector, investors can forecast how future market changes may impact its price. This renders beta a decisive factor when determining equity investments within the configuration of a portfolio.

Equity Risk Premium (ERP)

The Equity Risk Premium (ERP) is an essential component in calculating the cost of equity. It represents the additional return that investors expect as compensation for the risk associated with investing in stocks over risk-free investments.

This premium is derived from historical data and reflects the anticipated performance of the stock market relative to a risk-free investment. Essentially, it signifies the extra return investors demand for bearing the uncertainties of equity investments.

Equity Risk Premium (ERP) is crucial as it compensates investors for taking on the additional risk associated with investing in stocks.

Methods to Calculate Cost of Equity

Calculate Cost of Equity using CAPM and DCM models. Read more about these methods in the blog.

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) aids in computing the cost of equity based on risk and return. It takes into account the risk-free rate, β (beta), and equity risk premium to assess expected returns.

The model measures systematic risk using beta, which illustrates the stock's volatility in comparison to the market. By including the market risk premium and risk-free rate, a more precise depiction of expected returns is obtained.

Utilizing CAPM can be beneficial because it provides a simple way to estimate the cost of equity by integrating essential factors such as beta and the overall risks and returns of the market.

This practical approach assists in establishing an appropriate return for investors, considering their risk tolerance level, and offers valuable insights for making investment decisions.

Dividend Capitalization Model (DCM)

The Dividend Capitalization Model (DCM) assesses the equity cost by considering a company's anticipated dividends. It utilizes the future dividend payment and discount rate to compute the current value of forthcoming dividends.

This model proves particularly valuable for firms with a track record of consistent dividend payments and foreseeable growth rates, facilitating a more precise estimation of their equity cost.

One crucial consideration in DCM is the assumption of perpetual dividends, which may not be feasible for all companies, thus limiting its applicability. When transitioning to the comparison of "Cost of Equity vs.

Cost of Debt," comprehending the distinctions between these models becomes essential.

Cost of Equity vs. Cost of Debt

Comparing cost of equity and cost of debt shows big differences. Here's a quick look:

| Aspect | Cost of Equity | Cost of Debt |

|---|---|---|

| Definition | Return required by shareholders. | Interest paid on debt. |

| Risk | Higher, due to equity position in bankruptcy. | Lower, creditors have claim over assets. |

| Calculation | Uses CAPM or DCM. | Based on interest rates. |

| Cost | Generally higher. | Often lower, tax-deductible. |

| Impact on Company Value | Can increase if managed well. | Excessive debt can lower value. |

Cost of equity involves more risk but can lead to greater rewards. Cost of debt is cheaper but too much can harm a company. Now, let's move to how cost of equity fits into the bigger picture with WACC.

Cost of Equity and WACC

The Cost of Equity plays a pivotal role in the calculation of the Weighted Average Cost of Capital (WACC). It signifies the return that investors demand for holding a company's stock.

When calculating WACC, Cost of Equity is used to evaluate the cost of funding from equity financing. This is crucial as it determines the expected returns shareholders anticipate in exchange for their investment and risk.

In computing WACC, integrating Cost of Equity with Cost of Debt is essential because it reflects both debt and equity financing costs, offering a comprehensive view of the overall cost of capital.

Put simply, comprehending the Cost of Equity aids companies in assessing whether potential investments or projects will yield returns higher than what their investors could anticipate elsewhere in the market.

Common Challenges in Estimating Cost of Equity

Determining the cost of equity presents several common challenges. One challenge involves accurately establishing the risk-free rate, which acts as a benchmark for expected stock returns.

Another difficulty is precisely estimating beta (β), which reflects a stock's volatility in comparison to the broader market. Furthermore, assessing the equity risk premium (ERP) demands thorough consideration of historical data and future projections.

Furthermore, factoring in company-specific risks adds further intricacy to the calculation process.

In addressing these intricacies, financial analysts encounter complex situations when assessing investment opportunities and firm valuation. The fluctuating nature of these factors demands careful attention to detail in accurately estimating the cost of equity.

Practical Applications of Cost of Equity

After overcoming the challenges in estimating cost of equity, companies apply it for crucial decisions. Evaluating investment opportunities and capital budgeting are key areas where the cost of equity comes into play.

It helps in determining the required rate of return for potential projects or new investments, guiding companies towards optimal investment choices. In addition, when a company wants to assess its valuation or growth prospects, understanding the cost of equity is essential.

This informs their decision-making process and ensures that they allocate resources efficiently based on future cash flows and expected market returns.

In corporate finance, the cost of equity is also used for figuring out a company’s specific risk as part of its capital structure evaluation. For instance, if a pharmaceutical company plans to initiate new research ventures or expand its operations, knowing the cost of equity enables them to make informed decisions about debt financing versus issuing new shares to raise funds while considering their overall capital structure and risk tolerance.

Conclusion

Understanding the cost of equity is crucial for companies. It helps them determine their required rate of return from investors. Through methods like CAPM and DCM, businesses can strategically calculate this cost.

This knowledge allows them to make informed decisions about capital structure and valuation. In summary, grasping the intricacies of cost of equity empowers companies to handle financial challenges with confidence, ultimately leading to better business outcomes.

FAQs

1. What is the cost of equity?

The cost of equity refers to the return a company needs to offer investors for their ownership stake. It represents a part of the company's capital structure, which includes both equity and debt financing.

2. How do you compute the cost of equity?

The computation of the cost of equity often involves an equation known as the dividend growth model. This formula uses factors like current stock price, future dividends, and dividend growth rate.

3. Does paying dividends affect a company's cost of equity?

Yes, if a company pays dividends regularly, it can influence its cost of equity. The expected market rate also plays a role in this calculation.

4. Why might some companies have higher costs of equity than others?

A higher cost could be due to increased risk associated with that particular business or industry (company-specific risk). Also, if there's high volatility in a company's stock price or if its current market value is large compared to other firms', it may result in increased costs.

5. Is interest on debt tax deductible while calculating Cost Of Equity?

Yes! Unlike payments made towards shareholder’s equity which are not tax deductible; interest payments on debt are often deducted from taxable income reducing overall corporate taxes.

6. Can I use an online tool for computing my firm's Cost Of Equity?

Absolutely! There are several online tools available such as 'equity calculators' that help businesses estimate their specific Cost Of Equity based on inputs like risk-free rates and expected returns.