Studying for the CFP exam can feel overwhelming. There are 170 multiple-choice questions to prepare for. This post offers study tips and practice CFP exam questions to help. Keep reading to learn more.

Overview of the CFP Exam

The CFP Exam structure and format, including the key topic areas covered. Understanding what to expect from the exam is crucial for success.

Structure and format

The CFP exam is a test that covers many areas of financial planning. It has 170 multiple-choice questions divided into two sections. One section must be finished in three hours, then there's an optional break before tackling the second section.

Each question aims to check understanding in various key areas like investment planning, insurance planning, and tax consequences.

The CFP exam format includes stand-alone questions and case studies, simulating real-world scenarios.

Questions mix short scenarios and longer ones that require analyzing different financial situations. Exam content touches upon critical topics such as retirement plans, risk management, and estate planning.

This design makes sure candidates can apply knowledge to actual tasks they will face as certified financial planners.

Key topic areas covered

The CFP Exam covers several key topics. You will need to know about general principles of financial planning, investment concepts, and tax planning. Also on the list are retirement savings, risk management with insurance, and estate planning.

The exam even tests you on the psychology behind financial decisions and professional conduct rules. Each area has its own weight, such as investment planning making up 17% of the exam.

You should also study income taxation and how it affects financial decisions. The test includes questions on GST tax compliance and non-qualified plan rules. Expect scenarios that involve life insurance choices for unmarried couples or saving plans for two children.

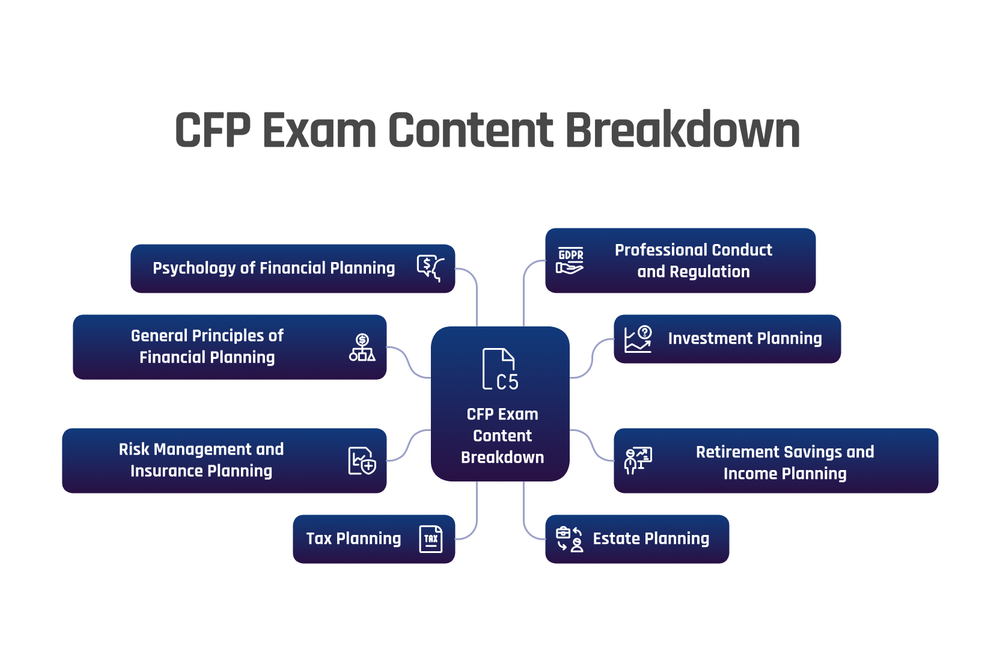

CFP Exam Content Breakdown

CFP Exam Content Breakdown provides an overview of the key areas covered in the exam, including General Principles of Financial Planning, Investment Planning, Retirement Savings and Income Planning, Risk Management and Insurance Planning, Tax Planning, Estate Planning, Psychology of Financial Planning, and Professional Conduct and Regulation.

Understanding the breakdown is crucial for effective study planning and preparation to ace the CFP exam.

General Principles of Financial Planning (15%)

The general principles of financial planning cover basic money concepts. This part makes up 15% of the CFP exam. It includes how to make a plan for someone's finances, understanding their goals and needs.

You learn about different savings options like high yield savings accounts. It also teaches you about risk tolerance and how it affects investment choices.

You must know the rules for non-qualified plans and Medicare planning. The section helps test takers see the big picture of personal finance. It asks questions on beneficiary designations and how they fit into a good financial plan.

Students use these principles to guide clients in making smart decisions with their money.

Investment Planning (17%)

Investment planning constitutes 17% of the CFP exam. It encompasses quantitative investment concepts and alternative investments. Candidates are required to comprehend risk exposures and apply tax-efficient strategies for taxable income within investment portfolios.

Moreover, they should be familiar with distribution rules, including non-qualified plan rules, and factors that impact businesses' distribution rules.

Approximately 29 questions on investment planning can be anticipated in the initial subsection of the CFP exam, making it a significant portion of the exam's content. A comprehensive understanding of these key topics is essential for success.

Retirement Savings and Income Planning (18%)

Retirement Savings and Income Planning constitutes 18% of the CFP exam. It's crucial for comprehending how to assist individuals in preparing for retirement. This section evaluates candidates' knowledge of retirement needs, personal savings strategies, employer-sponsored plans, and other sources of retirement income such as social security.

Furthermore, it evaluates tax issues associated with retirement savings and income, as well as distribution rules for various types of plans.

Grasping this part is essential because Americans are living longer than ever before, thus relying on their own savings to finance a lengthier retirement period. The retiree population is expected to increase significantly in the upcoming years.

Risk Management and Insurance Planning (11%)

Risk Management and Insurance Planning accounts for 11% of the CFP exam. This section assesses your comprehension of insurance products, risk management strategies, and their integration into a comprehensive financial plan.

It is essential to grasp subjects such as life, disability, health, property, and liability insurance. Furthermore, it is crucial to understand the fundamental principles behind risk management and its impact on financial planning decisions.

Tax Planning (14%)

Transitioning from risk management and insurance planning, tax planning holds a 14% weight in the CFP exam content. It's crucial to understand non-qualified plan rules, businesses distribution rules, and real-world scenarios.

Tax planning questions account for 24 standalone questions out of the 170 multiple-choice questions on the test.

Key factors in this section include stock market impacts and optional unscheduled break allocation. Practice with free sample questions from reputable resources like Dalton Review to grasp scenario-based queries related to tax planning.

Understanding these areas will be essential in answering both stand-alone and scenario-based questions that come your way during the exam.

Estate Planning (10%)

Estate Planning makes up 10% of the CFP exam content. It covers preparing for the transfer of wealth and assets after someone passes away or becomes unable to manage their affairs.

Areas include wills, trusts, probate, estate taxes, and gifting strategies. Understanding these areas is important as a financial planner.

The focus should be on knowing how to help clients plan for what happens to their assets when they are no longer able to manage them in life or death situations. This part of financial planning involves understanding laws concerning estates and different types of documents used in estate planning - wills, trusts, powers of attorney, and healthcare directives.

Psychology of Financial Planning (7%)

The Psychology of Financial Planning accounts for 7% of the CFP exam. This section emphasizes understanding how clients make financial decisions and react to various scenarios. It delves into client behavior, biases, and emotions in money management.

Grasping these psychological aspects is crucial for a financial planner as it aids in developing customized strategies that align with the client's mindset and goals, ultimately building stronger relationships and confidence.

Psychology plays a vital role in financial planning, influencing how individuals perceive risks, approach investments, and make long-term decisions about their finances. By integrating an understanding of psychology into financial planning strategies, planners can better guide clients through uncertainties and market fluctuations while helping them stay committed to their financial objectives.

It underscores the importance of empathy, communication skills, and anticipating potential behavioral hurdles in achieving successful financial plans.

Professional Conduct and Regulation (8%)

The Professional Conduct and Regulation section of the CFP exam evaluates your comprehension of ethical and professional standards in financial planning. This part assesses your knowledge of regulations governing the conduct of financial planners, including their duty to act in the client's best interest.

It also encompasses adherence to industry regulations established by regulatory bodies, such as the CFP Board's Standards of Professional Conduct, which outline ethical behavior for CFP professionals.

Furthermore, this section tests your understanding of disciplinary rules and procedures guiding misconduct investigations within the field.

This portion aims to ensure that future certified financial planners maintain high standards of professional conduct and regulation when working with clients, ensuring integrity and confidence in the profession.

Key concepts include codes of ethics, fiduciary duty towards clients, compliance requirements from regulatory authorities like SEC or FINRA, as well as effectively addressing unethical practices.

Practice Questions for the CFP Exam

Looking for practice questions to prepare for the CFP Exam? Find out the importance of practicing with sample questions and where to find reliable resources.

Importance of practicing with sample questions

Practicing with sample questions is crucial for CFP exam preparation. It helps you familiarize yourself with the format and types of questions you'll encounter. By using practice questions, you can identify your weak areas and focus on improving them to ace the exam.

Accessing reliable practice question resources is vital, as it allows you to simulate real exam scenarios and gain confidence in tackling different question types such as scenario-based or stand-alone questions.

Regularly practicing with a variety of sample questions will also help you understand how to answer 170 multiple-choice questions effectively within the allocated time during the actual CFP exam.

By including sample questions into your study schedule, alongside other review materials, you can develop a deeper understanding of various key topic areas covered in the CFP exam, like Investment Planning, Risk Management and Insurance Planning, Tax Planning, and more.

This comprehensive approach enhances your readiness for navigating through real-world scenarios presented in the exam.

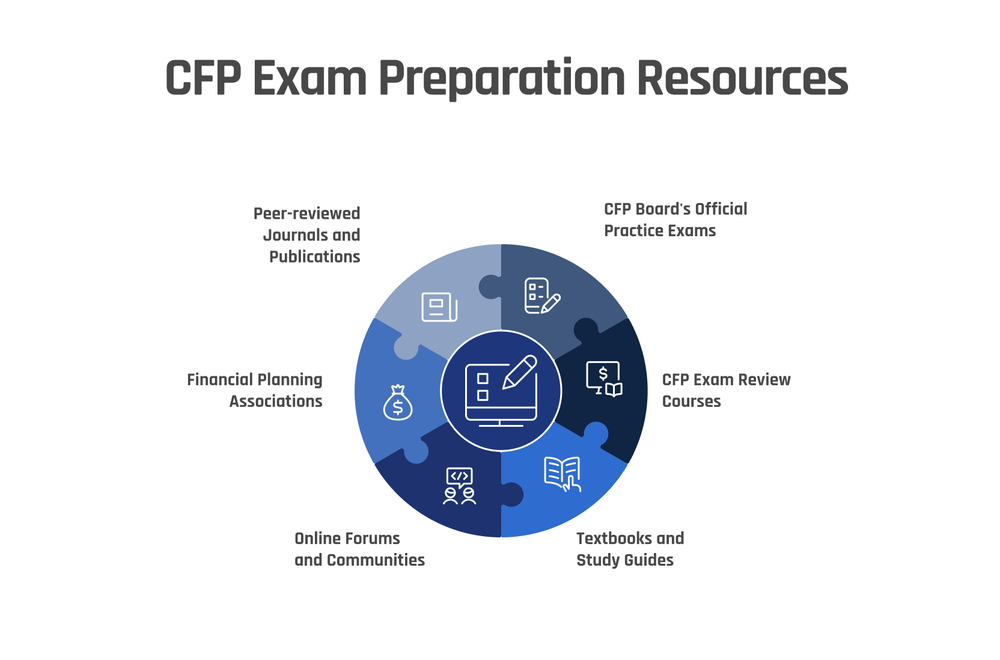

Where to find reliable practice question resources

Looking for top-tier practice question resources to excel in the CFP exam? Check out these reputable options:

-

CFP Board's Official Practice Exams - An exceptional resource directly from the exam creators for authentic practice questions.

-

CFP Exam Review Courses - Many respected providers offer comprehensive review courses with ample practice questions and materials.

-

Textbooks and Study Guides - Explore well-regarded study materials tailored specifically to the CFP exam, which often include practice questions.

-

Online Forums and Communities - Engage with fellow test-takers in online communities where members share valuable study resources and practice questions.

-

Financial Planning Associations - They often provide access to practice question banks as part of their membership or through their educational resources.

-

Peer-reviewed Journals and Publications - Stay updated with industry-specific publications that can feature sample questions or case studies relevant to the CFP exam.

Seeking out reputable resources can significantly boost your preparation for the CFP exam, putting you on the path to success!

Study Tips for Success

Create a study schedule and focus on weaker areas. Utilize CFP exam review courses and practice with full-length mock exams for best results.

Create a study schedule

To ace the CFP Exam, it's crucial to create a structured study schedule. Allocate specific time slots for each exam topic area based on their weightage: General Principles of Financial Planning (15%), Investment Planning (17%), Retirement Savings and Income Planning (18%), Risk Management and Insurance Planning (11%), Tax Planning (14%), Estate Planning (10%), Psychology of Financial Planning (7%), and Professional Conduct and Regulation (8%).

Prioritize your weaker areas but ensure you cover all sections. A well-planned study schedule will help you stay organized and focused.

Furthermore, remember to factor in breaks within your timetable to avoid burnout. By dedicating consistent time towards your studies, you can efficiently tackle the comprehensive content breakdown of the CFP Exam.

Focus on weaker areas

Improve your chances of passing the CFP exam by focusing on your areas for improvement. Look for study resources that target specific topics like investment planning, retirement savings and income planning, risk management and insurance planning, tax planning, estate planning, psychology of financial planning, and professional conduct and regulation.

Use mock exams to identify where you need improvement. Set a schedule to practice these areas consistently.

Allocate more time to practicing the sections where you need to improve. Seek out sample questions and scenarios that cover the key topic areas in which your weaknesses lie. Repeatedly practicing in these areas can strengthen your understanding and performance.

Use CFP exam review courses

You can enhance your CFP exam preparation by utilizing CFP exam review courses. These courses are crafted to improve your comprehension of the essential topic areas covered in the exam, including investment planning, retirement savings and income planning, risk management and insurance planning, tax planning, estate planning, psychology of financial planning, and professional conduct and regulation.

By integrating these customized study resources into your preparation routine, you can gain direct experience with real-world scenarios via practice tests and scenario-based questions.

Moreover, these review courses aid you in addressing the challenging and constantly changing landscape of financial planning by focusing on individual questions and two subsections – general principles of financial planning as well as a focus on areas that require improvement.

These courses offer a holistic approach to assisting candidates in discovering the strategies behind successful scores by providing practice material for 170 multiple-choice questions along with full-length mock exams modeled after the actual test format.

They also emphasize essential concepts such as non-qualified plan rules and plan selection. Ultimately, utilizing CFP exam review courses is recommended for those seeking more than just standalone study materials; it's a crucial tool to enhance success in becoming a certified financial planner.

Practice with full-length mock exams

Using full-length mock exams is crucial for excelling in the CFP exam. It allows you to become familiar with the test format and timing. These practice tests, available from trustworthy sources, prepare you for success by simulating real-world scenarios and containing 170 multiple-choice questions like those on the actual exam.

Integrating these into your study routine enables you to pinpoint areas requiring more attention and improves your overall grasp of the exam topics.

Conclusion

Ready to excel in the CFP exam? Enhance your preparation with practice questions and study tips. Develop a strategic study schedule to address weaker areas and utilize dependable resources for sample questions.

Integrate mock exams into your preparation and keep your focus and determination in mind! With these tools, you'll be well-equipped to handle the intricacies of the exam.

FAQs

1. What types of questions are asked in the CFP exam?

The CFP exam includes both stand-alone questions and scenario-based questions. Stand-alone ones test specific knowledge, while scenario-based ones apply that knowledge to real-world scenarios.

2. How can I practice for the CFP exam effectively?

You can prepare by studying sample questions relevant to each subsection of the exam, focusing on non-qualified plan rules and other key topics.

3. Where do I find these sample questions for my study routine?

CFP exam sample questions are usually found on the left side of your exam registration portal or through various online resources dedicated to CFP preparation.

4. Are there any tips to tackle scenario based questions effectively?

Yes! To handle scenario-based questions well, it's crucial to understand how concepts apply in real-life situations. Practice with as many real-world scenarios as possible will be beneficial.