Deciding to become a certified financial planner is a big step. It involves lots of studying and hands-on experience in financial planning.

Our guide will show you how long the CFP certification process takes, from education to passing the exam.

Key Takeaways

-

It takes about 18-24 months to complete the CFP certification process. This includes education, exam prep, gaining professional experience, and an ethics declaration.

-

You need a bachelor's degree and to finish specific financial planning programs before taking the CFP exam. If you haven't graduated yet, you can still start the course but must prove your degree within 5 years after passing the exam.

-

Preparing for the CFP exam usually requires around 250 study hours on topics like tax and retirement planning. The six-hour test covers real-life financial planning situations.

-

To get certified, you need 6,000 hours of related work experience or 4,000 hours through an apprenticeship under a certified planner focusing on direct client work.

-

Your timeline to become a CFP might change based on program availability, how quickly you pass exams, collect needed work hours, and manage personal commitments alongside these requirements.

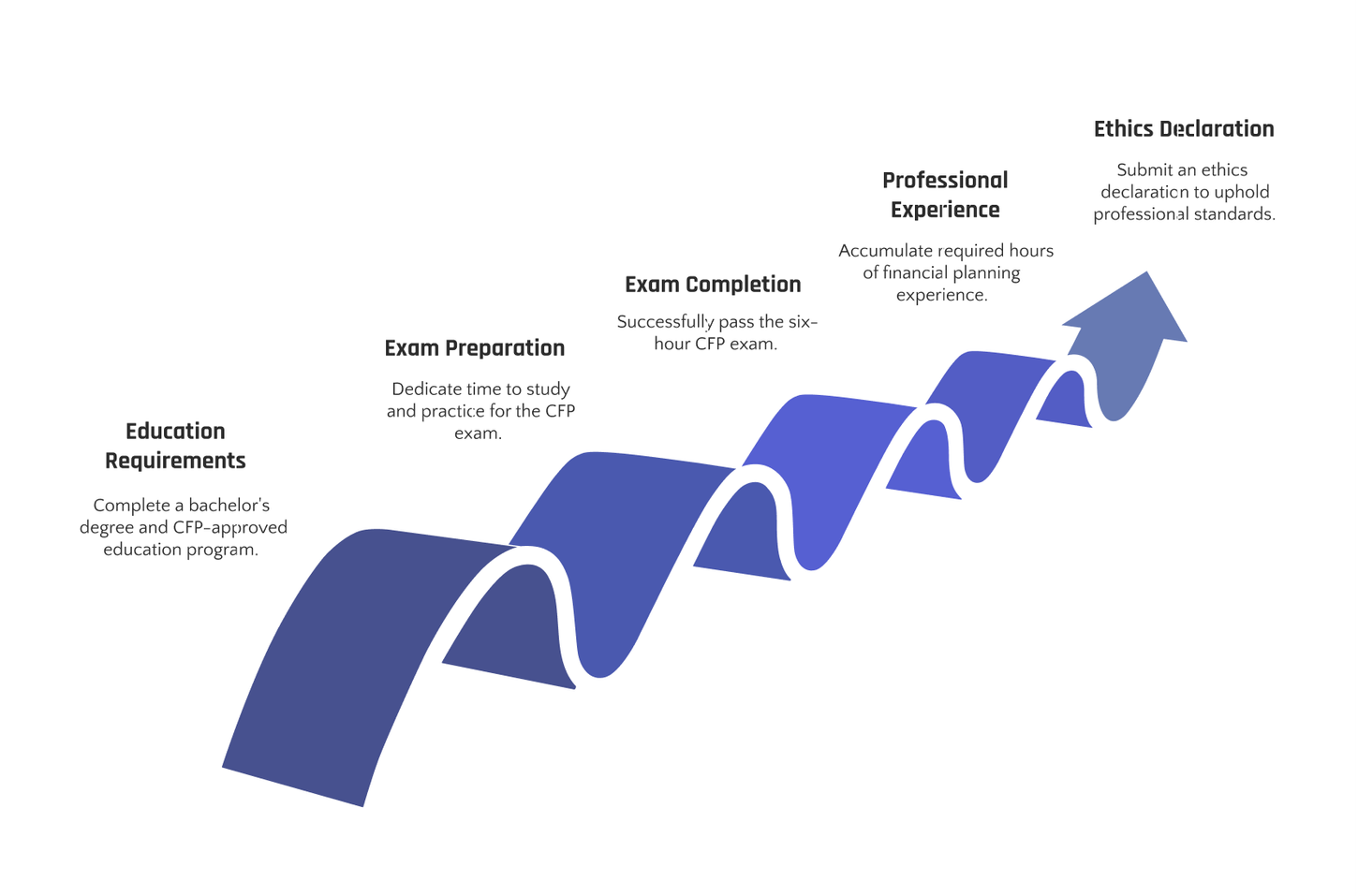

Overview of the CFP Certification Process

The CFP certification process includes education requirements, exam preparation and completion, professional experience hours, and ethics declaration.

Once you complete the educational requirements and gather professional experience, you prepare for the CFP exam and make an ethics declaration.

Education Requirements

To start the Certified Financial Planner (CFP) certification, one needs a bachelor's degree from an accredited college or university. This is a must-have before you can get your certification.

But, if you're still in school or haven't finished your degree yet, don't worry. You can still go through the CFP course and pass the exam. After that, you'll have 5 years to show proof of your completed degree.

Next comes choosing the right education program for learning about financial planning. The CFP Board has approved specific programs that cover various important areas like tax planning, retirement planning, insurance planning, and investment management.

These programs make sure you receive all the necessary knowledge and skills needed for personal financial planning. They often end with a big test that helps prepare students for the CFP exam itself.

Exam Preparation and Completion

Exam preparation for the Certified Financial Planner (CFP) exam requires concentration and time investment. The majority of candidates allocate roughly 250 hours for study, which includes financial planning subjects, risk management, education planning, among others.

Educational programs registered by the CFP Board serve to assist in this process, providing courses that align with the exam content.

The actual CFP exam is a six-hour assessment encompassing real-life situations and case studies related to diverse financial planning subjects. Practicing with mock exams is crucial for optimal preparation.

Successfully passing the CFP exam validates one's understanding of comprehensive financial planning principles.

Achieving a passing score on the CFP exam is a significant progression in the journey of becoming a certified financial planner.

Professional Experience Hours

To become a CFP, you need 6,000 hours of professional experience. This can be from financial planning or related activities. Your work has to involve using financial planning skills.

It should also show that you apply general financial planning principles in real life scenarios.

You can also choose an apprenticeship path. This requires 4,000 hours under the direct supervision of a certified financial planner. Here, focus is more on learning by doing. You'll help with clients' financial goals and make crucial decisions about their money.

Ethics Declaration

As part of the CFP certification process, applicants are required to complete an ethics declaration. This declaration emphasizes professional responsibility and ethical conduct in financial planning.

It supports the CFP Board's code of ethics requirements, ensuring that certified financial planners adhere to high standards of professional competence and conduct. The ethics declaration is aimed at improving the overall quality and integrity of the financial advisory industry by including strict ethical guidelines that all CFP professionals must uphold.

Completing this important step in the certification process not only demonstrates a commitment to ethical behavior but also serves as a crucial aspect of becoming a qualified financial advisor.

With these rigorous standards in place, clients can have confidence that their financial advisors have undergone thorough training and have pledged to maintain the highest levels of professionalism and integrity in their practice.

Timeline to Complete the CFP Process

The timeline to complete the CFP process varies, but it generally takes around 18-24 months from start to finish.

-

Education Requirements: Completion of specific financial planning programs at an accredited university often takes 12-18 months.

-

Exam Preparation and Completion: Preparing for and passing the CFP exam typically takes an additional 6-12 months, with the exam covering various financial planning topics.

-

Professional Experience Hours: Obtaining the required 6,000 hours of professional experience related to financial planning can take anywhere from 1-4 years, depending on employment and apprenticeship experience.

-

Ethics Declaration: The completion of the ethics declaration is usually integrated into the overall timeline and is required before obtaining final certification.

Factors That May Impact the Timeline

Factors that may affect the timeline to become a Certified Financial Planner (CFP):

-

Availability of education programs meeting CFP Board's requirements.

-

The candidate's ability to pass the CFP exam on the first attempt.

-

The time taken to accumulate the necessary professional experience hours.

-

Personal commitments and availability, affecting the pace at which education and experience can be pursued.

Conclusion

To conclude, attaining the designation of a Certified Financial Planner (CFP) requires meeting educational prerequisites, successfully passing the certification exam, acquiring professional experience hours, and declaring ethical commitments.

The time needed to complete the CFP process depends on individual situations and dedication. Elements like exam readiness, work responsibilities, and ongoing education may influence the duration of achieving CFP certification.

Ultimately, comprehending the process and maintaining dedication are crucial for successfully progressing toward becoming a certified financial planner.

FAQs

1. What is the timeline for getting a Certified Financial Planner (CFP) certification?

The timeline to become a CFP professional involves completing the CFP Board registered education program, passing the comprehensive CFP certification examination, and meeting financial planning experience requirements. The exact duration can vary based on one's own personal career path and pace.

2. What does the CFP certification process entail?

The CFP certification process works in several steps: enrolling in a board registered program, acquiring practical knowledge of financial planning, taking practice exams, passing the cfp certification examination that assesses your ability to apply financial planning knowledge effectively and meeting ongoing continuing education requirements.

3. How does being a Chartered Financial Consultant differ from being a Certified Financial Planner?

While both roles influence crucial financial decisions and require deep financial planning knowledge, they differ in their focus areas and educational paths. A Chartered Financial Consultant may have more emphasis on insurance or estate planning while a Certified Financial Planner covers broader aspects including behavioral finance.

4. Do I need any prior work experience to apply for CFP?

Yes! Obtaining real-world financial planning experience under an advisory firm or as new financial advisors enhances your application for cfp board registration by emphasizing professional responsibility alongside academic learning.

5. What are some ethical standards expected from certified professionals by the Certified Financial Planner Board?

Certified professionals must adhere to high standards of integrity and professional conduct set forth by the board's fitness standards which include abiding by registered ethics rules that protect clients' interests above all else.

6. Are there any ongoing requirements after receiving my CPF certification?

Absolutely! To maintain your status as certified professionals you'll need to earn continuing education credits regularly which helps keep up with changes in regulations or market trends thereby ensuring you're always providing top-notch advice to clients.